CCM Blockchain Newsletter (August 19, 2024)

Last week was the best week for US markets of 2024.

Hope you all had a fantastic weekend. It’s been a few weeks since we’ve last sent out our weekly market update and we appreciate all the messages we’ve received inquiring about the latest. The team has been heads down on several interesting transactions that we’ll share with you at the right time but we’re excited to get back on track with our weekly update. A lot has happened so let’s dive right in.

Macro Market Update

Last Week's Market Overview

Last week was the best week of 2024 as markets react to anticipations of a dovish Fed and improved economic data.

- Markets last week recovered from the previous week's sharp pullback, with the S&P 500 up over 6.5% from the August 5 lows, and the Nasdaq up over 8%

- Recovery has been driven by two themes, slowing inflation and positive economic data

- Slowing Inflation:

- Both PPI and CPI inflation came in below expectations for July, with headline CPI inflation now at its lowest for the year

- Headline PPI inflation came in at 2.2% annually, below forecasts of 2.3%, while headline CPI inflation came in at 2.9%, also below expectations of 3.0%

- This is welcome news for consumers and investors alike as it brings us closer to the Fed’s target of 2% inflation

- Positive economic data:

- Outside of the yen carry trade unwind, one key indicator that may have triggered a market sell-off two weeks ago was higher than expected nonfarm-jobs unemployment rate, coming it at 4.3%

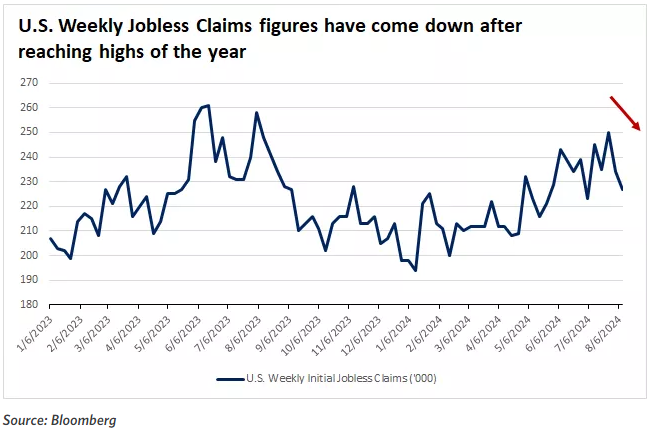

- Since then, there have been several positive economic data points including the weekly U.S. initial jobless claims, which offer a real-time look into the health of the U.S. labor market by tracking those that have filed for unemployment benefits

- While the numbers have come down week over week, it appears that we are still generally on an upwards trajectory

- Slowing Inflation:

What to Look Out for This Week

- FOMC Minutes

- Jackson Hole Economic Symposium

- PMIs

- New Home Sales

Interesting Chart of the Week

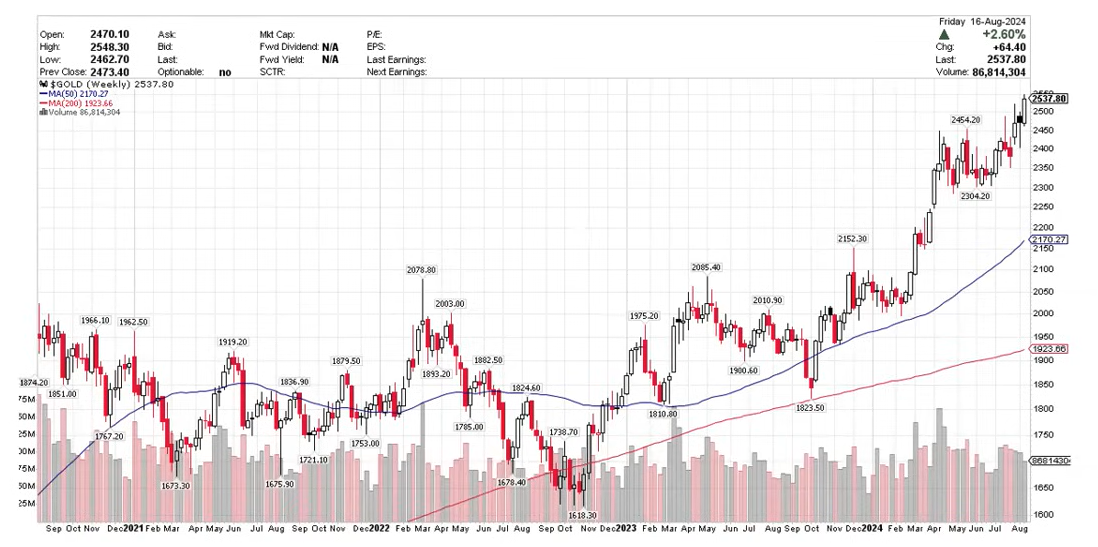

Gold has made a new high.

- We’ve been talking about this for months now – gold continues to appreciate as the nation’s gross cumulative debt balance has surpassed $35 trillion

- Gold’s market cap sits at around $17 trillion while BTC trails, at $1.2 trillion

Bitcoin Market Update

Bitcoin Price Action

- We’ve had a series of lower highs and lower lows despite the broader market recovery

- Bitcoin is above $60k as I write this although it has traded sideways below $60k for the last two weeks following the drawdown in early August

- A few factors appear to be contributing to the downward pressure:

- US Gov’t selling Silk Road BTC

- Mt. Gox and Genesis BTC creditor distribution on the back of bankruptcies

- This forced selling appears to be largely behind us while global governments continue to issue fiat denominated debt

Tapping Capital Markets

- Several key deals have hit the market as the capital markets window for bitcoin miners appears to be open:

9/1/2031: Marathon Digital Holdings | $250M Senior Unsecured Convertible Note

- MARA intends to use the net proceeds from the sale of the notes to acquire additional bitcoin and for general corporate purposes, which may include working capital, strategic acquisitions, expansion of existing assets, and repayment of debt and other outstanding obligations.

- Principal Amount: $250M

- Option to issue additional $50M

- Interest Rate: 2.125% per year

- Conversion Rate: $18.89/share (52.94 shares / $1000 of principal notes)

- Redemption Date: On/after September 6, 2028, if the stock exceeds 130% of the conversion price

- $75M principal of notes must remain outstanding if all outstanding notes are not redeemed

- Repurchase Date: On March 1st, 2029, holders may require MARA to repurchase any/all of notes

- Conversion rate will increase if redemptions occur

- Maturity Date: September 1st, 2031

Core Scientific Prices Upsized $400 Million Convertible Senior Notes Offering | Nasdaq: CORZ

- Core Scientific, Inc., a leader in digital infrastructure for bitcoin mining and high-performance computing, today announced the pricing of its offering of $400 million aggregate principal amount of 3.00% convertible senior notes due 2029 (the “notes”) in a private offering to qualified institutional buyers

- Core Scientific estimates that the net proceeds from the offering will be approximately $386.6 million (or approximately $445.0 million if the initial purchasers fully exercise their option to purchase additional notes), after deducting the initial purchasers’ discounts and commissions and Core Scientific’s estimated offering expenses. Core Scientific intends to use approximately $61.2 million of the net proceeds from the offering to repay in full the outstanding loans under its credit and guaranty agreement entered into on January 23, 2024 and approximately $150.0 million of the net proceeds to redeem all of its outstanding senior secured notes due 2028, in each case excluding accrued but unpaid interest.

- Principal Amount: $400.00M

- Option to issue an additional $60.00M

- Interest Rate: 3.00% per year

- Conversion Rate: $11.00/share (90.9256 shares / $1000 of principal notes)

- 30% premium over stock price ($8.46)

- Redemption Date: On/after September 7th, 2027, if the stock exceeds 130% of the conversion price

- Maturity Date: September 1st, 2029

- Last Close: $8.46

- Market Cap: $2.18B

- Public Float: 86.97%

- ADTV (90 day): $117.5M

Bitdeer Announces Proposed Offering of US$150 Million Convertible Notes | Nasdaq: BTDR

- Bitdeer Technologies Group, a world-leading technology company for blockchain and high-performance computing, today announced a proposed registered underwritten public offering by the Company of US$150,000,000 aggregate principal amount of its convertible senior notes due 2029, subject to market and other conditions.

- The Company intends to use the net proceeds from the Offering for datacenter expansion, ASIC based mining rig development as well as working capital and other general corporate purposes.

- Principal Amount: $150.00M

- Option to issue an additional $22.50M

- Interest Rate: 8.5%

- Maturity Date: August 15th, 2029

- Last Close: $7.73

- Last Price: $6.90 (down ~12% today)

- Market Cap: $894.46M (yesterday’s close)

- ADTV (90 day): $20.1M

- Public Float: 31.40%

Interesting Reads

- Bitcoin miners may gain $13.9B yearly from 20% shift to AI and HPC — VanEck

- US mulls applying fiat reporting mandate on crypto transfers

- BitGo to Move WBTC to Multi-Jurisdictional Custody to Accelerate Global Expansion Plan

- Senate Majority Leader Chuck Schumer sets goal to pass crypto legislation by the end of this year