CCM Blockchain Newsletter (December 1, 2025)

Assets rose across the board last week, only to sell off at market open today.

Happy Monday everyone, and welcome back to this week’s market newsletter. Please see below this week’s market data.

Bitcoin Market Update and News

- Bitcoin recovers above $90,000, sells off to start the week: Bitcoin enjoyed a Thanksgiving bounce that propelled the cryptocurrency to as high as $92,000 over the holidays, only to sell off to start December. At the time of publication, bitcoin is down 2.6% WoW to $84,900.

- White House launches Genesis Mission to accelerate AI R&D, energy grid upgrades: President Trump signed an executive order last week for the Genesis Mission, an initiative to spur R&D for AI and energy systems. This includes advancements in manufacturing, biotechnology, critical materials, nuclear energy, quantum information science, semiconductors / microelectronics by working with U.S. universities and tech stalwarts like Amazon, Nvidia, Microsoft, Google, Anthropic, OpenAI, and more.

Interesting Reads and Videos

- Bitcoin Ruined Your Thanksgiving (Here’s What To Do)

- Bitcoin Hashprice Falls to Record Low as Network Hashrate Shows Early Signs of Pullback

- Did the Bitcoin Bull Market Just End?

Bitcoin Treasury Company News and Updates

- Metaplanet draws $130M BTC-backed loan for share buybacks, BTC purchases: Metaplanet (TYO: 3350, OTCQX: MTPLF) has taken out a $130 million bitcoin-backed loan, bringing its total draw under the $500 million credit facility to $230 million. The company said that it plans to use proceeds for share buybacks, bitcoin purchases, and other corporate purposes.

- BitMine Immersion adds ~70k to ETH treasury, now owns 3% of ETH supply: BitMine Immersion Technology (NYSEAMERICAN: BMNR), a crypto miner-turned ETH treasury and staking company, bought 69,822 ETH to bump its Ethereum holdings to 3.63 ETH worth $10.27 billion at the time of writing. With the purchase, BMNR now owns 3% of ETH’s circulating supply.

- Hyperscale Data reveals 382 BTC treasury: Hyperscale Data (NYSEAMERICAN: GPUS), a data center company, said last week that it holds 382 BTC (~$33 million), more than double the 150 BTC listed on bitcointreasuries.net.

Market Update

- Equities rebound: Stocks soared over Thanksgiving week, with the major indices rising 3-5% just shy of their record highs.

- S&P 500: 6,849.09 (+3.7%)

- Nasdaq: 23,365.69 (+4.9%)

- Dow: 47,716.42 (+3.2%)

- Russell 2000: 2,500.43 (+5.5%)

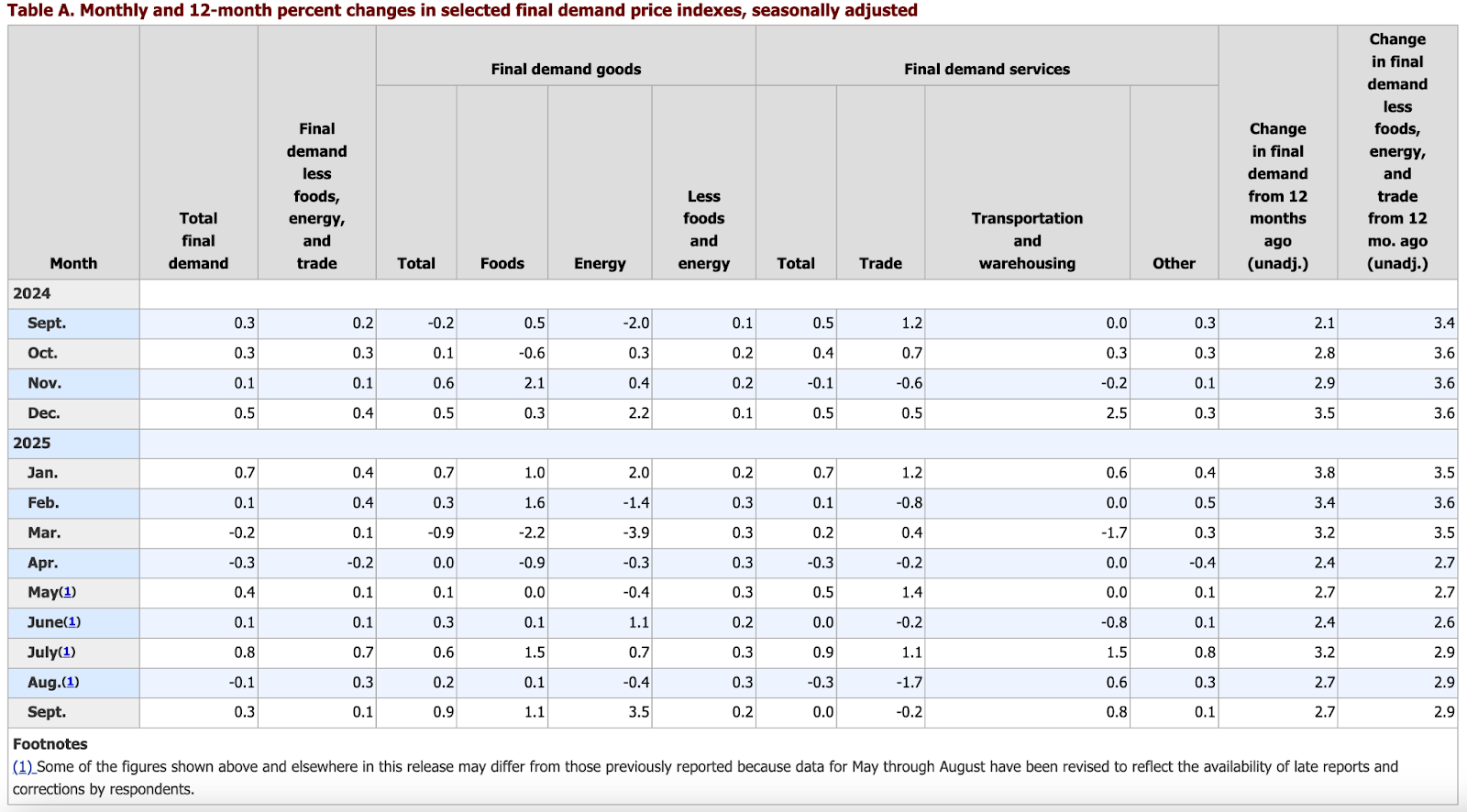

- Producer Price Index (PPI) up in September after decline in August: Per the Bureau of Labor Statistics, headline PPI rose 0.3% MoM after dipping 0.1% in August. Prices for final-demand goods jumped 0.9%, the largest monthly gain since early 2024, with 2/3rds of the increase coming from energy (+3.5%) and food (+1.1%). By contrast, the final-demand services index was unchanged in September. Core PPI (less energy and food) rose 0.1% MoM, and YoY headline and core PPI increased 2.7% and 2.9% respectively.

- Retail sales rebound in September but still show signs of slowing: Per the U.S. Census Bureau, headline retail and food service sales were up 0.2% in September, a modest reversal of the -0.6% MoM decrease in August. September’s YoY sales growth was 4.3% in September, with miscellaneous store retailers and gas stations leading MoM growth. Core sales, which excludes building materials, autos, gas stations, and food services, fell 0.1% MoM versus a strong rise in August.

- Business inventories flat in August, auto sales fall: Business inventories were unchanged in August, according to the U.S. Census Bureau. Retail inventories fell slightly by 0.1%, and auto sales fell 0.5% over the month.YoY inventory growth was up 1.1%, and the bureau’s inventory-to-sales ratio stayed steady at 1.37 months.

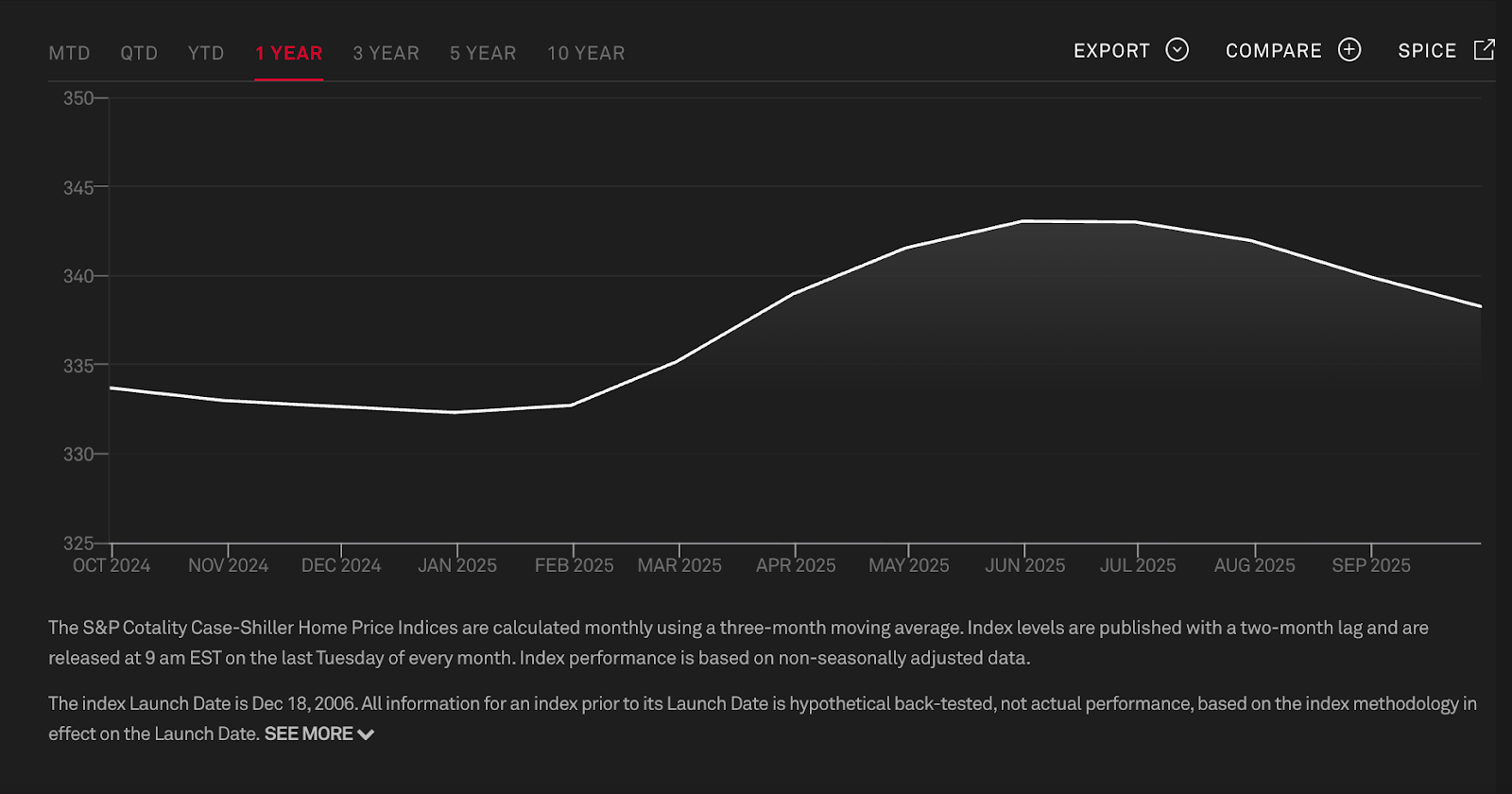

- 20-City Index posts slowest annual growth in years: The S&P Cotality Case-Shiller 20-City Index rose 1.4 % year-over-year in September 2025, the eighth consecutive month of decelerating price growth and the weakest annual increase since mid-2023. On a non-seasonally adjusted basis, prices fell about 0.5% month-over-month in September (following a −0.6% drop in August). The broader S&P Cotality Case-Shiller U.S. National Home Price Index posted a 1.3% year-over-year gain, down from 1.4% the prior month — also the weakest reading in over two years. The Sun Belt shoulder the largest declines in price, reflecting deepening divides in regional housing markets.

- Pending Home Sales rise in October as index sees highest level in 2025: According to the National Association of Realtors Pending Home Sales report, the pending home sales index increase by 1.9% MoM in October but declined 0.4% YoY, and the index’s 76.3 reading for October is the highest of the year. MoM, contract signings rose in the Northeast (+2.3%), Midwest (+5.3%), and South (+1.4%) but fell in the West. YoY, pending sales increased in the Midwest (+0.9%) and South (+2.0%), but decreased in the Northeast (−1.0%) and notably in the West (−7.0%).

- Consumer confidence droops in November: The Conference Board’s November 2025 Consumer Confidence Index fell from a revised 95.5 in October to 88.7 in November. The Present Situation Index (views of current business and labor-market conditions) declined to 126.9, down 4.3 points, and The Expectations Index (views on short-term economic outlook, income, jobs) fell more steeply – down 8.6 points to 63.2. – and has now remained below 80 for ten straight months, a threshold the Conference Board often associates with elevated recession risk. Only 20% of consumers said U.S. business conditions are “good” (down from 21% in October) and 28% described jobs as “plentiful,” down from 29%.

- Durable goods orders up in September: The U.S. Census Bureau’s durable goods orders report shows a 0.5% MoM rise in new orders in September to $313.7 billion, the second month in a row of growth. Ex-transportations, orders rose 0.6%, while ex-defense, durable goods orders only rose a modest 0.1%

- Oil inches upward: Oil prices rebounded slightly last week, with both WTI and Brent Crude rising.

- WTI Crude: $58.48/barrel (+1%)

- Brent Crude: $61.50/barrel (+1.1%)

- Gold surges: Gold ran last week alongside the rest of the market. At the time of writing gold is up 4.2% WoW to $4,256/oz.

The week ahead in data*:

- ISM Manufacturing Index (Monday)

- Domestic Vehicle Sales report (Tuesday)

- ADP National Employment Report (Wednesday)

- U.S. Bureau of Economic Analysis Personal Consumption Expenditures Price Index September read (Friday)

*Government reports may be delayed in the aftermath of the shutdown

Thank you for reading, and please feel free to reach out with any questions.