CCM Blockchain Newsletter (December 15, 2025)

Bitcoin fell below $90,000 once again last week as stocks ended on a mixed note.

Happy Monday everyone, and welcome back to this week’s market newsletter. Please see below this week’s market data.

Bitcoin Market Update and News

- Bitcoin falls below $90,000: Bitcoin continues to chart choppy waters, with the cryptocurrency rising to $94,000 last week in light of the Fed’s rate cut, only to fall to $86,000 by the time of writing for a -5% WoW change.

- DTCC receives SEC approval to launch tokenized US securities service in 2026: The Depository Trust and Clearing Corporation has received a no-action letter from the Securities and Exchange Commission, clearing the firm to tokenize stocks, bonds, and other real-world assets. Starting in 2026, the DTCC can offer tokenized services for the Russell 1000, ETFs, U.S. Treasury bills, bonds, and other liquid assets on approved blockchains.

- Coinbase soon to launch prediction market, tokenized stock trading: Coinbase is reportedly launching a prediction market in a partnership with Kaslhi, and the exchange is expected to reveal the product this Wednesday at a company showcase. A Bloomberg source said that the rollout may also include a tokenized stock trading product, a feature recently offered by Coinbase competitor Kraken for U.S. users.

Interesting Reads and Videos

- Critical Materials: A Strategic Analysis

- Texas large load requests up 270% in 2025 on data center growth: ERCOT

- The Future of Bitcoin Treasuries | Jeff Walton

Bitcoin Treasury Company News and Updates

- Twenty One Capital begins trading on NYSE under ticker XXI: Bitcoin treasury company Twenty One Capital (NYSE: XXI) debuted on the New York Stock Exchange last Tuesday following its combination with Cantor Equity Partners. Tether is the majority owner of the new bitcoin treasury company, which holds 43,514 BTC ($3.8 billion), making it the second largest pure-play bitcoin treasury company behind Strategy itself.

- Strategy acquires 10,624 bitcoin for $936 million: Strategy (NASDAQ: MSTR) acquired 10,264 bitcoin for $962.7 million during the week ending December 7, brining the company’s total treasury to 660,624 ($58 billion) with an average purchase price of $74,696.

- Hyperscale Data earmarks $43 million for bitcoin treasury: Hyperscale Data (NYSEAMERICAN: GPUS) reported that it has set aside $43 million for its subsidiary, Sentinum, to add to its bitcoin treasury. Via Sentinum, Hypserscale Data currently holds 451.85 BTC ($39.8 million).

Market Update

- Equities end week with a mixed bag as tech slumps: Stocks ended the week on a sour note, with the S&P 500 and Nasdaq falling, dragged down by a tech sector selloff. Industrial and small-cap stocks fared better, with the Dow Jones and Russell 2000 gaining on the week.

- S&P 500: 6,827.41 (-0.6%)

- Nasdaq: 23,195.17 (-1.6%)

- Dow: 48,458.05 (+1%)

- Russell 2000: 2,551.46 (+1.2%)

- FOMC lowers Fed Funds Rate by 25 bips: In a 9-3 decision, the Federal Open Market Committee (FOMC) voted to lower the Fed Funds Rate by 0.25% to 3.75-4.00%. Chicago and Kansas city Presidents Goolsbee and Schmid voted to hold rates, while Fed Governor Miran was in favor of a more aggressive 0.50% cut. For forward guidance, Powell remarked in a press conference that the Fed would take a meeting-by-meeting approach on future policy, but Bloomberg Intelligent noted that the conference included the most dovish remarks by Powell since 2021.

Most dovish FOMC presser since 2021 according to Bloomberg @markets pic.twitter.com/sL9j6iVGGq

— Forward Guidance (@ForwardGuidance) December 10, 2025

- Job openings largely unchanged in October: The U.S. Bureau of Labor Statistics reported that there were 7.7 million job openings in October, a 4.6% rate that was virtually unchanged from September, but layoffs were slightly up to 1.9 million (1.2%). There were 5.1 million hires in October at a rate of 3.2%, which was also stable from September. October’s quit rate was 1.8% (2.9 million), potentially signaling weaker worker confidence amid economic uncertainty.

- Trade deficit narrowed significantly in September: Per the U.S. Census Bureau, the U.S. goods and services trade deficit was $52.8 billion in September 2025, declining by $6.4 billion from August's revised $59.3 billion. The 10.9% contraction marks the smallest U.S. trade gap since June 2020, a time when COVID shutdowns choked international supply chains. Exports increased to $289.3 billion (+$8.4 billion from August), a 3% growth that overshadowed the 0.5% import growth (+$1.9 billion) of $342.1 billion. The shrink in the trade deficit largely comes from goods instead of services, as the goods trade deficit narrowed more than services in September.

- Small business optimism rose modestly in November: The National Federation of Independent Business reported that its Small Business Optimism Index rose in November, increasing by 0.8 points to 99. The first increase in three months, the rise was slightly above consensus expectations and above the 52-year historical average of 98. Still, 33% of respondents were unable to fill positions in November, the first increase since June and well above the 24% historical average, while net hiring plans rose to their highest of the year with 19% of respondents planning to add roles in the next three months. Owners cited inflation as second only to labor quality on their list of concerns, with 34% increasing average prices in November after a 13 point increase from October, the biggest MoM increase in the survey’s history and the highest reading since March 2023.

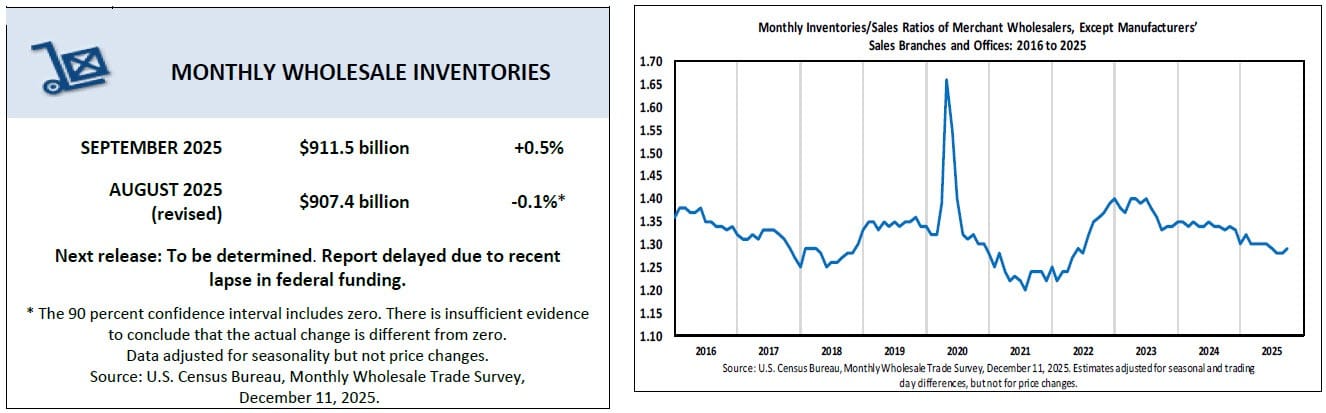

- Wholesale inventories up in October as sales fall: Wholesale inventories rose about 0.2% MoM and ~1% in September to $911.5 billion, while the revised MoM figure for August fell 0.1% to $907.4 billion, the U.S. Census Bureau reported last week. Sales fell 0.2% MoM to $708.2 billion but were up 4.8% YoY

- Crude inventory rises, cold weather shakes out natural gas inventory: In its most recent petroleum and natural gas updates, the EIA reported that crude oil and gas inventories rose modestly for the week ending December 5, while natural gas inventories fell below the 5-year average as cold snaps in the U.S. have increased demand. Refinery utilization rates drooped amid scheduled maintenance and gasoline demand fell, with the EIA saying increasing inventories for oil and gasoline align with seasonal trends. Crude oil exports remain strong with net petroleum imports still historically low, and LNG exports were elevated as well.

- Oil prices drop off: Oil prices fell significantly last week as inventories rose amid the typical holiday slump.

- WTI Crude: $57.44/barrel (-4.5%)

- Brent Crude: $61.12/barrel (-4%)

- Gold and silver shine: Monetary metals continue to rally, with gold rising 2% WoW to $4,330/oz and silver surging to $65/oz before correcting to $62/oz for a 6% weekly gain at the time of writing. Gold and silver are respectively up 62% and 108% YTD.

Upcoming Earnings Reports

- Heico (HEI): Tuesday

- Lennar (LEN): Tuesday

- Micron Technology (MU): Wednesday

- General Mills (GIS): Wednesday

- Accenture (ACN): Wednesday

- Nike (NKE): Thursday

The Week Ahead in Data*:

- U.S. Census Bureau Q3 Manufacturing, Mining, Wholesale Trade report (Monday)

- U.S. Census Bureau Q3 Retail Trade report (Monday)

- National Association of Home Builders Housing Market Index (Monday)

- U.S. Bureau of Labor Statistics November Jobs Report (Tuesday)

- U.S. Census Bureau Housing Starts and Permits report (Tuesday)

- U.S. Census Bureau October Retail Sales report (Tuesday)

- U.S. Census Bureau September Inventories and Sales report (Tuesday)

- U.S. Bureau of Labor Statistics November Consumer Price Index (Thursday)

- Philadelphia Federal Reserve Manufacturing Index (Thursday)

- U.S. Department of Labor weekly jobs report (Thursday)

- University of Michigan Index of Consumer Sentiment (Friday)

- National Association of Realtors Existing Home Sales report (Friday)

*Government reports may be delayed in the aftermath of the shutdown

Thank you for reading, and please feel free to reach out with any questions.