CCM Blockchain Newsletter (December 22, 2025)

Stocks ended last week with mixed returns while bitcoin rose slightly.

Happy Monday everyone, and welcome back to this week’s market newsletter. Please see below this week’s market data.

Bitcoin Market Update and News

- Bitcoin rises slightly on the week: Bitcoin’s price swung wildly last week, whipsawing between crests and troughs only to end the week roughly where it began by market close on Friday. On Monday, bitcoin's price popped above $90,000, and at the time of publication, bitcoin is up 4.1% WoW to $89,500.

- CCP cracks down on bitcoin mining in Xinjiang: Chinese officials began a probe last week into bitcoin mining operations in Xinjiang, a coal rich region in northern China. Industry professionals estimate that the region could house 100 EH/s of hashrate (roughly 1/12th of Bitcoin’s hashrate at the time of the crackdown), equivalent to as much as 2 GW of capacity when factoring in machine and overall facility power draw. Officials reportedly seized some equipment while leaving some operations intact. China banned bitcoin mining in 2021, but some miners have continued to operate in the shadows.

Interesting Reads and Videos

- Will Quantum Computing Kill Bitcoin?

- Bitcoin and the Quantum Problem – Part II: The Quantum Supremacy

- Critical Materials: A Strategic Analysis – Iron Ore Edition

Bitcoin Treasury Company News and Updates

- Strategy buys 10,645 bitcoin for $980 million as total holdings top 671,000: Last week, Strategy (NASDAQ: MSTR) disclosed a 10,645 BTC purchase it made the week prior, a $980.3 million purchase that increased Strategy’s total bitcoin holdings to 671,268. As covered in the last newsletter, Strategy also purchased roughly $1 billion worth of bitcoin over the preceding week.

- American Bitcoin reports 5,098 bitcoin treasury: Bitcoin miner and treasury firm American Bitcoin (NASDAQ: ABTC) reported that it holds 5,098 BTC as of December 14, 2025, nudging it into the top 20 BTC treasuries according to BitcoinTreasuries.net, unseating Semler Scientific (NASDAQ: SMLR) for the 20th spot.

- Norway's sovereign wealth fund supports Metaplanet bitcoin plan ahead of EGM vote: Norway’s Norges Bank Investment voted yes on five Metaplanet (TYO: 3350 | OTC: MTPLF) management proposals. The Norwegian sovereign wealth fund, one of the world’s biggest, holds a roughly 0.3% stake in the Japanese bitcoin treasury company.

Market Update

- Stocks end the week with mixed returns: Another week of mixed performance for U.S. equities, with the S&P 500 and Nasdaq rising this time (as opposed to last week),while the industrial sector and small-cap stocks took a hit in a reversal of fortune from last week’s slight gains.

- S&P 500: 6,834.50 (+0.10%)

- Nasdaq: 23,307.62 (+0.48%)

- Dow: 48,134.89 (-0.67%)

- Russell 2000: 2,529.42 (-0.86%)

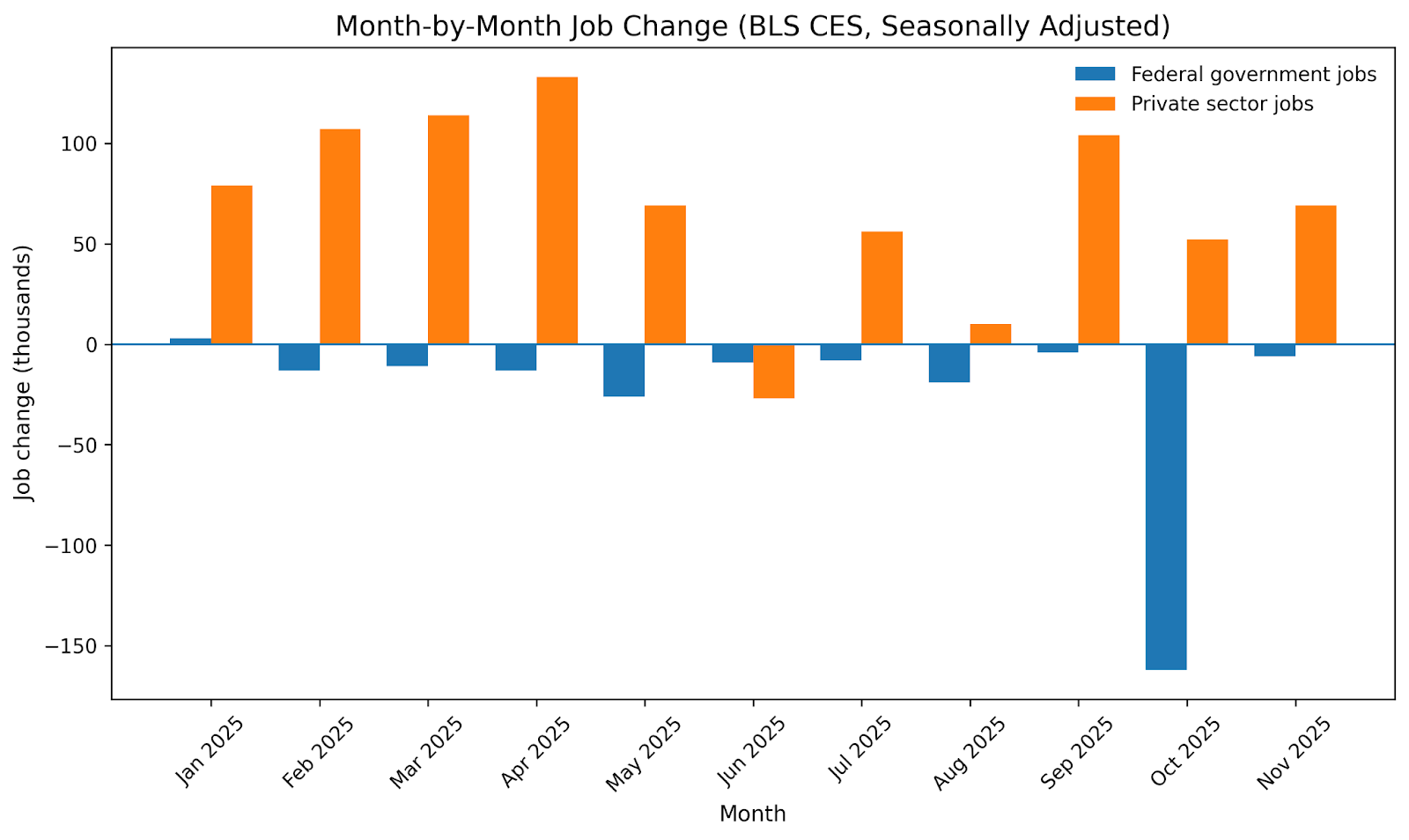

- Payrolls up in November as unemployment climbs amid Federal layoffs: Per the Bureau of Labor Statistics, nonfarm payrolls rose with 64,000 jobs in November, a reversal of the job losses recorded from earlier in the year. Unemployment, however, crept to 4.6%, the highest read since September 2021. The healthcare sector recorded the biggest gains, while construction grew modestly and transportation/warehousing continued its multi-month decline. When we look at federal vs. private sector unemployment losses and gains YTD (-268,000 vs. +766,000 respectively), we can clearly see the job market bifurcating, with the private sector adding 2.9 jobs to every 1 job lost in the federal public sector. As the Trump administration’s fiscal austerity enervates public sector jobs, the private sector, though not particularly strong, is seeing growth.

- CPI cools in November; data includes caveats: The U.S. Bureau of Labor Statistics reported headline CPI increased 2.7% YoY in November (versus 3.0% in September), beating expectations for a 3.1% rise. Core CPI came in at 2.6% YoY, marking the lowest reading in several years. Food prices rose 2.6% YoY, energy was up 4.2%, and shelter was up 3.0%, indicating that indispensable goods and services are still elevated well above the 2% target. To caveat the read, it's important to note that the BLS did not collect data for October, and it also failed to record data for early November, leaving some economists to caution that the data is too incomplete to draw any conclusions.

- Retail sales up in September on revised figure: Per the U.S. Census Bureau, retail sales were up 0.1% in September MoM and 3.4% YoY, with ecommerce/non-store retailer sales up 9.0% and food/drink services up 4.1%. Early, seasonally-adjusted estimates for October project flat growth at $732.6 billion, although notably, auto sales are expected to fall 1.7% MoM.

- NAHB Housing Market Index up a smidge in November; conditions still weak: The National Association of Home Builders and Wells Fargo Housing Market Index rose one point to 39 in December 2025, up from 38 in November. This reading is still well below the 50 baseline, with confidence remaining negative for roughly 20 consecutive months. Current sales conditions improved slightly, while future sales expectations remained above 50, continuing a months-long trend of rising expectations. Some 40% of builders offered incentives or price cuts in November, a trend that has grown in recent months.

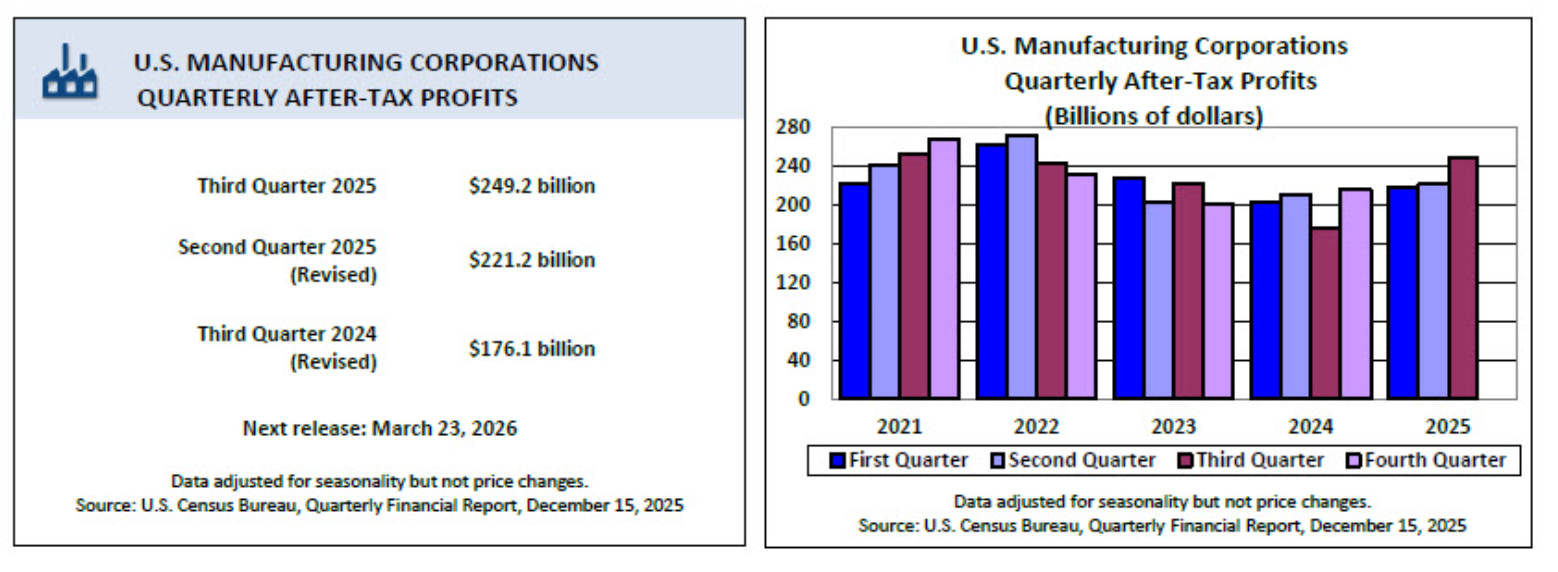

- Manufacturing profits, sales rise in Q3: The U.S. Census Bureau reported that seasonally-adjusted, after-tax profits for U.S. manufacturers rose to $249.2 billion in Q3 2025, a $28 billion bump from Q2 and up $73.1 billion from Q3 2024’s revised figure. Manufacturing sales increased from $1.98 trillion in Q2 2025 to $2.03 trillion in Q3. Durable goods saw the largest profit growth at $157.9 billion, while nondurable goods rose modestly.

- Manufacturing Index takes a dive in December read: The Philadelphia Federal Reserve’s Manufacturing Index fell 8.5 points to −10.2 in a reading for December 2025, down from −1.7 in November and well below expectations for roughly +2.5. This is the third consecutive negative reading for the index. Counterintuitively, hiring rose over the month despite the contraction in activity, and prices paid fell to a six month low while prices received rose. New orders and shipments were up, and future outlooks were positive, although manufacturers reported that they are expecting slower growth in 2026.

- Consumer sentiment rises in final reading for December: The University of Michigan Consumer Sentiment Index increased to 52.9 in December 2025 from 51.0 in November, a 3.7% increase that reverses a slew of consecutively weak readings. Still, this is well below December 2024’s 74.0 print, reinforcing that sentiment is historically frail. The Current Economic Conditions Index inched down modestly to 50.4, while year-ahead inflation expectations declined to 4.2% for the lowest print in roughly 11 months. Consumer unemployment fears for 2026 edged up to 63% even though labor market expectations were up.

- Oil prices slip once again: Oil prices dropped again last week as the market priced in potentially easing supply chain disruptions.

- WTI Crude: $55.99/barrel (-2.5%)

- Brent Crude: $59.63/barrel (-2.5%)

- Gold plods along while silver runs: Gold prices were basically flat on the week, bouncing between $4,300-4,400/oz, while silver soared 7% to $67/oz. Gold and silver are respectively up 64% and 125% YTD.

Upcoming Earnings Reports

- Ennis (EBF): Monday

- Limoneira (LMNR): Tuesday

- Korea Electric power (KEP): Tuesday

- iHuman (IH): Thursday

- Outlook Therapeutics (OTLK): Friday

The week ahead in data*:

- Chicago Federal Reserve September National Activity Index (Monday)

- U.S. Census Bureau Durable Goods Orders, Advance Report (Tuesday)

- Richmond Federal Reserve December Manufacturing Index (Tuesday)

- Bureau of Economic Analysis Q3 2025 GDP, Initial Estimate (Tuesday)

- Federal Reserve Board October Industrial Production (Tuesday)

- The Conference Board December Consumer Confidence Index (Tuesday)

- U.S. Bureau of Labor Statistics Weekly Jobs Report (Wednesday)

*Government reports may be delayed in the aftermath of the shutdown