CCM Blockchain Newsletter (December 29, 2025)

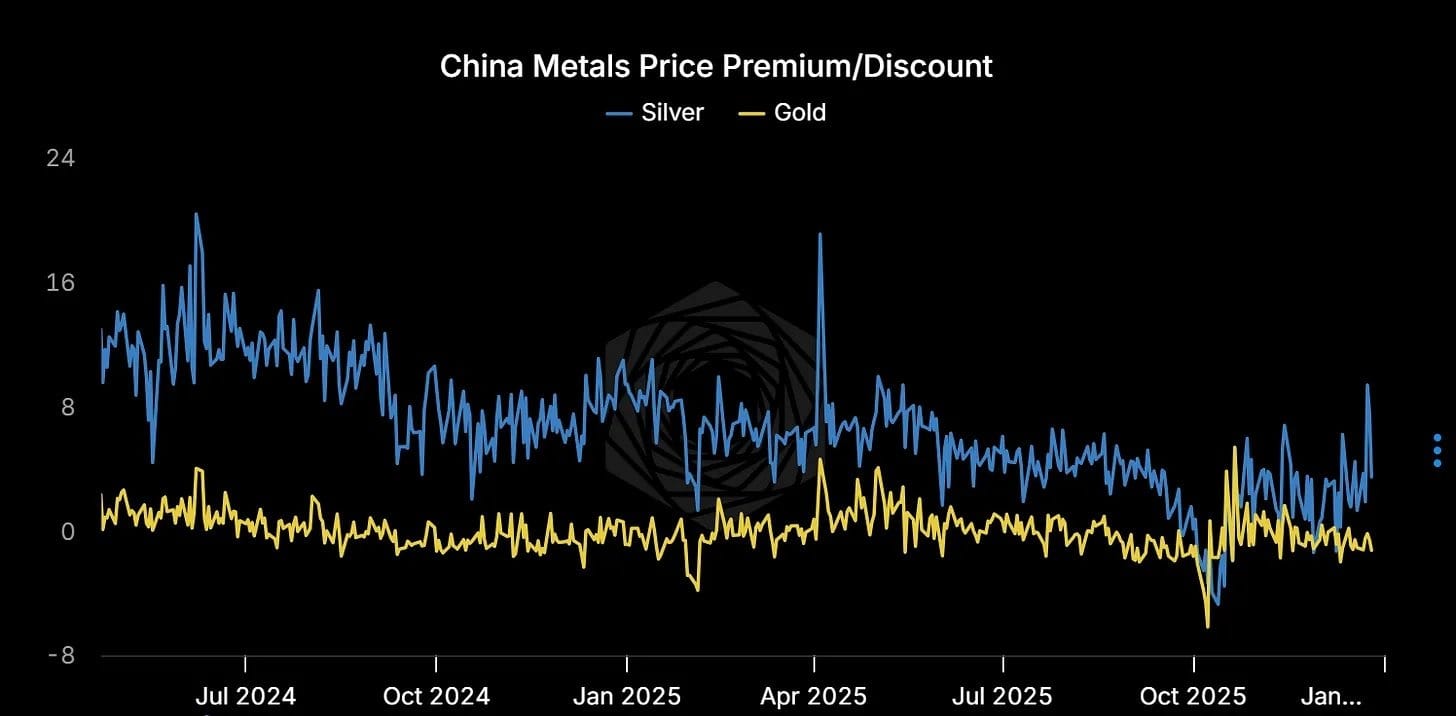

Silver stole the show last week, surging to as high as $85/oz in the Chinese market.

Happy Monday everyone, and welcome back to this week’s market newsletter. Please see below this week’s market data.

Bitcoin Market Update and News

- Bitcoin remains range-bound: Bitcoin briefly touched $90,000 last week before tumbling back to the same place it began the week. At the time of publication, Bitcoin is down 1.4% WoW to $87,300.

- Bitcoin hashrate drop may signal bottom as treasury firms buy the dip: VanEck: Bitcoin’s hashrate has contracted over the last month, and if history repeats, analysts at VanEck say that this signal could be bullish for Bitcoin’s short-term price. According to VanEck’s Patrick Bush and Matthew Sigel, Bitcoin’s 30-day average hashrate was down 4% since its November peak as of December 22, with mining margins compressed and miners in the capitulation zone. VanEck notes that, since 2014 under such conditions, Bitcoin saw a positive return 65% of the time when hashrate contracts versus 54% when it expands.

Interesting Reads and Videos

- 10 Silver Days of Christmas

- The Global Financial System Is Structurally Broken | David Dredge

- VanEck Mid-December 2025 Bitcoin ChainCheck

Bitcoin Treasury Company News and Updates

- Strategy raises $747.8 million via stock sales, records no Bitcoin purchases: Last week, Strategy (NASDAQ: MSTR) disclosed that it raised $747.8 million from its MSTR at-the-market offering the week prior. However, the Bitcoin treasury frontrunner made no Bitcoin purchases over the week, using the cash instead to pad its USD reserves, which stood at $2.19 billion as of December 21.

- Metaplanet board approves multiple proposals for Bitcoin strategy, capital structure in 2026: Metaplanet (OTC: MTPLF) shareholders approved 5 proposals that will guide its Bitcoin strategy and capital management in 2026: 1) An increase in reserves for preferred share dividends and share buybacks; 2) An increase in Class A and Class B preferred shares from 277.5 million to 555 million each; 3) An amendment to the Class A structure, authorizing a floating dividend rate delivered monthly; an amendment to the Class B structure for a quarterly dividend; and 5) An approval to issue Class B shares to international institutional investors.

- Bitmine increases ETH treasury to over 4 million: Bitmine Immersion Technologies (NYSE AMERICAN: BMNR) has increased its Ethereum position to 4,066,062 ETH (worth $11.97 billion at the time of writing), representing 3.37% of the entire Ethereum supply at the time of announcement.

Market Update

- Santa rally sends stocks to all-time highs: Over the Christmas holiday week, the S&P 500 and Dow Jones hit record highs, with the Nasdaq just a few hundred dollars behind its own all-time high set at the end of October.

- S&P 500: 6,929.94 (+1.4%)

- Nasdaq: 23,593.10 (+1.2%)

- Dow: 48,710.97 (+1.2%)

- Russell 2000: 2,534.35 (+0.2%)

- Silver surges as supply deficit blows out spot premium: Silver is on a generational run, with the multi-use industrial and monetary metal surging 22% last week to $79/oz. Critical for solar panels and high-performance computing electrical equipment, the energy transition and AI infrastructure demand has placed immense pressure on inventories. Couple this with China’s new silver export controls effective January 1, 2026 (China dominates ~60-70% of global refining capacity) and you get a perfect storm for the supply squeeze that is sending silver’s price skyward. The premium for spot in Shanghai’s market went as high as $85/oz on Friday, and it tapped $91/oz in Dubai. Meanwhile, NYC and COMEX futures for silver are trading in contango, but they are trading in backwardation in London, with these market mismatches highlighting the rush to secure physical silver under the current market stress.

- U.S. indices lag international counterparts in 2025: The S&P 500 is on track for a ~19% gain in 2025, but indices for international stocks have outshined the premier index for U.S. equities. The EAFE index, which tracks a basket of stocks spanning Europe, Australia, Asia, and the Far East, has increased 31.9% YTD, while Blackrock’s MSCI Emerging Markets ETF is up 32.3%. Some YTD returns for country-specific indices are even more striking, with for example, the Korean KOSPI index up 72.2% and Spain’s IBEX 35 up 47.1%.

- Analysts eye double digit earnings growth for S&P 500 companies in 2026: Per FactSet’s 2026 market forecast in its latest Earnings Insight, FactSet analysts project S&P 500 companies to post an average 15% YoY profit growth, nearly double the 10-year average of 8.6%. If realized, such growth would etch the 6th straight year of earnings growth and the 3rd straight of double-digit growth. The projection forecasts growth across all 11 sectors tracked in the S&P 500, with FactSet expecting information tech, materials, industrials, communications, and discretionary consumer cohorts to post double-digit increases to earnings. FactSet believes that the bulk of growth will come from non-Magnificent 7 companies.

- National Activity Index inches up in September, but not enough to escape contraction: The Chicago Federal Reserve’s National Activity Index rose to -0.21 in September, an improvement from August’s -0.31 but still below the 0 threshold, indicating that economic growth is contracting and below the historical trend. The Index’s 3-month average actually slipped from -0.18 in August to -0.21 in September as growth decelerated over Q3. Of the four categories the Index tracks, only employment was positive in September at +0.01, and barely at that. By contrast, production indicators (-0.10); sales, orders, and inventories (-0.07); and personal consumption (-0.06) were all down on the month.

- Durable goods orders down in October: The U.S. Census Bureau reported that durable goods orders fell by 2.2% in October to $307.4 billion, a reversal that negated September’s rise. This decrease exceeded expectations of a smaller decline. Transportation equipment accounted for the majority of the loss with a decline of 6.5%, and without this drop, durable goods orders would have inched higher 0.2%. Excluding defense orders, however, new orders were down 1.5%, suggesting that sectors outside of transportation are also softening.

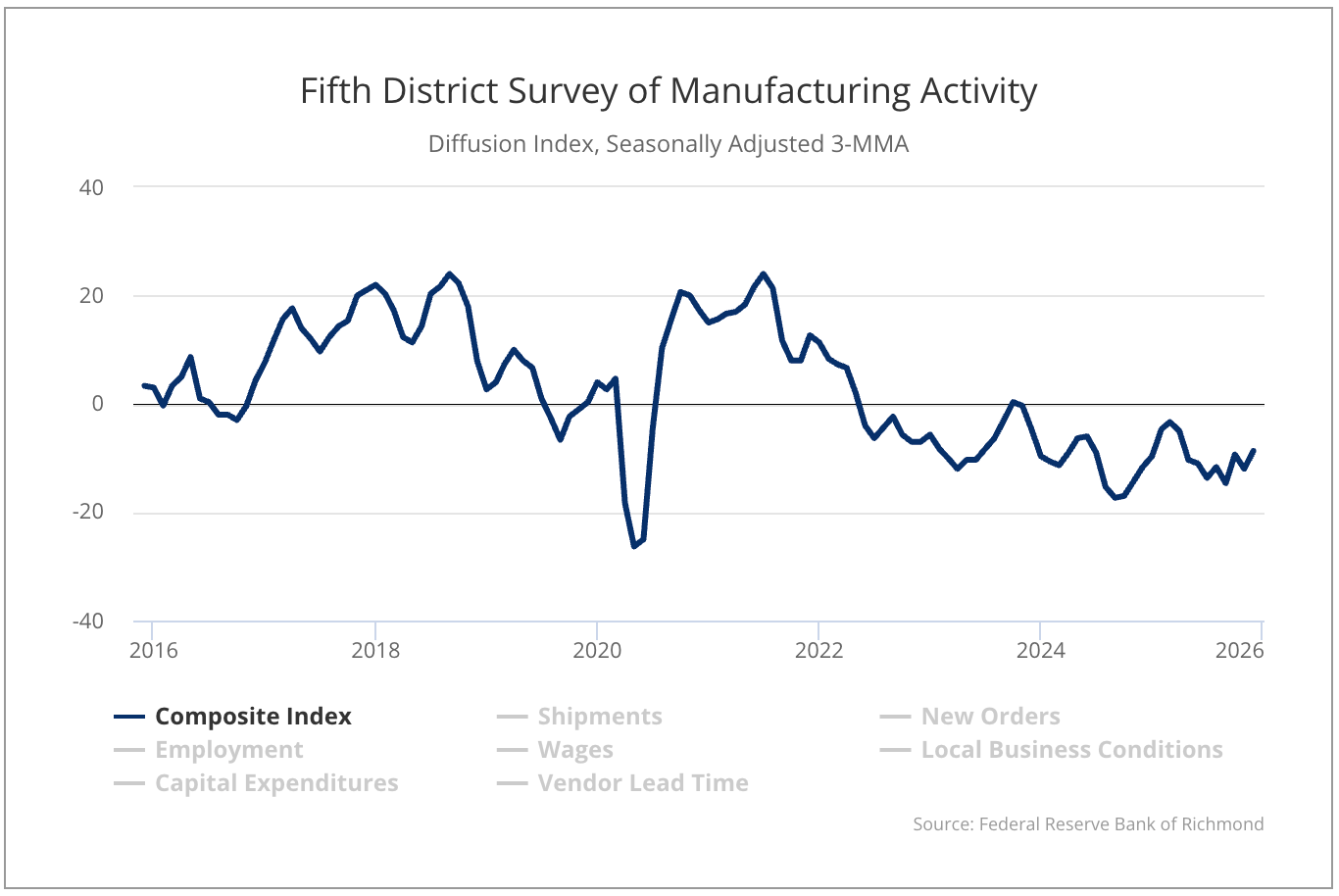

- Richmond manufacturing index still in contraction despite improvement in December: The Richmond Federal Reserve’s manufacturing composite index improved significantly in December from -15 to -7, so while manufacturing conditions are improving in the bank’s district, the sector is still in contraction. Shipments and new orders improved respectively from -14 to -11 and -22 to -8, and employment bounced from -7 to -1. Local conditions are still weak but rose aggressively from -20 to -9, while future local business expectations surged from 1 to 16 as future shipments and new orders increased. Manufacturer prices paid fell in December, but prices received rose, as past input inflation has phased into an increase in output prices.

- Q3 GDP initial estimate clocks in at 4.3%: The U.S. Bureau of Economic Analysis’s initial read for Q3 GDP estimates 4.3% annualized growth for the quarter, well above expectations of a 3.2-3.3% increase. If the reading holds, it would mark the strongest quarterly growth in nearly two years and would be above Q2’s 3.8% rise. Consumer spending is spearheading the growth, with real final sales to private domestic purchasers up 3%, while a boost in exports and a corresponding decline in imports has also elevated the estimate. Business investment, however, declined over the quarter, dragging performance.

- Industrial production down in October: The Federal Reserve Board’s Industrial Production and Capacity report indicated that industrial production fell in October by 0.1% in continuation of a months-long trend. Preliminary data for November showed a modest rebound of +0.2%. Manufacturing output suffered in October, with this trend unchanged in November’s preliminary reading, but mining output perked up inNovember by 1.7% after falling in October. Total capacity utilization was 75.9% in October versus ~76% in November.

- Consumer confidence slips in December: The Conference Board’s Consumer Confidence Index fell 3.8 points in December to 89.1 from November’s revised 92.9 figure for the 5th consecutive monthly decline and the 19th straight month below the 100 point benchmark. The present situations index plummeted 9.5 points to 116.8, while the expectations index stayed at 70.7 for the 11th consecutive month below the 80 threshold (historically associated with recession risks). The current financial situation index for families flipped negative, with more families reporting bad conditions versus good ones for the first time since July 2022. Notably, older generations are more pessimistic than younger ones, with consumer confidence from Millennials and Generation Z diverging significantly from Baby Boomers and Generation X.

- Oil inches upward: Oil prices rose last week following a multi-week decline. Week-over-week changes:

- WTI Crude: $56.74/barrel (+1.4%)

- Brent Crude: $60.64/barrel (+1.7%)

Upcoming Earnings Reports

No notable earnings this week.

The week ahead in data*:

- National Association of Realtors Pending Home Sales report (Monday)

- S&P Cotality Case-Shiller 20-City Composite Home Price Index (Tuesday)

- Fed December 9-10 meeting minutes release (Wednesday)

- U.S. Department of Labor Weekly Unemployment Claims (Wednesday)

*Government reports may be delayed in the aftermath of the shutdown

Thank you for reading, and please feel free to reach out with any questions.