CCM Blockchain Newsletter (December 8, 2025)

Equities eked out a rally last week, while bitcoin continues to chop sideways.

Happy Monday everyone, and welcome back to this week’s market newsletter. Please see below this week’s market data.

Bitcoin Market Update and News

- Bitcoin treads just below $90,000: Bitcoin sold off to as low as $83,000 last Monday, recovered to $93,000 by Wednesday, and sold off into the weekend. At the time of publication, Bitcoin is up 4.4% WoW to $90,500.

- CFTC clears spot crypto trading on registered exchanges: Commodity and Futures Trading Commission Acting Chairman Caroline D. Pham announced that, as of December 4, 2025, the CFTC has cleared spot crypto trading on registered futures exchanges. “Recent events on offshore exchanges have shown us how essential it is for Americans to have more choice and access to safe, regulated U.S. markets. Now, for the first time ever, spot crypto can trade on CFTC-registered exchanges that have been the gold standard for nearly a hundred years, with the customer protections and market integrity that Americans deserve,” Pham said.

- Bank of America expands crypto access for wealth management clients: Per Reuters, Bank of American will allow its wealth advisors to recommend crypto in client portfolios starting January 5, 2026. The mandate will also affect BOA subsidiaries Merrill (formerly Merrill Lynch) and Merill Edger, allowing advisors to open bitcoin and crypto ETP access with no threshold.

Interesting Reads and Videos

- American Bitcoin (ABTC) stock plunged 39% on Tuesday. Here’s why.

- The So-Called “Debasement Trade”

- The $60 Billion Bitcoin Bet | Phong Le

Bitcoin Treasury Company News and Updates

- Strive all-stock offer for Semler Scientific plummets after loss of customers: Strive's (NASDAQ: ASST) acquisition offer for Semler Scientific (NASDAQ: SMLR) has fallen by 76%, as Semler's stock price has fallen following the loss of key customers in Q3. Per the all-stock agreement, Strive will pay Semler shareholders a fixed ratio of 21.05 shares of Strive Class A common stock for each SMLR share.

- Strategy Announces Establishment of $1.44 Billion USD Reserve and Updates FY 2025 Guidance: Strategy (NASDAQ: MSTR) has established a $1.44 billion cash reserve in a bid to bolster liquidity to pay dividends on its preferred shares. Strategy funded the reserve using an outstanding MSTR ATM offering, and it aspires to build enough cash to be able to cover 24 months of dividends payments. In the same announcement, Strategy also updated its fiscal year 2025 guidance to reflect Bitcoin’s recent selloff.

- Jack Maller’s TwentyOne Capital expects to debut on NYSE on December 9: Bitcoin treasury company Twenty One Capital expects to debut on the NYSE under the ticker XXI following the projected completion of its merger with SPAC Cantor Equity Partners (NASDAQ: CEP). Cantor Equity Partners shareholders approved the combination during a December 4 meeting. TwentyOne’s self reported Bitcoin treasury is 43,514 BTC, a $3.97 billion trove that would make it the third largest Bitcoin treasury company in the game.

- Anthony Pompliano's Bitcoin Treasury Firm ProCap BTC Closes SPAC Merger Deal: ProCap BTC, a Bitcoin treasury firm helmed by Anthony Pompliano, closed its its SPAC merger with Columbus Circle Capital (NASDAQ: BRR), with the combined company expects to debut on the Nasdaq on Monday under the ticker BRR. ProCap BTC has a self-reported Bitcoin treasury of 4,951 BTC worth $451 million at the time of writing.

Market Update

- Equities edge upward, eye all-time highs: Stocks eked forward last week, with each major index climbing fractions of a point, led by the Nasdaq. Each of the big three indices is just a point or two away from their October all-time highs.

- S&P 500: 6,870.40 (+0.3%)

- Nasdaq: 23,578.13 (+0.9%)

- Dow: 47,954.99 (+0.5%)

- Russell 2000: 2,521.48 (+0.8%)

Final S&P 500 Q3 earnings scorecard shows 13.4% average earnings growth: Per FactSet’s final scorecard for Q3, S&P 500 companies reported an average earnings growth of 13.4% last quarter, with 83% reporting higher earnings-per-share than estimated, the most since Q2 2021. Information technology continues to outperform the index’s 10 other sectors, with the industry booking a blended average earnings growth of 29% in Q3.

- Private sector jobs take a haircut in November: According to the ADP’s November jobs report, the private sector lost 32,000 jobs in November, versus an estimated 47,000 jobs added in October. Retained employee wage growth was up 4.4% year-over-year (just down from 4.5% in October), while pay for “job changers” was up 6.3% YoY versus 6.7% in the previous month. Small businesses led the cuts while mid-to-large firms saw a moderate bump in hiring. Manufacturing, construction, professional/business services, and information also saw the most cuts, while only healthcare, education, and leisure & hospitality experienced growth on the services side.

- Fed rate cut odds rise as FOMC meeting looms: The Federal Open Market Committee will meet this week from December 9-10 to decide whether it will change the Federal Funds Rate. Market participants are betting on an 86% chance that the Federal Reserve drops rates from 3.75-4.00% to 3.5-3.75%, according to the CME’s FedWatch.

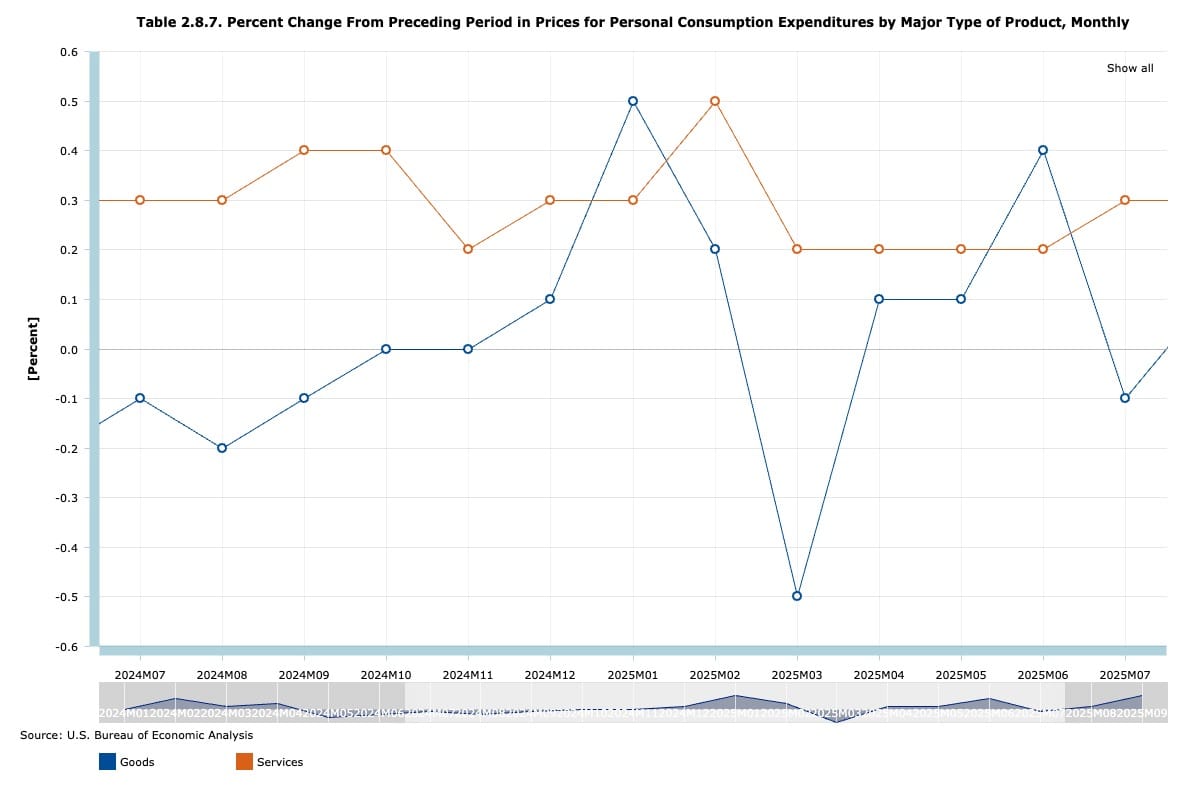

- Fed’s favored inflation gauge up in September: The Personal Consumption Expenditures Index (PCE) rose in September, with headline PCE up 0.3% MoM and 2.8% YoY (versus 2.7% in August), and core PCE rose 0.2% MoM and 2.8% YoY. Consumer spending rose 0.3% in September in nominal terms, largely on behalf of services spending, while real spending was flat when adjusting for inflation. Reflecting this, personal income rose by 0.4% and disposable personal income rose 0.3%, barely above reported inflation levels.

- U.S. Treasury yields rise in face of likely December rate cut: Medium and long-term U.S. Treasury Bonds took a haircut last week, sending yields higher at a time when the market is expecting the Fed to cut next month. The 30-Year hit its highest level since September during the yield rally. The Week-over-week changes:

- 30-Year: 4.79% (+12 bps)

- 10-Year: 4.14% (+12 bps)

- 5-Year: 3.72% (+12 bps)

- 2-Year: 3.56% (+6 bps)

- Manufacturing Index in contraction for ninth straight month: The Institute for Supply Management’s Manufacturing Index fell to 48.2 in November, a half a point decline from October that marks the ninth month of contraction for the U.S. manufacturing sector (anything below a 50 reading is considered contraction). New orders fell to 47.4 for the third month of contraction in a row, while production rose out of contraction to 51.4 from 48.2. The employment sub-index fell to 44 from 46 in October, and input costs rose to 58.5 from 58.

- University of Michigan Consumer Sentiment inches up in early Dec. read: U. of Michigan’s Consumer Sentiment Index increased to 53.3 for an early December read, up from 51 in November. Still, the index is 28% below the December 2024 level. Consumer expectations also rose from 51 in November to 55, but the Current Economic Conditions Index ticked lower to 50.7 versus 51.1 in the prior month.

- U.S. vehicle sales soften in November YoY, strengthen MoM: The National Automotive Dealers Association (NADA) reported that new-vehicle sales in the U.S. rose in November to 15.6 million units from 15.3 million in October, but the November read is still down 5% YoY. NADA cited elevated prices, expiration of EV tax credits, and consumer affordability concerns given elevated interest rates and high pricing as driving the decline in demand. On the EV front, Ford said its EV volume plummeted 61% in November, while industry-wide demand for hybrids and internal-combustion autos stayed resilient. Dealers inventories are reflecting the moderation in demand, rising at a more modest pace than earlier in the year.

- Oil rallies: Oil prices continued to rally last week, with WTI Crude and Brent Crude both rising over the week.

- WTI Crude: $60.08/barrel (+2.7%)

- Brent Crude: $63.42/barrel (+4.7%)

- Gold stagnates as silver eyes breakout above $60: Gold took a breather last week, falling 1.3% with gold trading at $4,220/oz at the time of writing. Silver has rallied hard over the last month, up 22% as little brother precious metal tries to break above $60/oz for the first time ever.

Upcoming Earnings Reports

- Oracle (ORCL): Monday

- Toll Brothers (TOL): Monday

- AutoZone (AZO): Tuesday

- Adobe (ADBE): Wednesday

- Synopsys (SNPS): Wednesday

- Broadcom (AVGO): Thursday

The week ahead in data*:

- U.S. Census Bureau construction spending report (Monday)

- U.S. Bureau of Labor Statistics Job Openings and Labor Turnover Survey (Tuesday)

- U.S. Bureau of Labor Statistics Productivity and Costs (Tuesday)

- National Federation of Independent Business Small Business Optimism Index (Tuesday)

- Jerome Powell Press Conference Following FOMC Meeting (Wednesday)

- EIA petroleum report (Wednesday)

- U.S. Bureau of Labor Statistics productivity and labor costs (Wednesday)

- U.S. Treasury federal budget (Wednesday)

- U.S. Bureau of Labor Statistics Producer Price Index (Thursday)

- EIA natural gas report (Thursday)

- U.S. Census Bureau wholesale inventories (Thursday)

- U.S. Census Bureau trade balance report (Thursday)

- U.S. Department of Labor weekly jobs report (Thursday)

*Government reports may be delayed in the aftermath of the shutdown

Thank you for reading, and please feel free to reach out with any questions.