CCM Blockchain Newsletter (January 5, 2026)

Bitcoin is eying a breakout while silver and gold test their own highs.

Happy Monday everyone, and Happy New Year! Welcome back to this week’s market newsletter. Please see below this week’s market data.

Bitcoin Market Update and News

- Bitcoin breaks above $90,000: Bitcoin topped $91,000 over the weekend for the first time in nearly a month, following its close above $90,000 on Friday. At the time of writing, bitcoin is up 4% to $97,200.

- Bitcoin ends 2025 in the red despite all-time high: Bitcoin closed 2025 down ~6% despite setting a record high of $127,000 in October. This marks the first first time that Bitcoin lost value at the close of a year in which it also hit a record high.

Interesting Reads and Videos

- The Venezuelan Oil Narrative is Pure Theatre

- Market Memo: Venezuela - Rising Tensions and a Potential Regime Shift

- Stone Ridge 2025 Investor Letter

Bitcoin Treasury Company News and Updates

- Strategy buys 1,229 bitcoin funded by $108.8M MSTR issuance: Last week, Strategy (NASDAQ: MSTR) disclosed that it acquired 1,229 bitcoin for $108.8 million between December 22 and December 28, 2025, funding the purchase with a proportional sale of MSTR shares over the same week.

- Semler Scientific chairman urges investors to approve Strive merger ahead of Jan 13 meeting: On X last week, Semler Scientific (NASDAQ: SMLR) Chairman Eric Semler urged shareholders to vote yes on its proposed merger with Strive Asset Management (NASDAQ: ASST) in anticipation of a January 13, 2026 meeting. Per the merger agreement, Semler Scientific shareholders will receive 21.05 ASST for every share of SMLR.

- Bitmine increases ETH treasury ahead of shareholder vote on 4 proposals: Bitmine Immersion Technologies (NYSE AMERICAN: BMNR) has increased its Ethereum position to 4,110,525 (~$13 billion). The company will be holding a meeting on January 15, where shareholders will vote on four separate proposals: the election of new directors, a charter to increase the number of authorized common stock, a 2025 Omnibus Incentive Plan, and a performance-based compensation package for Bitmine’s executive chairman.

Market Update

- Stocks droop to start the New Year: Major indices declined last week, finishing Friday in the red to mark the first trading day of 2026.

- S&P 500: 6,858.47 (-1.03%)

- Nasdaq: 23,253.63 (-1.5%)

- Dow: 48,382.39 (-0.7%)

- Russell 2000: 2,508.22 (-1%)

- Stocks end 2025 on a high note, but less so than 2024 and 2023: Per JohnHancock, the S&P 500 returned 17.9% in 2025, a strong showing but shy of 2024’s 25% and 2023’s 26.3% gains. Magnificent 7 firms accounted for 42% of the S&P 500’s returns, versus 55% for the last three years, and they made up 34.9% of the index’s market capitalization at the end of 2025 (and 33.5% in 2024). Accordingly, communications services and information technology respectively generated 33.6% and 24% returns in 2025. Each of the S&P 500’s 11 sectors generated positive returns in 2025, although real estate lagged the bunch at 3.2%.

- Bonds have their strongest year in 2025 since 2020 as yields slide: The Morningstar US Core Bond TR YSD Index rose 7.3% in 2025 while the Bloomberg U.S. Aggregate Bond Index rose ~7%, marking the best year for U.S. private and public bonds since 2020. U.S. Treasury bonds yields fell for almost every duration in 2025 as the Federal Reserve pushed forward rate cuts; the 30-Year, however, bucked the trend, rising as investors and traders price in fears of long-term dollar devaluation. The year-over-year changes to U.S. Treasury yields at the end of 2025 were as follows:

- 30-Year: 4.84% (+5 bps)

- 10-Year: 4.16% (-41 bps)

- 5-Year: 3.72% (-66 bps)

- 2-Year: 3.48% (-36 bps)

- U.S. conducts military operation in Venezuela, apprehends Nicolas Maduro: In a midnight raid conducted late Friday night into Saturday morning. U.S. special forces struck military targets in Venezuela and apprehended Venezuelan dictator Nicolas Maduro and his wife. Venezuela has the largest proven oil reserves of any nation at 303 billion barrels, as well as vast mineral deposits. As analysts digested the news, many see the transition as a potential headwind for U.S. refineries but bearish for Canadian producers, whose Albertan oil sands produce a sour crude oil similar to that produced in Venezuela. That said, Venezuela is only producing roughly 1 million barrels of oil per day, compared to 4 million before Hugo Chavez took power in 1999. Decades of misappropriated investment, capital flight, and mismanagement have hollowed out Venezuela’s oil industry and led to dilapidated infrastructure, so it will take time and billions in investment to get production back to pre-Chavez levels.

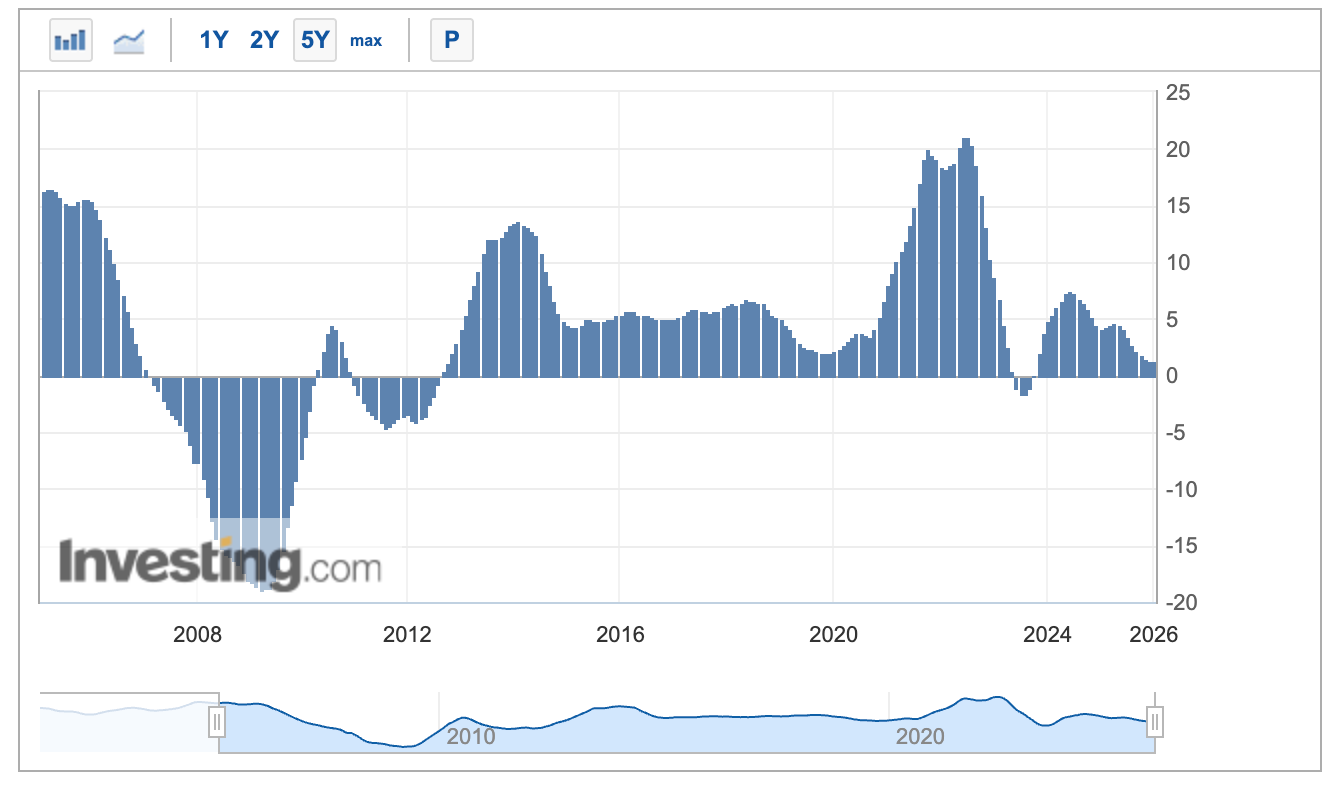

- 20-City Home Price Index grew 1.3% YoY in October: The S&P Cotality Case-Shiller 20-City Composite Home Price Index posted a 1.3% YoY increase in October 2025, just a hair off from the 1.4% growth in September while beating expectations for a 1.1% increase. This reading marks the smallest YoY increase since mid-2023, a year when the index’s growth posted multiple negative readings in a row. Chicago experienced the largest price increase at 5.8%, followed by New York (5%), and the Midwest and Northeast continue to display resilience from COVID-era real estate volatility. Meanwhile, Sunbelt states – whose markets benefited the most from the pandemic’s interstate migration and concomitant real estate boom – are losing ground, with Dallas (-1.5%), Phoenix (-1.5%), and Miami (-1.1%) all seeing price declines YoY.

- Pending home sales up in November: Per the National Association of Realtors Pending Home Sales Report for November, pending home sales rose by 3.3% MoM for the fourth consecutive month. Contracts were up 2.6% YoY as well, and the index reading of 79.2 was the highest in almost three years. The West led MoM pending sales, up 9.2%, followed by the South at 2.4%. The Northeast and the Midwest respectively increased 1.8% and 1.3%. NAR Chief Economist Lawrence Yun attributed the increase in pending sales to lower mortgage rates.

- Federal Reserve meeting minutes highlight differing policy opinions: The meeting minutes from the FOMC’s December 9-10, 2025 meeting show division between FOMC members regarding the vote to reduce the federal funds rate by 0.25% for the third-straight time. While passing in a 9-3 vote, Stephen Miran preferred a 50 bp cut, while Austan Goolsbee and Jeffrey Schmid wanted no change. In the meeting, officials also agreed to an initial $40 billion in short-term Treasury bill purchases to plug liquidity issues.

- Silver takes a breather as COMEX raises margin requirements: Silver chopped sideways last week, bouncing between ~$80-70/oz before closing around $72. Amid the volatility, a product of relentless physical demand, COMEX raised margin requirements for futures trading roughly 15% for initial margin, and as much as ~30% for maintenance margin; COMEX also raised margin requirements for gold futures to ~9%, and gold itself was down 3% last week to $4,400.

- Oil inches upward: Oil prices rose again last week, marking the second consecutive increase, with WTI Crude rising to $57.32/barrel (+1% WoW) and Brent Crude to $60.75/barrel (+0.2%). However, oil prices slipped slightly in Asia upon market open on Monday, as traders price in the regime change in Venezuela.

Upcoming Earnings Reports

No notable earnings next week.

The week ahead in data*:

- Institute for Supply Management Manufacturing Index (Monday)

- U.S. Bureau of Labor Statistics Job Openings and Labor Turnover Survey (Wednesday)

- Institute for Supply Management Non-Manufacturing Index (Wednesday)

- U.S. Census Bureau factory orders report (Wednesday)

- U.S. Census Bureau trade balance and inventories report (Thursday)

- U.S. Federal Reserve consumer credit report (Thursday)

- U.S. Department of Labor weekly unemployment (Thursday)

- U.S. Bureau of Labor Statistics jobs and unemployment report (Friday)

- University of Michigan Index of Consumer Sentiment (preliminary) (Friday)

- U.S. Census Bureau Housing starts report (Friday)

*Government reports may be delayed in the aftermath of the shutdown

Thank you for reading, and please feel free to reach out with any questions.