CCM Blockchain Newsletter (January 8, 2025)

Bitcoin turned 16 last week, and the network has processed over $131 trillion in transactions since inception.

Happy Wednesday, all, and welcome back to this week’s market newsletter. Please see below this week’s market data.

Bitcoin Market Update and News

- Bitcoin surges into the New Year: Bitcoin rose to start 2025 last week, increasing roughly 5% to ~$98,000 by the end of Friday. At the time of publication, bitcoin is trading at ~$95,400.

- Bitcoin rings in the New Year with its sweet sixteen: Bitcoin turned 16 years old last week. January 3 marked the sixteenth Genesis Day – the day that Bitcoin creator Satoshi mined the network’s first block. Over these 16 years, bitcoin has settled over 1.138 billion transactions for a total transacted value of more than $131 trillion, according to a report by Glassnode.

- Blackrock bitcoin ETF sees record outflows: Blackrock recorded the largest outflows ever from its bitcoin ETF on January 2. Over $332 million left the fund on the second day of the new year, smashing the prior record of $188 million in December.

Interesting Reads and Videos

- How AI partnerships could drive bitcoin mining stocks higher in 2025: CNBC Crypto World

- Recounting Ethiopia’s Bitcoin Developments In 2024

- Galaxy Digital Research’s 2025 Predictions

Bitcoin Mining Market News and Trends

- Marathon leverages its bitcoin stack, loans it out for yield: MARA, the largest U.S. public bitcoin miner by hashrate under management, has loaned out 7,377 out of the 44,893 BTC (16%) it holds on its balance sheet for yield. The move comes after MARA made headlines by adopting a Microstrategy-esque strategy and issuing convertible notes to buy bitcoin to the tune of $1.53 billion (15,574 BTC). The maneuver is a reminder that bitcoin miners can leverage their treasuries to generate yield, providing an alternative (if riskier) financing strategy to equity offerings, convertible notes, and debt instruments.

- Rhodium sells Temple site amid bankruptcy, co-CEO departs: A bundle of news for Rhodium this week, a Texas bitcoin miner beleaguered by a Chapter 11 bankruptcy and embroiled in numerous court cases. The company sold its Temple, Texas site for $40 million as part of its ongoing Chapter 11 restructuring, and it also announced that Nathan Nichols, its co-CEO and co-founder, is leaving the company. Rhodium also recently reached a court victory in a years-long litigation with Riot over its hosting contract for Riot’s Whinstone facility in Rockdale, Texas; a judge ruled in favor of Rhodium that a December 2020 hosting agreement for Whinstone did not nullify a prior hosting agreement, and the second round of litigation will determine what remuneration (if any) is due to either party as a result of this ruling.

Market Overview

- Equities slump in first week of New Year: Equities closed the first week of the new year in the red. All the major indices fell week-over-week; the Dow fell 0.95% to 42,732.13, the S&P 500 fell 10.6% to 5,942.47, the Nasdaq fell 1.38% to 19,621.68, and the Rusell 2000 had a negligible decrease of 0.02% to 2,268.47.

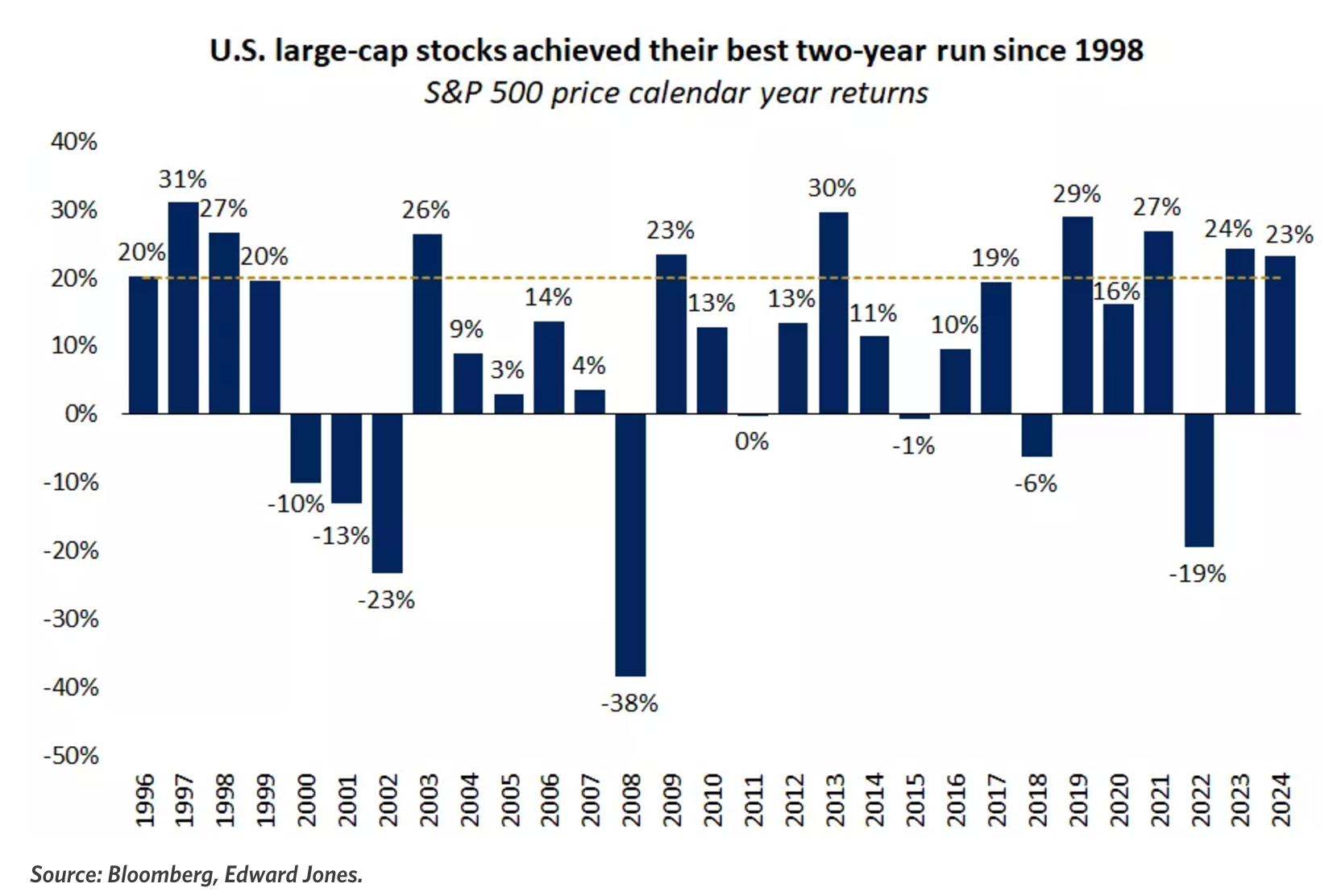

- S&P has back-to-back years of 20%+ returns: The S&P 500 finished 2024 up 25%, marking two years in a row of 20% or more returns since 1997/1998. Last year, 7 tech and tech-adjacent stocks constituted 53% of the index’s returns.

- Oil rises, gas falls:

- Oil prices jumped once again last week, with Brent Crude futures increasing 5.29% week-over-week to $76.68/barrel. Some analysts expect oil prices to come down in 2025 on account of increased production, particularly given the prospect of faster permitting in the United States under a Trump presidency.

- Henry Hub fell for the second week in a row, closing Friday down 4.6% to $3.35/MMBtu after surging at the beginning of the week. U.S. natural gas demand hit a record high on New Years Eve, and prices jumped earlier last week as swaths of the United States braced for a serious winter storm.

- The U.S. bond market has been in a drawdown for over a year: According to data from the Bloomberg U.S. Aggregated Bond Index reported by Charlie Bilello, the United States bond market has been in a drawdown for 53 consecutive months, the longest drawdown ever which is three times longer than the prior record drawdown of 16 months between July 1980 and October 1981.

- Communications, information technology steal the show in 2024: Communications services and information technology stocks outperformed other sectors last year. Per S&P Dow Jones Indices, communications services and information technology stocks respectively returned 40.2% and 36.6% over 2024. Meanwhile, the materials sector performed the worst, posting a marginally negative return last year.

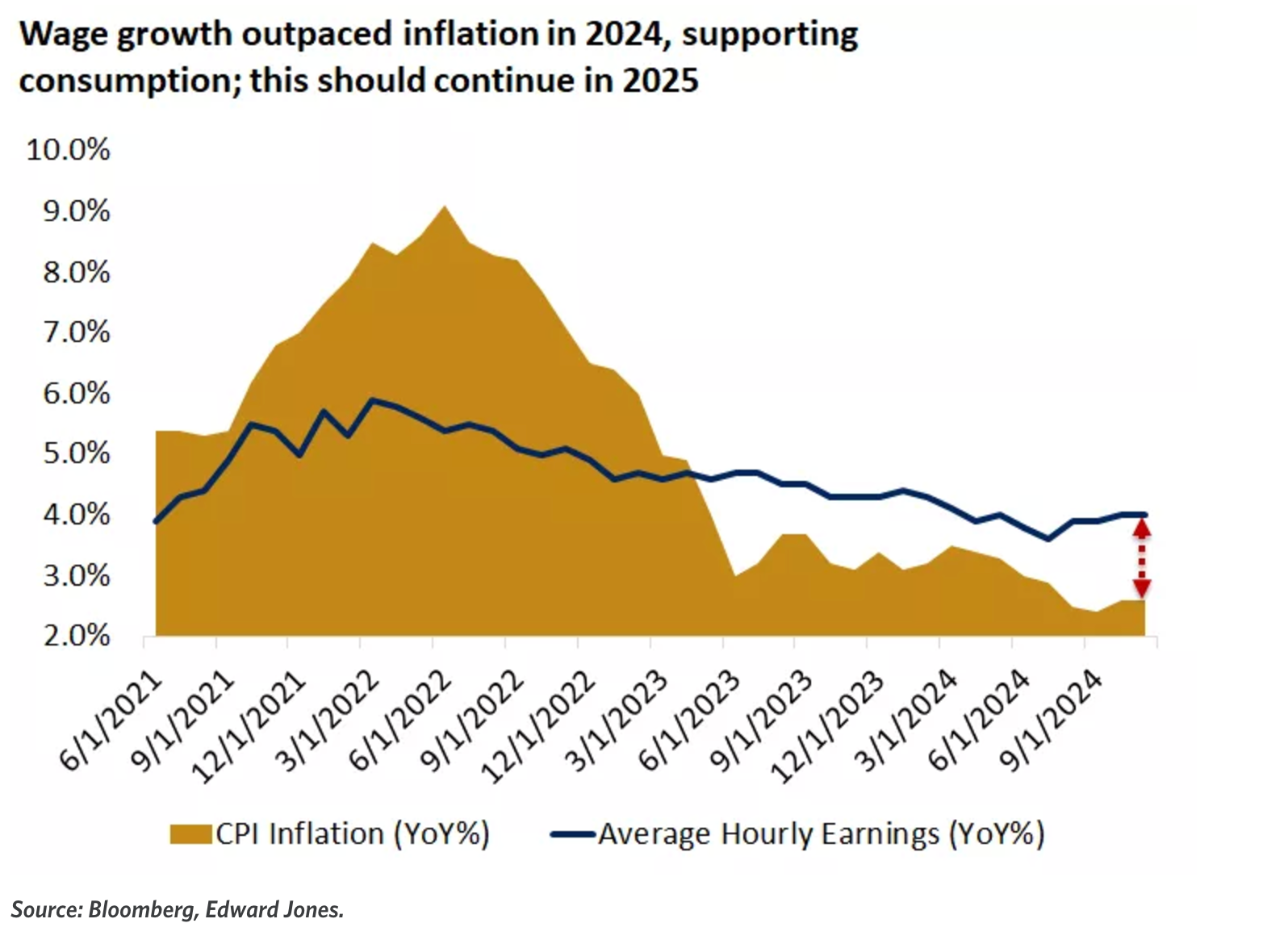

- Wage growth outran CPI in 2024: CPI dropped below wage growth in the middle of 2023, and it stayed below it all throughout 2024, with the gap widening the most in the latter half of the year.

The week ahead in data:

- U.S. Census Bureau Factory Shipments, Inventories, and Orders Survey (Monday)

- U.S. Bureau of Labor Statistics Job Openings and Labor Turnover Survey (Tuesday)

- Institute for Supply Management non-manufacturing index (Tuesday)

- U.S. Census Bureau Trade balance report (Tuesday)

- ADP National Employment Report (Wednesday)

- U.S. Federal Reserve Consumer Credit report (Wednesday)

- Labor Department unemployment claims (Thursday)

- U.S. Census Bureau Wholesale Inventories report (Thursday)

- S&P December Final U.S. Manufacturing PMI (Thursday)

- U.S. Department of Labor weekly unemployment report (Thursday)

- U.S. Bureau of Labor Statistics Jobs and Unemployment report for December 2024 (Friday)

- University of Michigan Index of Consumer Sentiment (preliminary) (Friday)

Thank you for reading, please feel free to reach out with any questions.

Christian Lopez