CCM Blockchain Newsletter (July 14, 2025)

Bitcoin set a new all-time high while equities take a breather.

Happy Monday everyone, and welcome back to this week’s market newsletter. Please see below this week’s market data.

Bitcoin Market Update and News

- Bitcoin rockets past all-time high: Bitcoin roared to record heights last week and through the weekend, rising to an all-time high of $123,000 in the early hours this Monday, July 14. At the time of publication, Bitcoin is up 10.9% week-over-week to $119,700.

- Bitcoin ETFs see second largest inflows last Thursday: Bitcoin sport ETFs saw $1.2 billion in net inflows on Thursday, the second highest level ever as investors piled into the leading cryptocurrency as it crested a new all-time high. The highest inflows occurred on November 7, 2024 at $1.37 billion, days after President Trump’s electoral victory. BlackRock’s IBIT ETF experienced the greatest net inflow at $448 million, followed by Fidelity's FBTC at $324 million.

- CoreWeave reveals acquisition deal for Core Scientific: Following rumblings of a pending buyout unveiled by the WSJ, CoreWeave (NASDAQ: CRWV) revealed the terms for its buyout of Core Scientific (NASDAQ: CORZ) last week. The neocloud company has struck an all-stock deal with Core Scientific, under which CORZ shareholders will receive 0.1235 newly issued shares of CRWV common stock for every share of CORZ common stock. The deal, valued at $9 billion at the time of the announcement, is expected to close in Q4.

Interesting Reads and Videos

- State-Level Strategic Reserve Toolkit

- Digital Asset Policy in the 119th Congress: The First 150 Days

- Myths Busted And Conflicts of Interest Noted at Senate Banking Crypto Market Structure Hearing

Bitcoin Treasury Updates

- Strategy launches $4.2 billion STRD offering: Strategy is opening a $4.2 billion at-the-market offering for a new Series A Perpetual Preferred Stock, Stride (STRD). The preferred stock, which Strategy introduced with an IPO in June, pays out 10% and is the third preferred stock the company has issued after its STRK and STRF offerings.

- These Bitcoin miners are shifting to crypto strategy companies: Two public Bitcoin miners, Bit Digital and BIT Mining, are venturing into the crypto strategy play, but not with Bitcoin. Last week, Bit Digital announced that it has converted all of its BTC into ETH. With over 100,000 ETH on its balance sheet, Bit Digital will divest its focus away from bitcoin mining entirely as it morphs into an Ethereum treasury and staking company, while also working to take its AI/HPC business, WhiteFiber, public. BIT Mining also announced that it is seeking to raise $200-300 million to establish a Solana treasury.

- The Smarter Web Company adds another 275 BTC to balance sheet: The UK-based Smarter Web Company purchased 275 BTC last week, upping its Bitcoin treasury to 1,275 BTC valued at over $150 million.

- Remixpoint finalizes $215 million financing round, eyes 3,000 BTC position: Japanese energy consultant Remixpoint has raised $215 million, and it plans to use the funds to add to its 1,051 BTC treasury with a goal of reaching 3,000 BTC.

- Two Swedish firms join corporate BTC treasury race: As the Bitcoin treasury play goes global, two Swedish companies are planting their flags in the ground. BTC AB revealed last week after its IPO on the Swedish Spotlight market that it currently holds 147 BTC and plans to acquire more with a new fundraise. The H100 Group also closed a $54 million raise recently and added 46.93 BTC to its treasury, upping its stash to 294.5 BTC.

- DigitalX to bring Bitcoin treasury play to Australia: The Bitcoin strategy is coming down under, with digital investment manager DigitalX announcing a $20.7 million raise to bootstrap a Bitcoin treasury.

Market Overview

- Stocks flat on the week: Equities took a breather last week, with the major indices slipping slightly after hitting record highs the week prior.

- S&P 500: $6,259.75 (-0.3%)

- Dow: $44,371.51 (-1%)

- Nasdaq: $20,585.53 (-0.1%)

- Russell 2000: $2,234.83 (-0.6%)

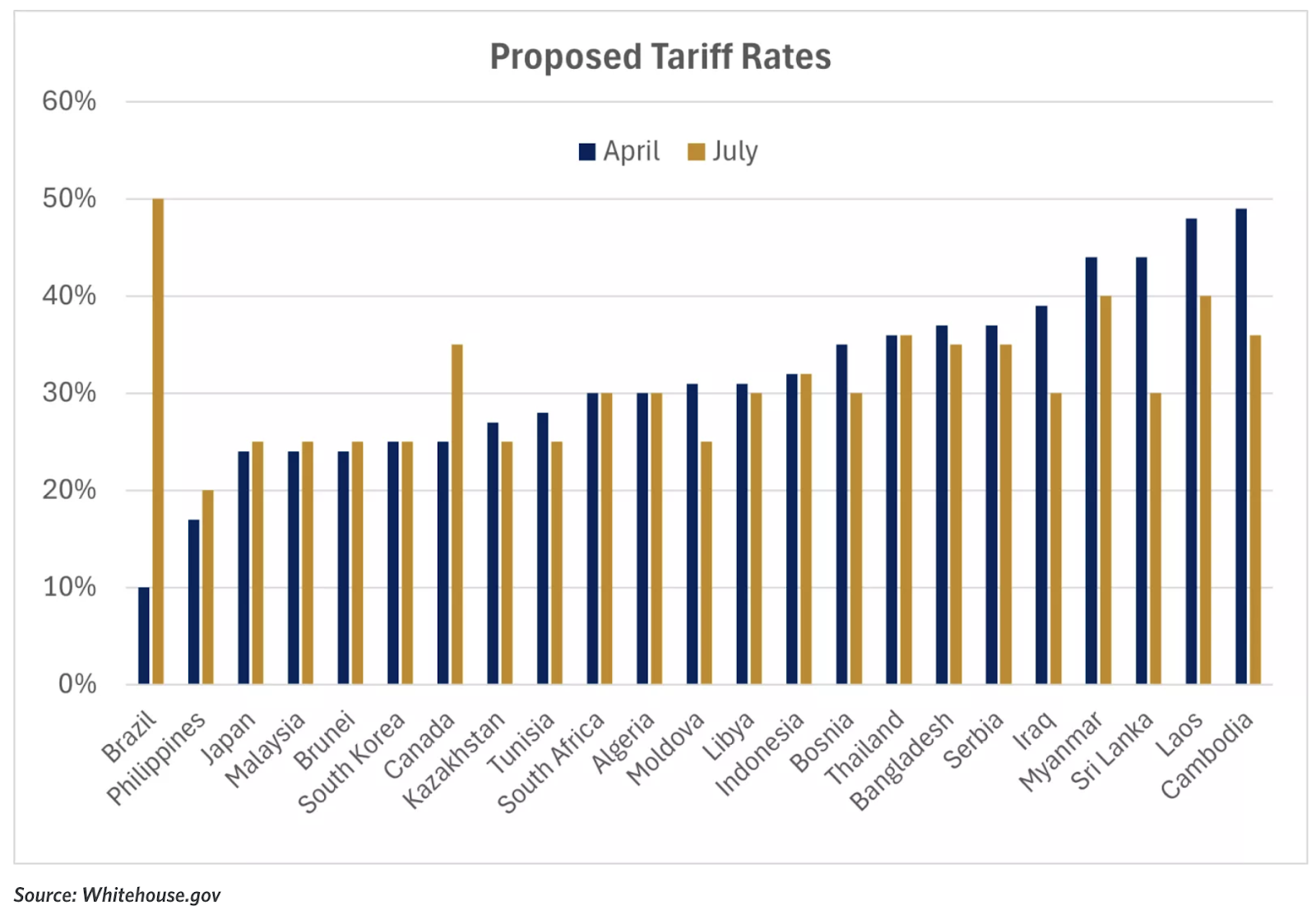

- Trump Administration tariff schedule shifts as executive hits pause on reciprocal policy deadline: The Trump administration is extending the deadline for its reciprocal tariff policy, extending the negotiation timeline to August 1 for key trading partners. In the interim, the 10% flat rate for imports will remain in place, while an elevated rate on Chinese goods is suspended until August 12. President Trump also signaled that the base 10% rate could rise to 15-20%, and he also threatened a 50% tariff on Brazil. A U.S. Court of International Trade injunction which is currently on appeal could block the “fentanyl tariffs” on Canadian, Chinese, and Mexican goods as well as the administration’s reciprocal tariff schedule.

- Precious metals rise on tariff jitters: Copper prices rallied aggressively last week, climbing 13% to a record high of $5.71/lb on news that the Trump Administration would roll out a 50% tariff on copper imports. Silver also rose 5.7% to $39.08/oz, the highest level since 2011. Gold rose modestly by 1.5% to $3,370.30/oz.

- Total dividend growth slowed in Q2 while dividends per share hit record high: The growth rate for dividends from S&P 500 companies slowed in Q2, with the net dividend increase falling by roughly half quarter-over-quarter from $15.3 billion in Q1 to $7.4 billion in Q2. The average payout per share rose from $19.36/share to $19.48/share QoQ, setting a record. Tariff uncertainty could be driving the change, as firms conserve cash to brace for duties shocks.

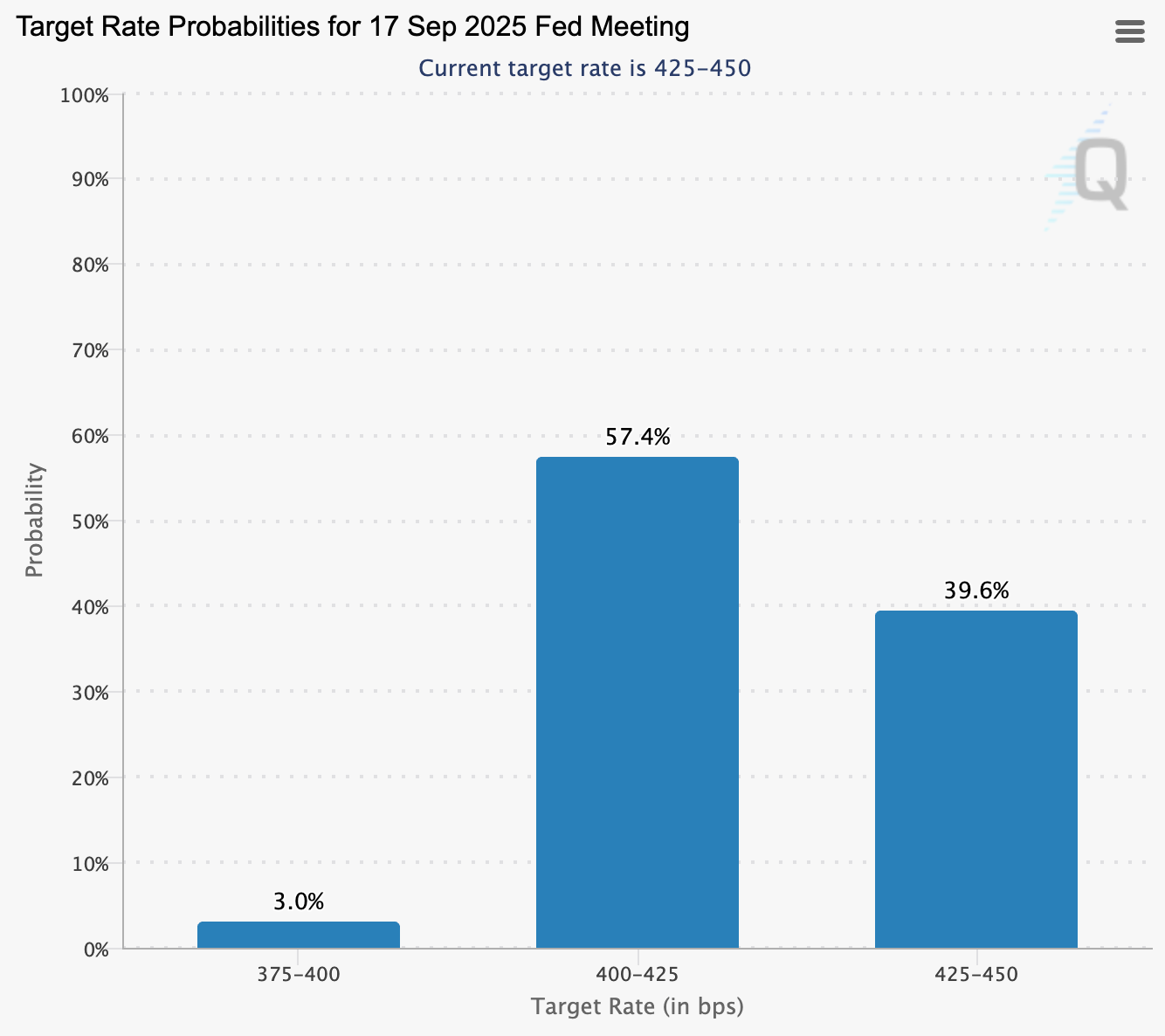

- Fed signals patience in last week’s minutes release but points to at least one cut in 2025: The Federal Reserve Open Market Committee’s June 17-18 meeting minutes convey that committee members are somewhat split on rate policy for the remainder of 2025. Two members are in favor of a cut as soon as July 30, while others argued for no cuts at all given the current level of inflation. However, most members indicated that they are in favor of at least one cut this year. For those against cuts or who advocate for a “wait and see approach,” inflation, tariff uncertainty, and a softening job market are primary concerns. CME’s FedWatch now places the probability of a 0.25% rate cut at 5% in July and 57% in September.

- Consumer credit moderates in May: The New York Fed’s Consumer Credit report shows that credit expansion slowed in May after a ramp up in April. Total consumer credit rose at a 1.2% annualized rate in May, a modest growth rate compared to April when consumers boosted spending spurred by tariff fears. Revolving credit (primarily credit cards) fell by –3.2% annually, reversing the upward trend from February through April. Non‑revolving credit (e.g., auto and student loans) climbed +2.8% annualized. In summary:

- Total: $5.05 trillion

- Revolving: $1.3 trillion

- Non‑revolving: $3.75 trillion

- Bond market continues to weather volatility: U.S. Treasury Bonds dropped again last week, sending yields higher in both long term and short term bonds. The 10-year and 30-year saw this most aggressive move upward, with the latter rising 10 bps.

- 2-year: 3.89% (+0.02%)

- 5-year: 3.98% (+0.04%)

- 10-year: 4.42% (+0.07%)

- 30-year: 4.96% (+0.10%)

- Oil inches up: Oil prices rose modestly last week. U.S. prices rose less than some analysts expected given oversupply concerns despite rig counts dropping for 11 weeks in a row. Week-over-week changes:

- WTI Crude: $68.45/barrel (+2.2%)

- Brent Crude: $70.36/barrel (+3%)

The week ahead in data:

- U.S. Bureau of Labor Statistics CPI (Tuesday)

- National Association of Home Builders Housing Market Index (Tuesday)

- U.S. Bureau of Labor Statistics PPI (Wednesday)

- Fed industrial production and capacity utilization report (Wednesday)

- U.S. Census Bureau retail sales report (Thursday)

- U.S. Census Bureau business inventory report (Thursday)

- U.S. Bureau of Labor Statistics export and import prices report (Thursday)

- U.S. Department of Labor Statistics Jobless Claims (Thursday)

- U.S. Census Bureau housing starts report (Friday)

- University of Michigan Consumer Sentiment Index preliminary result (Friday)

Notable corporate earnings this week:

- Fastenal (Monday)

- JPMorgan (Tuesday)

- Citigroup (Tuesday)

- Wells Fargo (Tuesday)

- BlackRock (Tuesday)

- BNY Mellon (Tuesday)

- State Street (Tuesday)

- Albertsons (Tuesday)

- Johnson & Johnson (Wednesday)

- Bank of America (Wednesday)

- Morgan Stanley (Wednesday)

- Goldman Sachs (Wednesday)

- United Airlines (Wednesday)

- Alcoa (Wednesday)

- TSMC (Thursday)

- Netflix (Thursday)

- GE Aerospace (Thursday)

- Novartis (Thursday)

- Abbott Labs (Thursday)

- PepsiCo (Thursday)

- American Express (Friday)

- Truist Financial (Friday)

- 3M (Friday)

Thank you for reading, and please feel free to reach out with any questions.