CCM Blockchain Newsletter (July 7, 2024)

AI industry stocks are ballooning, but are they a bubble?

Hope you all had a fun and loving 4th of July with friends and family. We’ve certainly seen some fireworks in the BTC market!

Please see this week’s BTC mining market data attached at the bottom of this post.

Macro Market Update

Market Overview this Week – Strong Start to Q3 although signs of economic weakness continue to show:

- The holiday-shortened trading week didn't stop stocks from pushing higher, with the S&P 500 up ~1.3%

- Market activity was subdued due to the 4th of July holiday, but stocks still managed to rise

- This was partly due to new comments from Fed Chair Powell, highlighting progress in combating inflation

- Additionally, Nvidia rebounded after a late June pullback, and Tesla surged 26.2% following an impressive vehicle delivery report

- 10-year U.S. Treasury yields declined as data suggested a cooling labor market, and cryptocurrencies continued to underperform, with Bitcoin dropping nearly 10% for the week.

- This week, more economic data rolls in, including a CPI update on Thursday

Interesting Chart of the Week

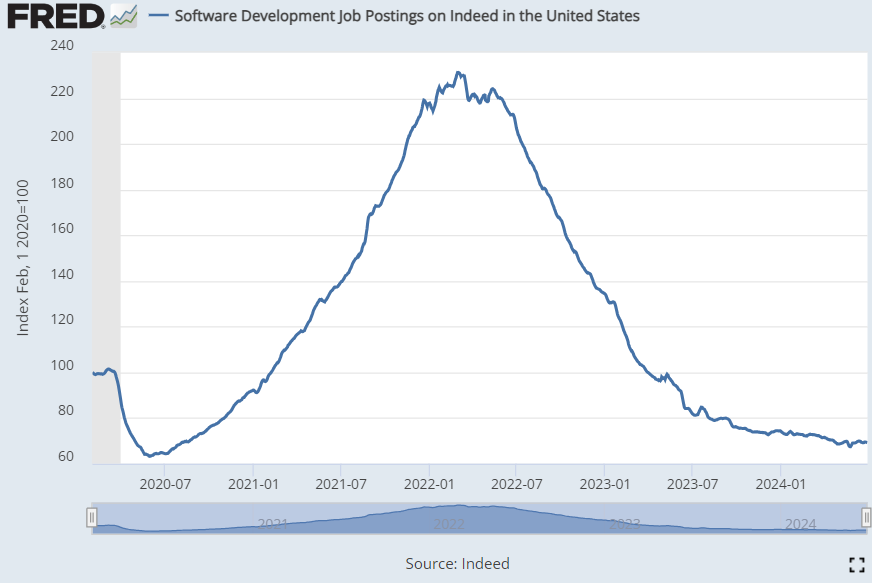

Are AI and corporate efficiency killing tech jobs?

- Some of you may have seen this chart on the All-In Podcast last week

- The following chart from FRED (using data from Indeed) displaying the number of software developer job postings since 2020

- Postings materially down 80% from the peak and we are currently below pre-covid levels

Are We in an AI Bubble?

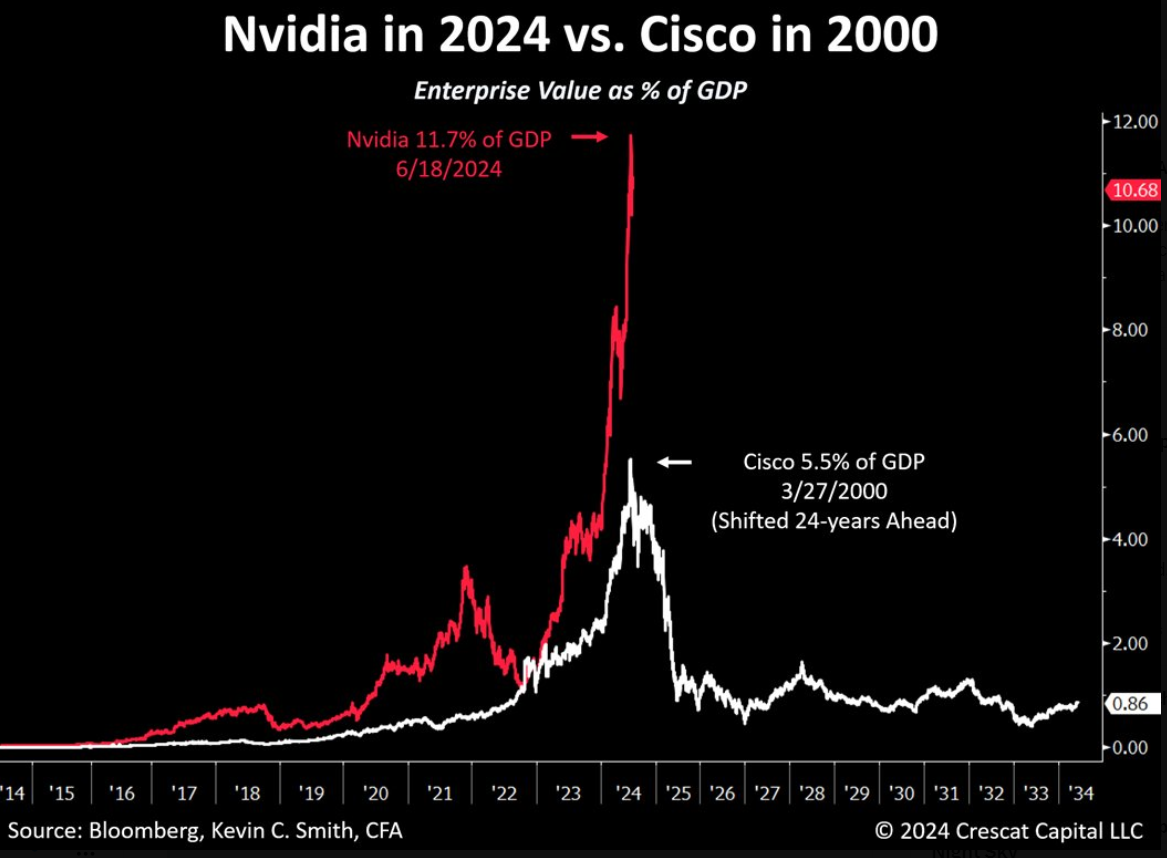

The run up in tech valuations elicits memories of 2000s internet bubble.

- There is no doubt that the recent advancements in AI will be revolutionary for the work place and life at home, and will lead to long-term economic growth

- However, investors continue piling into the Mag7 and driving valuation to what seems to be unsustainable levels

- Kevin C. Smith from Crescat Capital recently shared an interesting thread on tech valuations that I summarize below:

- Cisco Systems was the most valuable company in the world at the peak of the dot-com bubble in March 2000

- Its stock price had reached an all-time high giving the company an enterprise value (EV) of $548 billion or 5.5% of US GDP and 37 times sales

- Cisco’s stock price would fall 89% over the next two-and-a-half years. The stock price has yet to return to its prior high in the 24 years since

- Nvidia recently earned the most valuable company in the world status with an EV of $3.3 trillion

- This is a record 11.7% of total US GDP at its recent peak on June 18, more than twice as high as Cisco’s achievement in 2000

- It also has an even richer multiple of 41 times revenues

- Cisco Systems was the most valuable company in the world at the peak of the dot-com bubble in March 2000

Bitcoin Market Update

Downard Pressure

- Despite the positive broader market, bitcoin struggled this week for a variety of reasons

- The German government has been offloading Bitcoin, having already sold 7,583 $BTC worth $435M

- They still have over 41k $BTC left, worth about $2.3B

- Mt. Gox wallet moved 47,229 $BTC ($2.7B) on Thursday, gearing up for a July repayment

- The US government shifted 237 $BTC ($13M) to a new wallet and are sitting on 213K $BTC worth $12.3B

- Many are anticipating the continued downward pressure of these large stacks, but I urge you to remember that…

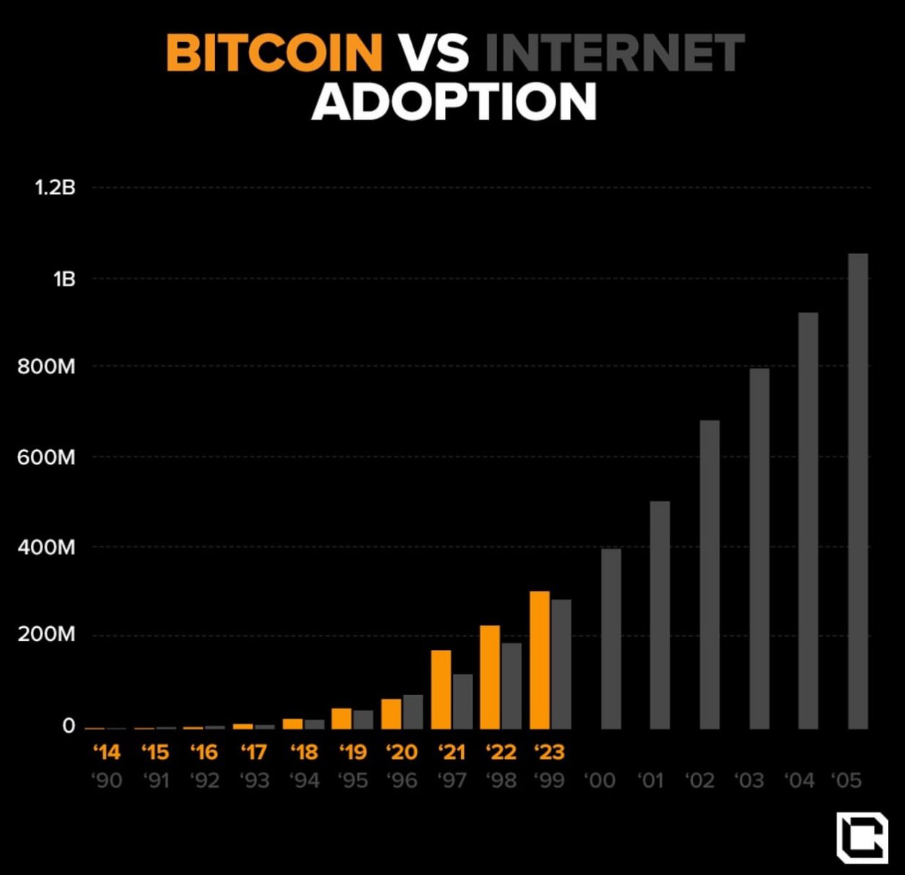

Bitcoin is Still in its Early Adoption Phase

- I don’t think I need to remind this audience too much but just in case, here are a few charts to remind us how early we still are and remember to play the long game