CCM Blockchain Newsletter (June 8, 2024)

Bitcoin ETFs pulled in $1.7 billion last week.

Macro Market Updates

Markets Continue Strong Performance

- All major indices traded up in May despite ongoing inflation concerns and softer economic data

- Post earnings performance from the Magnificent 7 boosted market sentiment

Despite Strong Performance, Labor Markets Showing Weakness

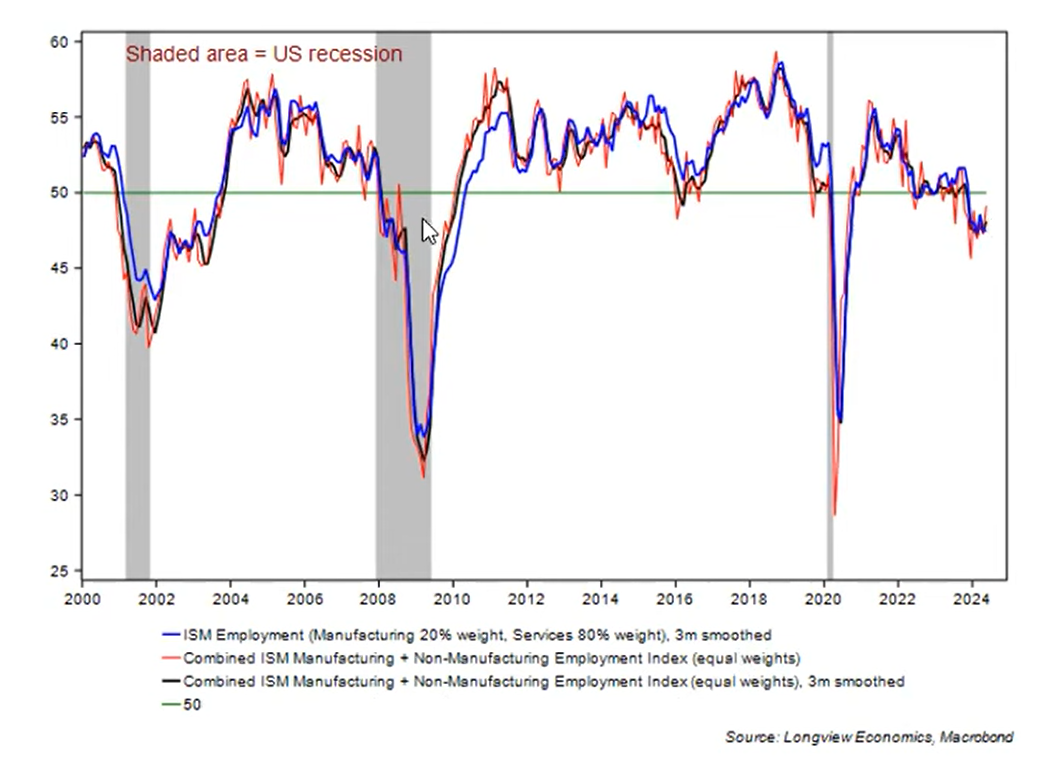

- The ISM (Institute for Supply Chain Management) employment outlook indices are below 50 (green horizontal line), suggesting weakness in the labor market

- The last three times it has fallen below 50 have led to recessions

Fed Remains Hawkish on Rate Cuts

- Economic data was somewhat softer in May

- April’s retail sales declined

- ISM manufacturing and services came in weaker-than-expected

- Consumer sentiment, however, rose after three months of decline

- Inflation data showed signs of a continuing disinflationary trajectory

- April CPI was in line with expectations and core PCE price index hit the lowest mark in 3 years

- There were no changes in market expectations for rate cuts, which are expected to start in Sept ‘24

- Fed speak remained hawkish but reflected greater confidence that inflation is moving back towards the 2% target

Bank of Canada and ECB Cut Rates

- On Wednesday, June 5th, Canada became the first G7 nation to cut its key policy rate – by 25bps

- On Thursday, June 6th, the European Central Bank confirmed a broadly expected reduction in its key rate – also by 25 bps

- While markets had priced in these policy changes, we expect that this is the beginning of a new liquidity cycle, some of which we are already starting to see play out in commodities such as gold and silver

Bitcoin Market Update

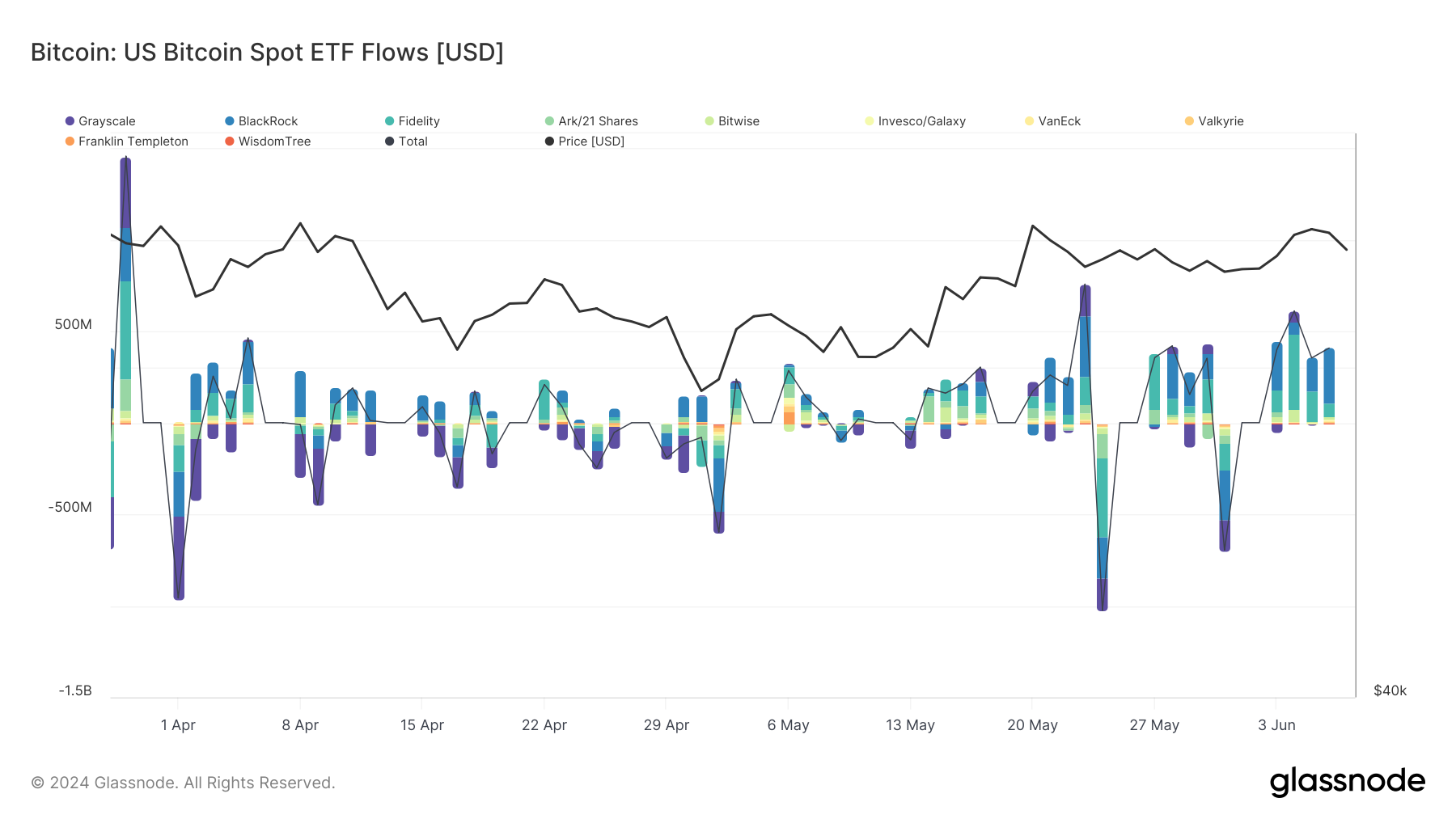

ETF Inflows Resurge Last Week

- Bitcoin ETFs drew in their best day since March as price topped $71k last week, drawing over $1.7 billion just last week alone

- The strong upward pressure is being met by miners and longer-term holders cashing out

- The ETFs now hold over 878k BTC or ~$61 billion using $69.4k / BTC ratio – this amounts to ~5.2% of all BTC in circulation

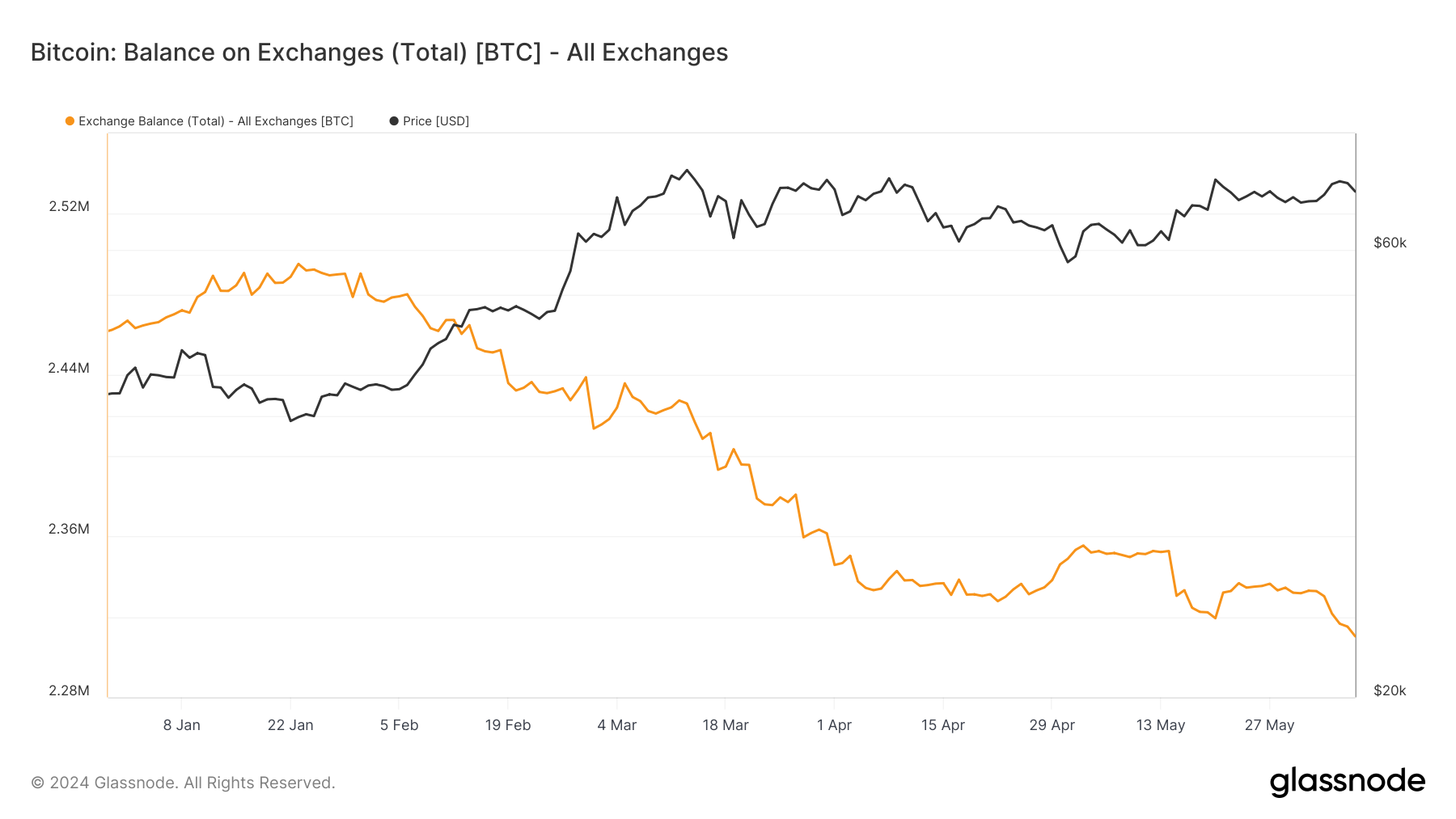

- All while BTC balances on exchanges continue to draw down

Please see below this week’s BTC mining market data attached.