CCM Blockchain Newsletter (May 3, 2024)

What drives bitcoin miner valuations?

Macro Views

The Darwinistic nature of bitcoin mining plays out as network hashrate drops to ~600 EHs post halving with hashprice hitting as low as $45 PH/Day. Not helping matters is the hawkish repricing of the Fed’s future rate policy informed by sticky inflation and mixed takes on the overall economy, helping to drive risk assets lower, including BTC. Concerns around the Fed’s ability to control inflation and reach their 2% target resulted in shifting market expectations around any near-term easing. In March, the market was pricing in 3 rate cuts starting in June, however, expectations now indicate the Fed may only easy by 25bps later this year.

What Drives Bitcoin Miner Valuations

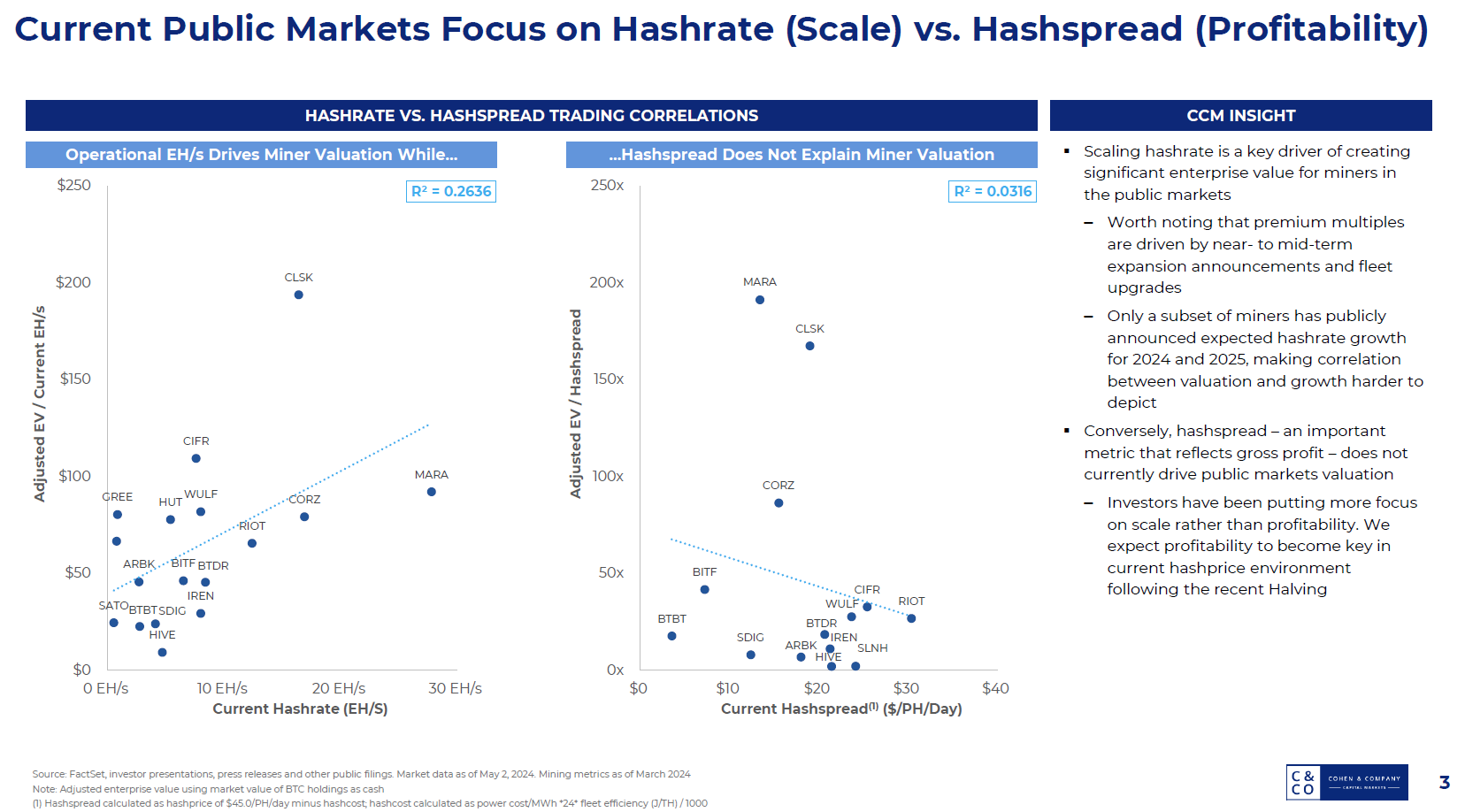

Everyone on this distribution knows that pricing miners is difficult - what is the right methodology? So far, the market (mainly retail) has awarded scale as is evidenced by the below analysis. There are a few outliers but the correlation between EV / Hashrate and Hashrate is apparent. However, if you believe that bitcoin mining is a commodity business, then shouldn’t valuation be focused on profitability and operational efficiency? It is interesting to note that there is effectively no correlation between EV/Hashspread and Hashspread (Hashspread being a profitability metric, known as gross margin in the fiat world).

If we expect fundamental, long-term investors to enter the space, they need to be educated on this topic - we are working to educate our investor network.

As always, looking forward to your feedback and complaints!

Best,

Christian Lopez