CCM Blockchain Newsletter (November 10, 2025)

The market sold off across the board last week as jobs data flashed warning signs.

Happy Monday everyone, and welcome back to this week’s market newsletter. Please see below this week’s market data.

Bitcoin Market Update and News

- Bitcoin tumbles: Bitcoin sold off last week, bouncing off the key support level of $100,000 three times before recovering over the weekend. At the time of publication, Bitcoin is down 0.2% WoW to $106,100.

- IREN, Cipher Mining land Magnificent-7 AI deals: Frontrunners in the Bitcoin miner-AI pivot race, IREN (NASDAQ: IREN) and Cipher Mining (NASDAQ: CIFR), both announced landmark deals with Magnificent-7 companies last week. IREN will be hosting GPUs for Microsoft (NASDAQ: MSFT) in a 5-year, $9.7 billion agreement, and Cipher Mining inked its own contract with Amazon (NASDAQ: AMZN) for a 15-year, $5.5 billion lease. The deals are the first contracts that bitcoin miners have signed to directly host Magnificent-7 hyperscalers at their facilities.

Interesting Reads and Videos

- In between worlds: the state of bitcoin mining in Russia

- Bitcoin Miners Back at Survival Mode — Again

- Will Bitcoin Strengthen or Weaken US Dollar Dominance?

Bitcoin Treasury Company News and Updates

- Strategy buys 397 Bitcoin for $47.5M, sells $69.5M in equity offerings: Strategy (NASDAQ: MSTR) purchased 397 Bitcoin last week for $45.6 million at an average cost of $114,771 per coin, the second purchase in a week from the leading and pioneering Bitcoin treasury company. Strategy holds 641,205 BTC worth over $65 billion dollars.

- Strive announced preferred stock, raises $160M upsized offering: Strive (NASDAQ: ASST) is going the way of Strategy, opting to issue a variable rate series A preferred shares with the ticker SATA. Following the announcement, Strive raised $160 million in an upsized, 2 million offering of the stock at $80 per share.

- Strategy to explore international offerings and expand marketing push for credit instruments: In its Q3 earnings call, Strategy announced it would be increasing the dividend on its STRC stock offering by 25 bps to 10.25%. Additionally, the company said that it is exploring avenues to offer this stock to international investors.

Market Overview

- Equities dragged down in larger market sell off: Equities were hammered last week alongside other assets, with the Nasdaq shaving off 3% as tech stocks led losses over ROI fears on AI CAPEX spend.

- S&P 500: 6,728.80 (-1.6%)

- Nasdaq: 23,004.54 (-3%)

- Dow: 46,987.10 (-1.2%)

- Russell 2000: 2,432.82 (-1.9%)

- Q3 Earnings growth rate for S&P 500 firms well ahead of estimates with 91% reporting: 91% of S%P 500 companies have reported their Q3 earnings, with 82% and 77% reporting positive earnings-per-share and revenue surprises, respectively. Thus far, the blended average growth rate for S&P 500 companies is 13.1%, far above 7.9% estimates.

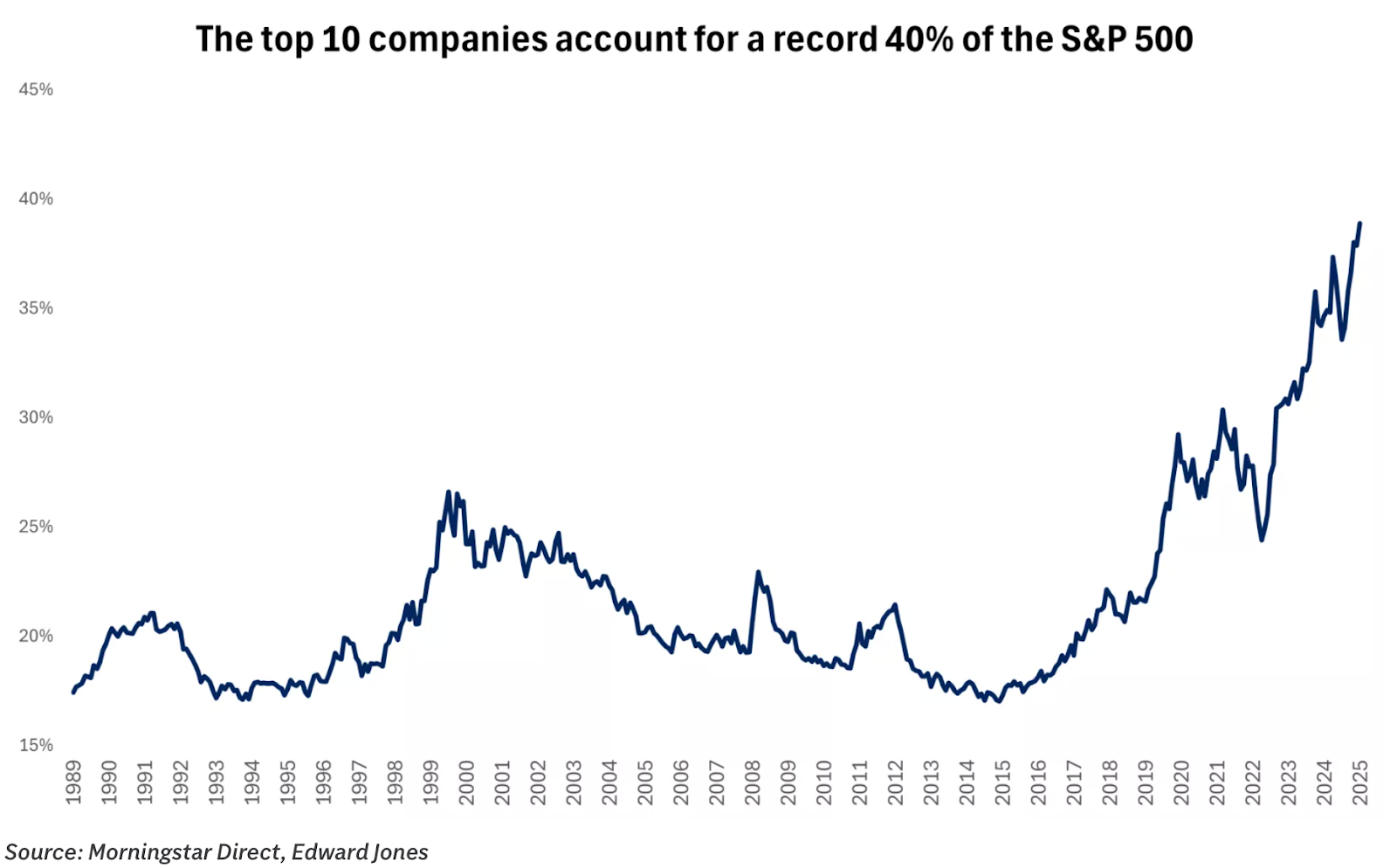

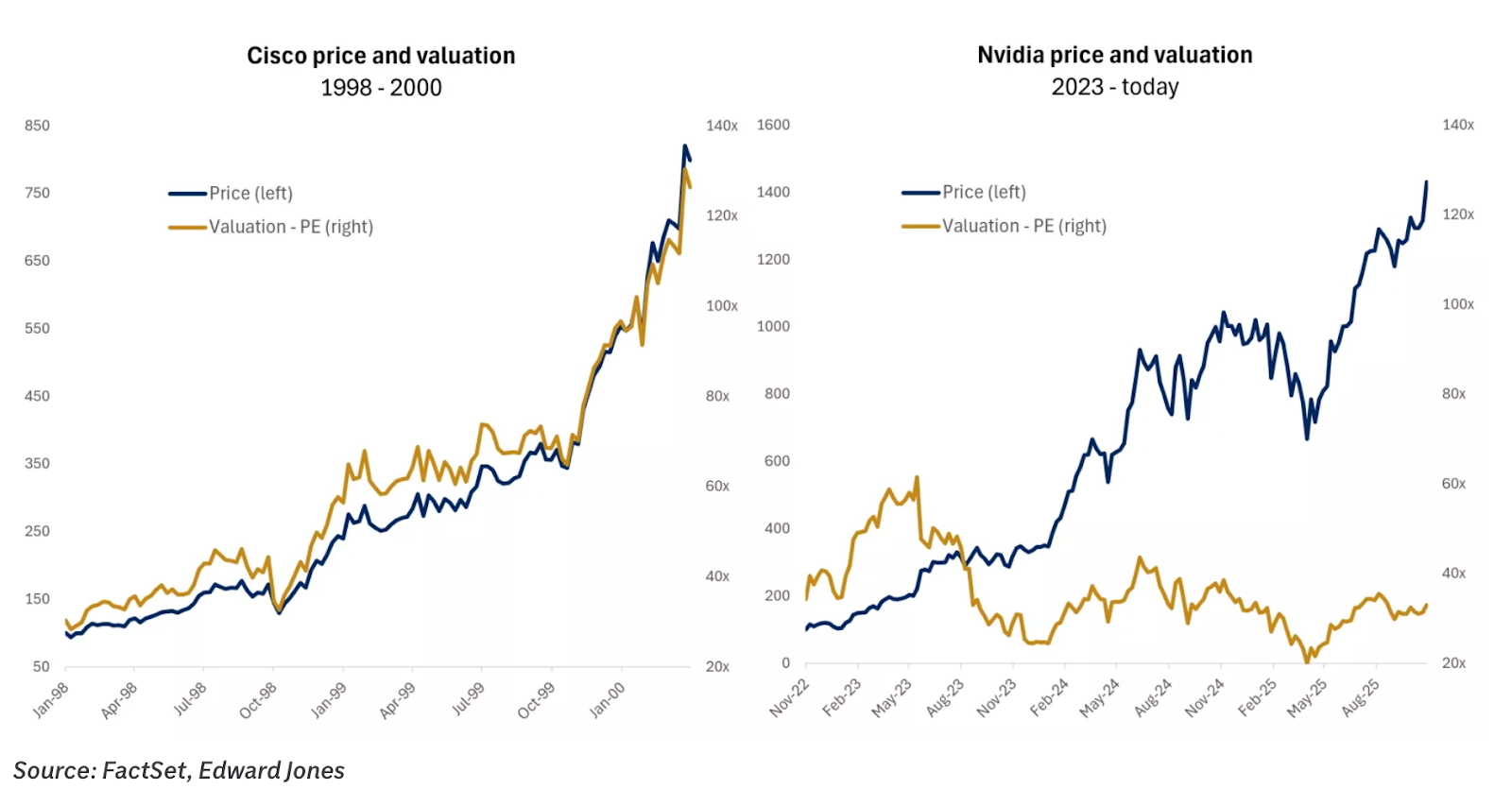

- S&P 500’s top 10 companies account for 40% of the index: Per EdwardJones, the top 10 stocks in the S&P 500’s make up 40% of the entire index’s capitalization, a record that puts this weighting ~12% above where it was at the peak of the Dotcom Bubble. Still, EdwardJones does note that Nvidia (NASDAQ: NVDA), the most valuable company in the S&P 500, its price-to-earnings ratio is still ~1/4th of Cisco’s (NASDAQ: CSCO) at the time of the Nasdaq’s peak in 2000.

- Private sector job data for October flashes warning signs: Two private sector labor reports for October show the job market is softening at best and cracking at the worst. Challenger, Gray & Christmas reported that job cuts soared to 153,000 in October, thrice the level in September. Meanwhile, the ADP reported that private-sector employment rose by 42,000 jobs last month, bouncing back from September’s lull but below expectations and average levels. In October, year-over-year wage growth for job-stayers stayed around 4.5%, while workers who changed jobs continued to see somewhat higher gains (typically 6-7%) in recent periods.

- Supreme Court hears arguments on Trump Tariffs but dithers on whether it will rule on lower court’s decision: The U.S. Supreme Court heard initial arguments last Wednesday on a consolidated court case (Learning Resources v. Trump, and Trump v. V.O.S. Selections, Inc.) regarding the Trump administration’s tariff policies. Three lower courts have ruled against Trump’s tariffs, with the case now appealed to the Supreme Court. Despite hearing initial arguments, the Supreme Court has not declared whether it will rule on the case.

- Manufacturing PMI contracts for eighth consecutive month. The Institute for Supply Management (ISM) released its Manufacturing PMI for October 2025 last week. PMI came in at 48.7, down from 49.1 in September and below the forecast of ~49.4, the 8th month in a row below the 50 point benchmark, indicating contraction. New orders rose slightly MoM to 49.4, while production fell to 48.2 from 51, and employment rose slightly to 46.

- Non-Manufacturing PMI jumps into growth level in October: The ISM also released its Non-Manufacturing PMI (NMPMI) last week, with NMPMI rising to 52.4 from 50 in September. While not the strongest move, the increase pushes the index into the growth zone. Business activity jumped to 54.3 MoM from 49.9 and orders increased to 56.2 from 50, but employment remained below 50 (contraction) but improved to 48.2 from 47.2 last month. Inflation persists, with prices paid up to 70 MoM from 69.4.

- Oil extends sell-off: Oil prices continued to slide across both the U.S. and European markets last week.

- WTI Crude: $59.86/barrel (-1.6%)

- Brent Crude: $63.72/barrel (-1.9%)

- Gold stands still: In a week a market turbulence, gold was a bulwark, with the precious medal largely unchanged over the week and closing last Friday at ~$4,000/oz.

The week ahead in data*:

- NFIB Small Business Optimism Index (Tuesday)

- Bureau of Labor Statistics October CPI (Thursday)

*Most government releases omitted due to the government shutdown

Thank you for reading, and please feel free to reach out with any questions.