CCM Blockchain Newsletter (November 17, 2025)

Bitcoin sold off below $100,000 last week, while equities produced mixed returns.

Happy Monday everyone, and welcome back to this week’s market newsletter. Please see below this week’s market data.

Bitcoin Market Update and News

- Bitcoin plummets below $100,000: Bitcoin broke below the $100,000 level last week, selling off to as low as $93,000 over the weekend. At the time of writing, Bitcoin is down 11.5% WoW to $93,000.

- Cash App rolls out Bitcoin payments feature that allows users to pay in BTC without holding any: Jack Dorsey’s Cash App, a subsidiary of Block (NYSE: XYZ) which also operates the Square point-of-sale system, has rolled out a new feature that allows users to pay in Bitcoin via Cash App or at any Square terminal – even if they don’t hold BTC. The feature makes use of the Bitcoin network on the back end to settle transactions, all while debiting Cash App users in USD on their end and crediting merchants USD on theirs. Cash App has roughly 58 million monthly users and, as of 2024's end, 4 million merchants used Square as their point-of-sale system.

- Czech Central Bank buys $1 million Bitcoin in pilot program: The Central Bank of Czechia (a.k.a The Czech Republic) has created a $1 million fund with bitcoin, an undisclosed USD stablecoin, and a tokenized deposit to test the waters of crypto finance. “The aim was to test decentralized bitcoin from the central bank’s perspective and to evaluate its potential role in diversifying our reserves,” CNB Governor Aleš Michl said. “We will inform the public about our experience on an ongoing basis and present an overall assessment in approximately two to three years.”

Interesting Reads and Videos

- TFTC - The Real Reason the Fed Just Restarted Money Printing (It's Not the Deficit) | Gary Brode

- Bitcoin mining stock prices plummet, lose $8 billion in one day

- Why High Frequency Traders Are Leaving Wall Street

Bitcoin Treasury Company News and Updates

- Michael Saylor’s Strategy pauses MSTR sales, buys 497 Bitcoin with preferred equity: Strategy (NASDAQ: MSTR) disclosed last week that it purchased 397 Bitcoin for $49.9 million at an average cost of $102,557 per coin, and it sold $50 million of its preferred stocks STRF, STRC, STRK, and STRD via ATMs, but it did not sell any MSTR shares. Strategy holds 641,692 BTC worth over $60 billion dollars.

- Strive raises $149.3 million in oversubscribed SATA IPO, buys 1,567 Bitcoin: Strive (NASDAQ: ASST) raised nearly $150 million from its preferred share (NASDAQ: SATA) IPO, selling 2 million shares at $80 a piece. The company purchased 1,567.2 BTC with the funds at an average cost of $103,315 per coin for $161.9 million, and the company currently holds 7,252 BTC worth ~$688 million.

- Bitcoin Treasury Corporation gets green light for $300 million shelf prospectus: Bitcoin Treasury Corporation (OTCQX: BTCFF) has secured approval to list a $300 million, 25-month shelf prospectus. As of the end of Q3, the Canadian firm held 771.37 BTC.

Market Overview

- Equities end choppy week with mixed returns: November’s market volatility continued to toss stocks last week for mixed returns, with the S&P 500 and Dow basically flat (but up) on the week, the Nasdaq down, and small caps leading losses.

- S&P 500: 6,734.11 (+0.1%)

- Nasdaq: 22,900.59 (-0.5%)

- Dow: 47,147.48 (+0.3%)

- Russell 2000: 2,388.23 (-1.8%)

- Q3 earnings growth rate for S&P 500 still on track to beat expectations: 92% of S&P 500 companies have reported their Q3 earnings, with 82% and 76% respectively reporting positive earnings-per-share and revenue surprises, according to FactSet. Thus far, the blended average growth rate for S&P 500 companies is 13.1%, unchanged from FactSet’s last S&P earnings update and above a 7.9% estimate going into earnings season.

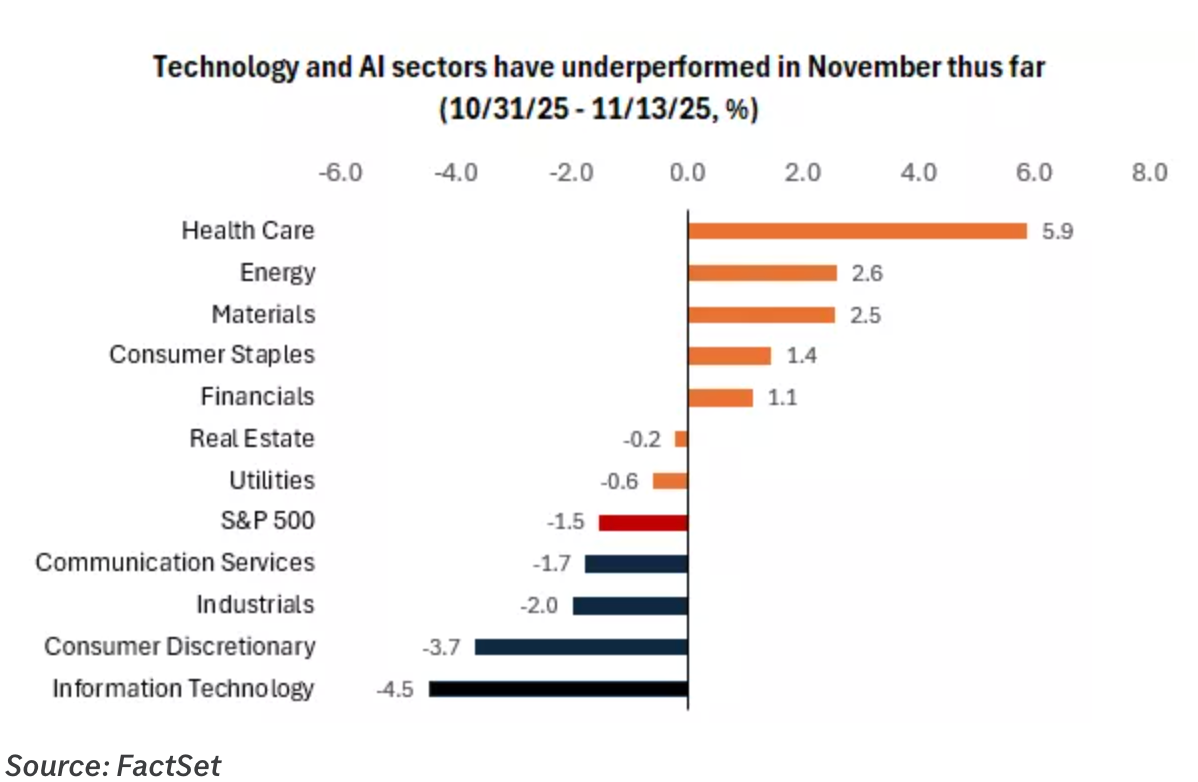

- Tech stocks lead market sell off: The cohort of AI and tech stocks that have been the life force of 2025’s market have been enervated so far this November. Per FactSet, information technology stocks were down 4.5% in November as of November 13, while healthcare (+5.9%), energy (+2.6%), and materials (+2.5%) have led all other industries.

Chart Source: EdwardJones

- U.S. Treasury yields plummet, then spike before market close to cap volatile week: Treasury yields across all durations fell to start last week, only to rise before week’s end, sharply plummet, and then spike before trading stopped on Friday to end the week slightly up. One way to read the volatility is that traders are groping around in the dark, expecting lower rates as QT comes to an end on the tail of the latest rate cut while the job market and inflation still cast shadows over the economy. Per the CME’s FedWatch, the odds of another Fed rate cut this December have flipped to a 55% chance of no cut. Week-over-week changes:

- 30-Year: 4.75% (+4 bps)

- 10-Year: 4.15% (+3 bps)

- 5-Year: 3.73% (+1 bp)

- 2-Year 3.61% (+1 bp)

- VIX surges on the week as volatility rocks market: The volatility that has shaken assets across the board has sent the CBOE’s Volatility Index (VIX) flying. The VIX closed last week up 8% to 19.83. This is still well below the VIX’s 2025 high in April at 52.33, when it spiked during a market sell-off sparked by fears over the Trump administration’s tariff policy.

- Business optimism falls slightly in October: Per the National Federation of Independent Business (NFIB) Small Business Optimism Index for October 2025, small business optimism fell 0.6 points in October to 98.2, down from 98.8 in September but still just above the 52-year average of 90. The Uncertainty Index, which measures how business owners view the future, fell 12 points to 88, the lowest reading so far this year. 32% of business owners said they could not fill job openings last month, with 27% complaining about labor quality. Only 13% reported higher nominal sales, down 6 points from September. 21% reported raising prices, a 3 point drop from the prior month, while another 30% expect to raise prices in the next three months. 60% reported supply chain disruptions, down 4 points from September.

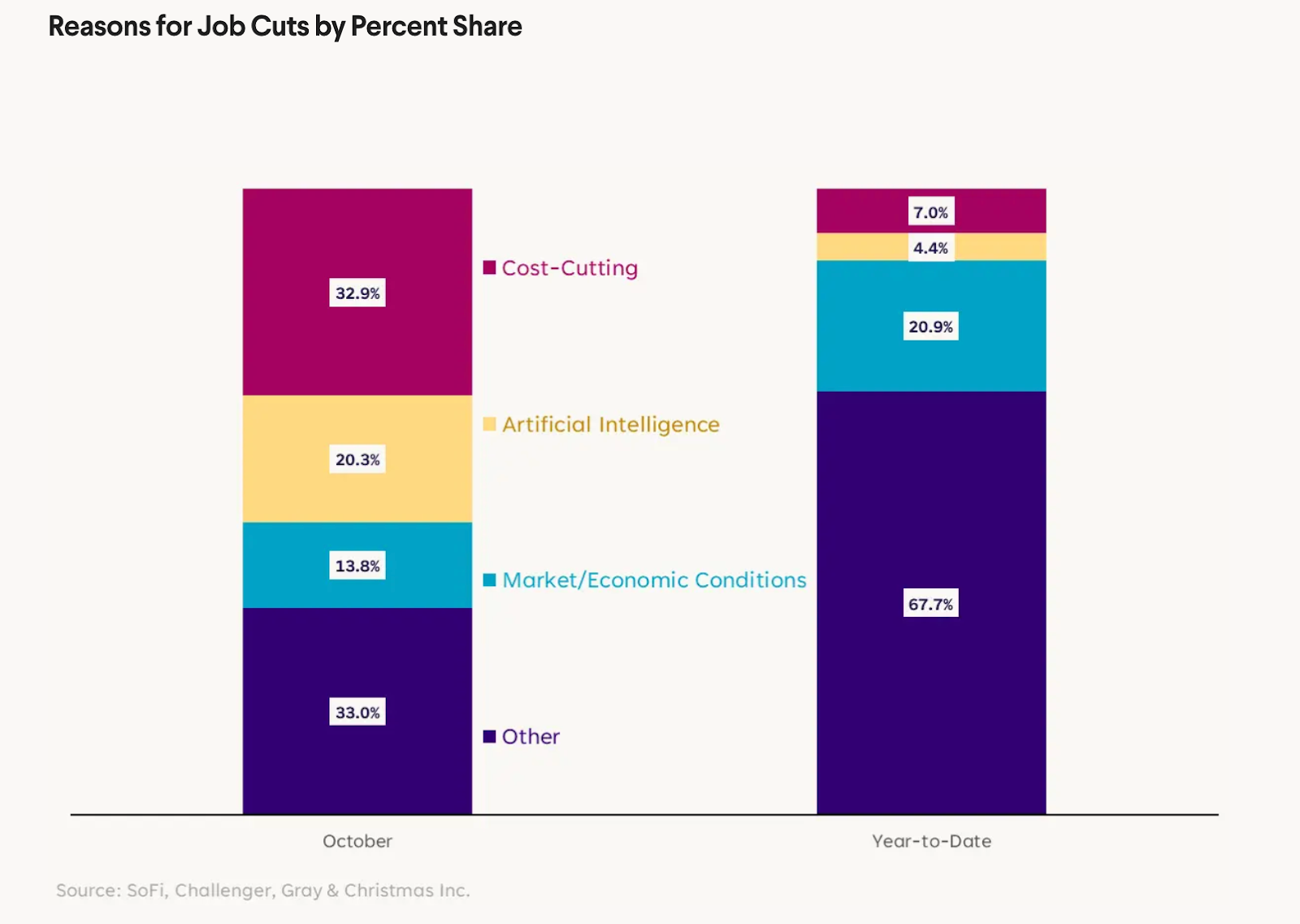

- Cost-cutting, AI surge as reasons for terminations in October: According to data from Challenger, Gray & Christmas presented by SoFi Head of Investment Strategy, Liz Thomas, cost-cutting was the top reason for job cuts last month, accounting for 33% of all terminations, versus 20% for AI, 14% for economic conditions, and 33% for other reasons.

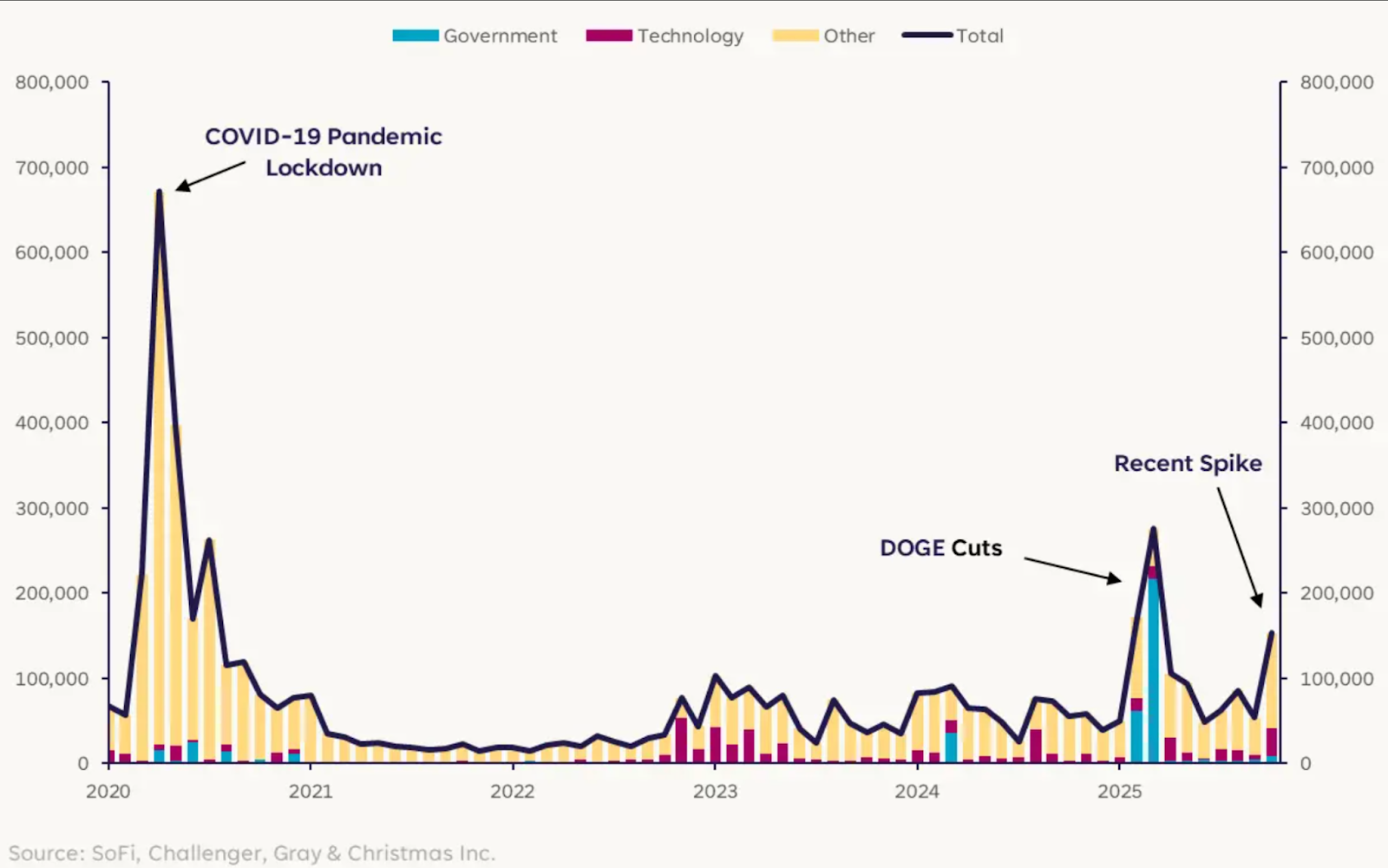

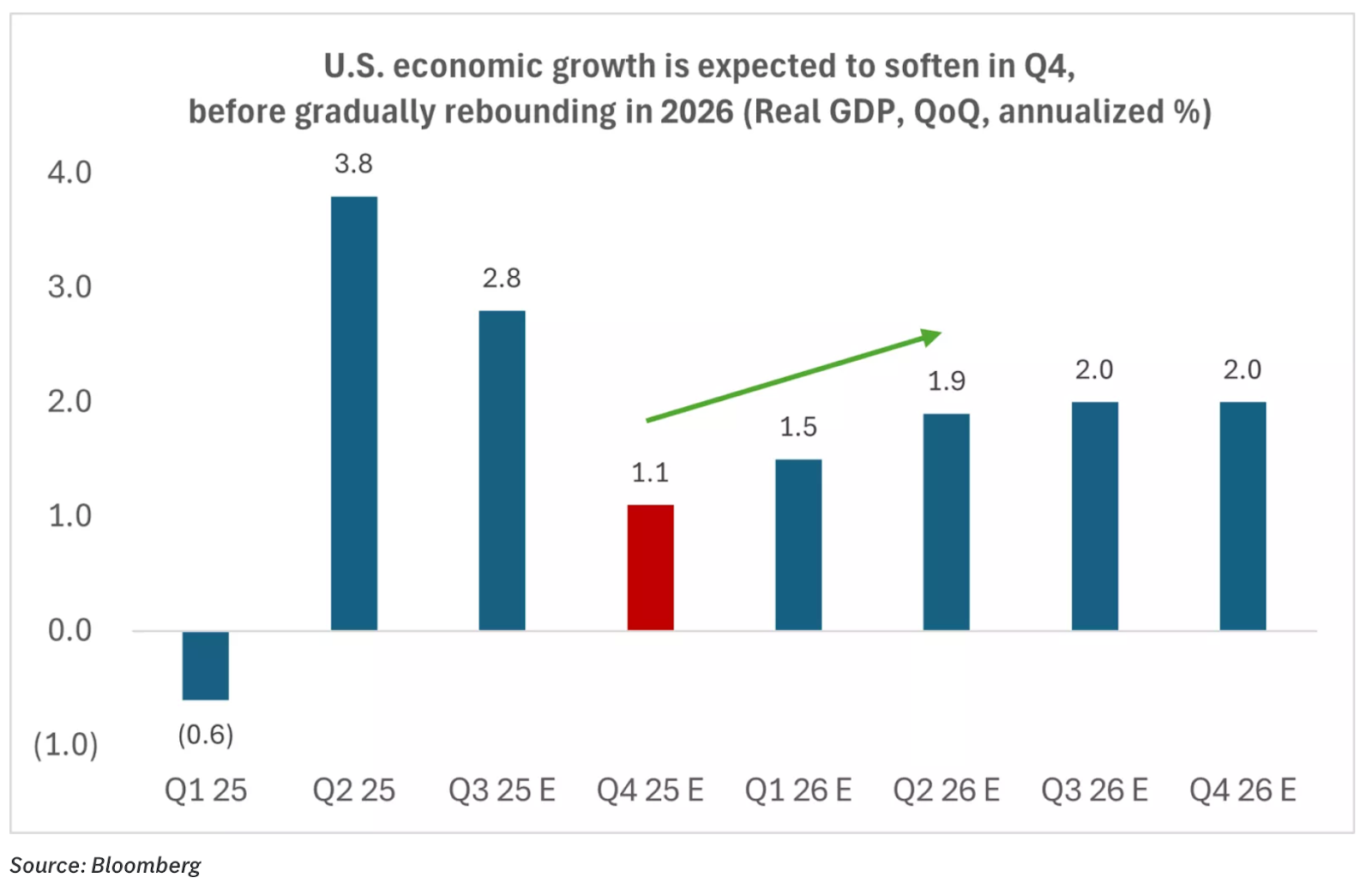

- Impact from government shutdown expected to drive down Q4 GDP: The government shutdown came to an end last week when President Trump signed the Congressional funding bill, putting an end to a 43 day gridlock that will go down as the longest Federal government shutdown in U.S. history. As detailed by Edward Jones, the Congressional Budget Office estimates that the shutdown could shave as much as 1.5% off U.S. Q4 GDP growth, dropping estimates from 2.5-3% to 1-1.5%.

- Oil extends sell-off: Oil prices were essentially flat on the week, with WTI slipping nearly a point and Brent rising by a fraction.

- WTI Crude: $59.42/barrel (-0.7%)

- Brent Crude: $63.86/barrel (+0.1%)

- Gold holds steady: Gold continued to be a safe haven amid market volatility last week, with the precious metal rising 0.7% WoW to just under $4,100.

The week ahead in data*:

- U.S. Bureau of Labor Statistics export and import prices (Tuesday)

- Federal Reserve industrial production and capacity report (Tuesday)

- National Association of Home Builders Housing Market Index (Tuesday)

- Federal Reserve October meeting minutes release (Wednesday)

- U.S. Census Bureau housing starts report (Wednesday)

- U.S. Bureau of Labor Statistics jobs and unemployment for September (Thursday)

- The Conference Board Leading Economic Index (Thursday)

- National Association of Realtors existing home sales report (Thursday)

- U.S. Department of Labor weekly unemployment claims (Thursday)

- University of Michigan Index of Consumer Sentiment (Friday)

*Government reports may be delayed due to the shutdown

Thank you for reading, and please feel free to reach out with any questions.