CCM Blockchain Newsletter (November 20, 2024)

Equities have retraced week-over-week, while bitcoin roared to a new all-time high on Tuesday.

Happy Wednesday, all, and welcome back to this week’s market newsletter.

You may have noticed that the format of today’s newsletter looks different from past emails. We’ve migrated this newsletter to Ghost to improve the reader experience and to provide an archive of past issues. You can find older newsletters at the CCM Blockchain blog.

And with that, let’s jump into today’s update.

Market Overview

- Equities correct from all-time highs: Last week, U.S. markets corrected following a post-election rally that sent them to record highs, and they ended the week in the red. The S&P 500 and the NASDAQ have rallied slightly to start the week, but they are still down respectively 1.15% and 1.55% week-over-week. The Dow has not enjoyed the same early-week rally as the other two major indices, and it is down 1.39% week-over-week. Taking a look at small-cap stocks, the Russell 2000 is fairing worse than the previously listed indices; it is down 3.21% week-over-week.

- Earnings rise – but don’t outpace CPI – in October: On November 13, the US Bureau of Labor reported that seasonally adjusted real average hourly earnings increased 0.1% in October for all employees. This coincided with a 2.6% increase in the CPI for the month, which is up slightly from September’s 2.4%.

- Oil stays steady while natural gas rises:

- The price of oil rose slightly over the course of last week, only to fall sharply to close the week in the red at $66.92/barrel. Prices have risen once again to start the week, and week-over-week, the price is up 1.76% to $69.32/barrel at the time of writing. Current prices are down roughly 20% from this year’s high of $86.91/barrel on April 4.

- Natural gas prices are quickly rising as we approach winter. The Henry Hub spot price is up 31.4% month-over-month and 1.7% week-over-week to 2.96/MMBtu.

- Yields continue to climb: U.S. government bonds continued to climb last week, with the 10-year closing at 4.44% on Friday. At the time of writing, the 10-year is trading at 4.40%, the 5-year at 4.26%, and the 2-year at 4.28%.

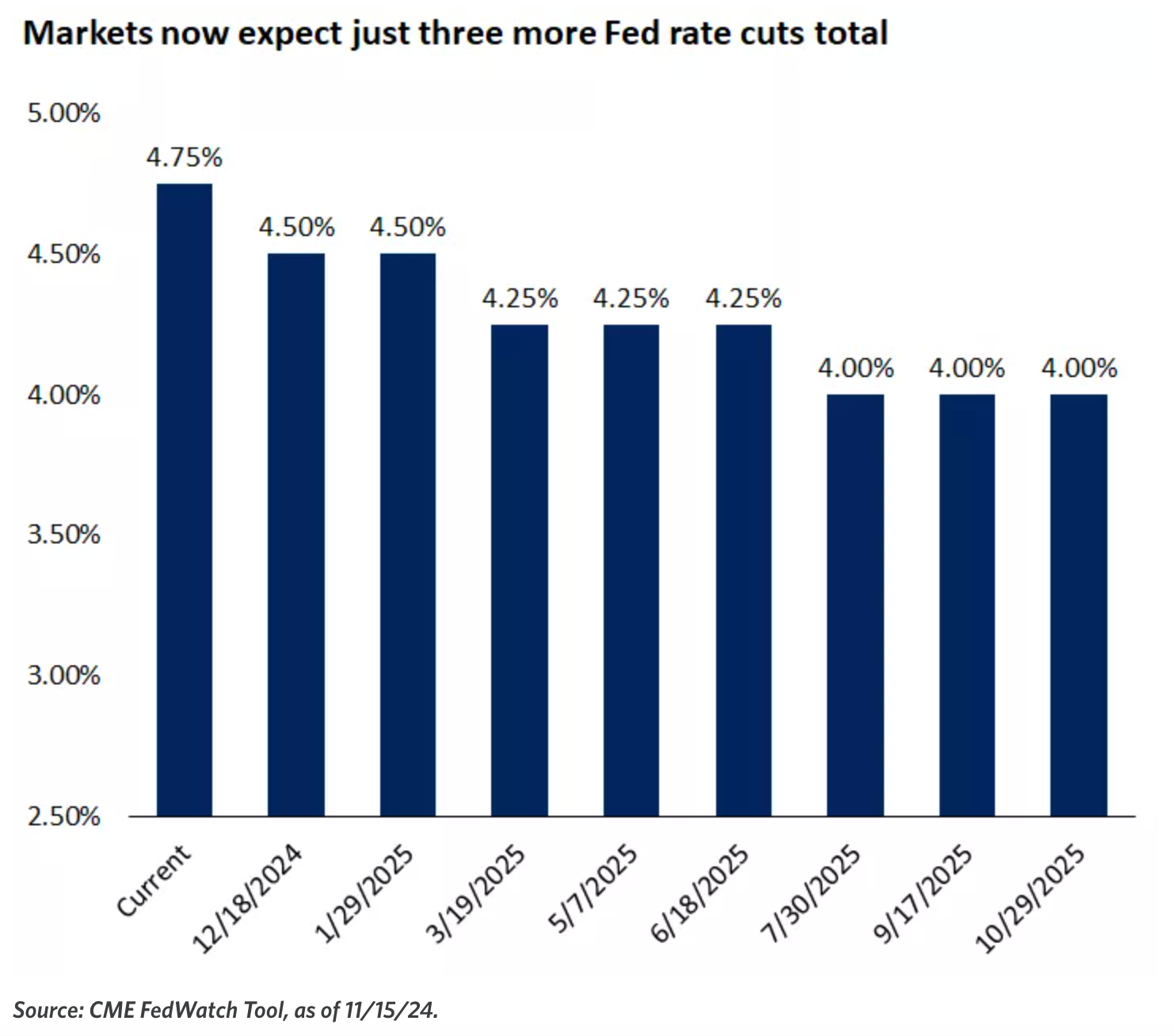

- Fed could put breaks on rate cuts: With a backdrop of higher CPI in October than September, the Federal Reserve may cut rates more slowly than previously expected. Last Thursday, Powell commented, “the economy is not sending any signals that we need to be in a hurry to lower rates.” According to the CME FedWatch Tool, market expectations now posit that the Fed may only cut rates three times over the next year for a total reduction of 0.75%.

What to look out for this week:

- Federal Reserve speeches from Governor Lisa Cook, Governor Michelle Bowman, and Fed President Susan Collins (Wednesday)

- National Association of Realtors report on sales for existing homes in October (Thursday)

- Weekly Unemployment claims from the U.S. Department of Labor (Thursday)

- S&P Global U.S. Preliminary Manufacturing and Services Purchase Manager’s Index for November (Friday)

- University of Michigan Consumer Sentiment Index for November (Friday)

Notable corporate earnings this week:

- Nvidia (Wednesday)

- Target (Wednesday)

- Deere and Company (Thursday)

Bitcoin Market Update

- Bitcoin has extended its impressive rally this week, rising to a new all-time high of ~$94,000 on Tuesday. At the time of writing, bitcoin is up 35% month-over-month and 1.44% week-over-week.

- The biggest news of the week for Bitcoin comes from the launch of options trading for BlackRock’s iShares Bitcoin Trust ETF (IBIT). These options began trading on Tuesday, and Nasdaq told CNBC that 73,000 contracts traded hands in the first 60 minutes of trading, putting IBIT in the top 20 for one of the most traded nonindex options.

- It remains to be seen how these options might affect trading for Bitcoin proxies like bitcoin mining stocks. An index of these stocks from bitcoin mining services company Luxor is down 10.5% over the week, but up 3.2% on the day.

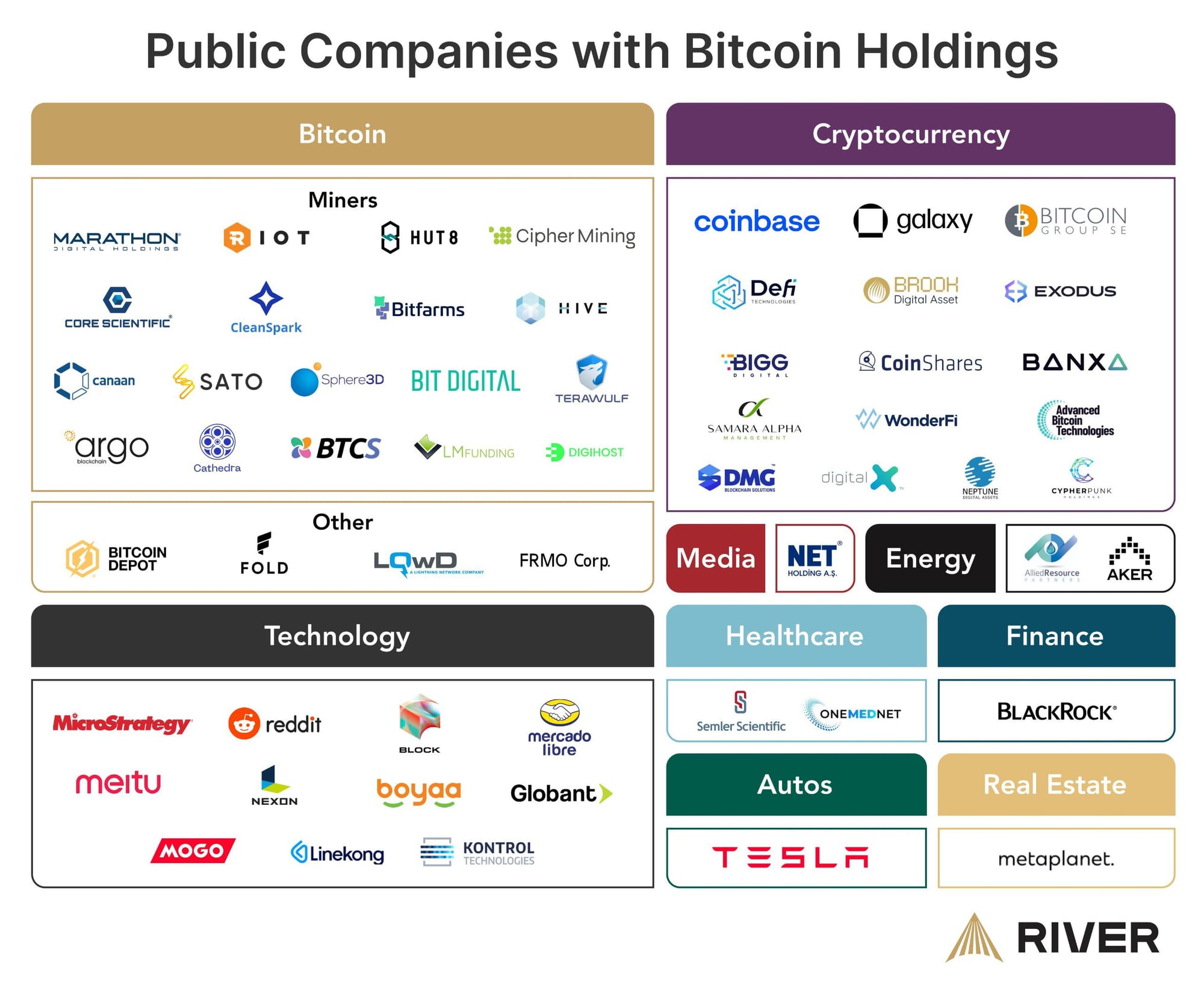

- The IBIT options launch has been heralded as another major milestone on the cryptocurrency’s path to mainstream (and institutional) acceptance. Per a graphic from Bitcoin financial service company River Financial, a number of public companies already hold the asset, from Tesla, to Reddit, to Mercado Libre, and many others.

Interesting Reads and Videos

- Bitcoin Mining Economics Improved in the First Half of November: JPMorgan

- Russia Bans Winter Cryptocurrency Mining in Siberia, North Caucasus and Occupied Ukraine

- Bitcoin mining stock shorts hit $4.6 billion, up 50% in one month

- Estimated cost of production for Bitdeer’s Sealminer ASIC miner

Bitcoin Mining Market Trends and Key Takeaways

- Hashprice – a measure of mining revenue per unit of compute – is rallying alongside bitcoin’s price. Hashprice is up to ~$60/PH/day, a decent 4.5% change week-over-week and a massive 25% change month-over-month. Margins are still thin, but miners are in a much better place than they have been since the April Halving, which dropped hashprice to an all-time low of $37.50/PH/day on August 5. Prior to the current rally, hashprice averaged $49/PH/day in the months following the Halving, compared to $95/PH/day in the three and a half months before it.

- The hashprice rally comes at a time when Bitcoin’s mining difficulty is at an all-time high. Bitcoin’s difficulty has risen 42% year-to-date in response to the relentless increase in Bitcoin hashrate as miners deploy next-generation ASICs like the S21 and M60 series.

- Public bitcoin miners have raised $7.7 billion so far in 2024 (see our attached mining market data update for more info).

Please see this week’s BTC Mining Market Data update attached below.

Thank you for reading, and please feel free to reach out with any questions.

Christian Lopez