CCM Blockchain Newsletter (November 24, 2025)

Bitcoin and stocks sold off last week, while traders played chicken with a Fed rate cut in December.

Happy Monday everyone, and welcome back to this week’s market newsletter. Please see below this week’s market data.

Bitcoin Market Update and News

- Bitcoin suffers one of its worst monthly drawdowns in history: Bitcoin has endured unrelenting sell pressure this month, driving the price down 20% MoM. At the time of publication, bitcoin is down 3.4% WoW to $89,000.

- Crypto exchange Kraken files for confidential IPO prospectus: Kraken, a U.S.-based international crypto exchange second only to Coinbase in the U.S. market, has filed a confidential IPO prospectus with the Securities and Exchange Commission. Kraken reported $178.6 million in EBITDA for Q3 (+124% QoQ) and $576.8 billion in trading volume (+26%).

Interesting Reads and Videos

- U.S. officials probe Bitcoin’s largest ASIC miner manufacturer Bitmain over national security concerns

- Bitcoin miners have now mined more than 95% of Bitcoin’s supply

- Bitcoin, Gold & the Coming Liquidity Pivot | Lyn Alden

Bitcoin Treasury Company News and Updates

- Strategy sells $136 million in preferred stock, adds 8,178 Bitcoin in latest week: Strategy (NASDAQ: MSTR) reported last week that it sold $136.1 million of its preferred stocks STRC, STRD, and STRK via its at-the-market offerings, and the Bitcoin treasury frontrunner also sold $716.8 million of its new preferred, STRE, in a private offering. During the same reporting period (November 10-16), Strategy also purchased 8,178 BTC at an average cost of $102,171 per coin for $835.6 million.

- Metaplanet reveals bitcoin-backed capital structure, $150M perpetual preferred offerings: The Strategy of Japan, Metaplanet (OTC: MTPLF) is rolling out preferred shares: MARS, a senior class A stock with a variable dividend inversely tied to the stock’s price, and MERCURY, a senior class B stock that pays a 4.9% dividend that also includes a bonus linked to BTC’s price performance. So far, Metaplanet has raised $150 million from MERCURY sales.

- Bitcoin treasury companies continue to outperform bitcoin, other assets in Japan: Japanese investors continue to bid up domestic treasury companies, a consequence of the country's tax code that treats cryptocurrency gains as income, which could subject it to a tax of 55% at the highest bracket. As a result, Japanese investors have flocked to bitcoin and crypto treasury companies for indirect, tax-advantageous exposure via equities.

Market Update

- Equities fall, led by tech and AI: Equities punctuated a rough week last Friday with red numbers across the board. The broader market sold off as tech and AI stocks led losses despite Nvidia posting its best quarter yet, indicating that investors are starting to question whether AI valuations have reached their peak on the backs of historic price-to-earnings ratios.

- S&P 500: 6,602.99 (-1.9%)

- Nasdaq: 22,73.08 (-2.7%)

- Dow: 47,147.48 (-1.8%)

- Russell 2000: 2,369.59 (-1%)

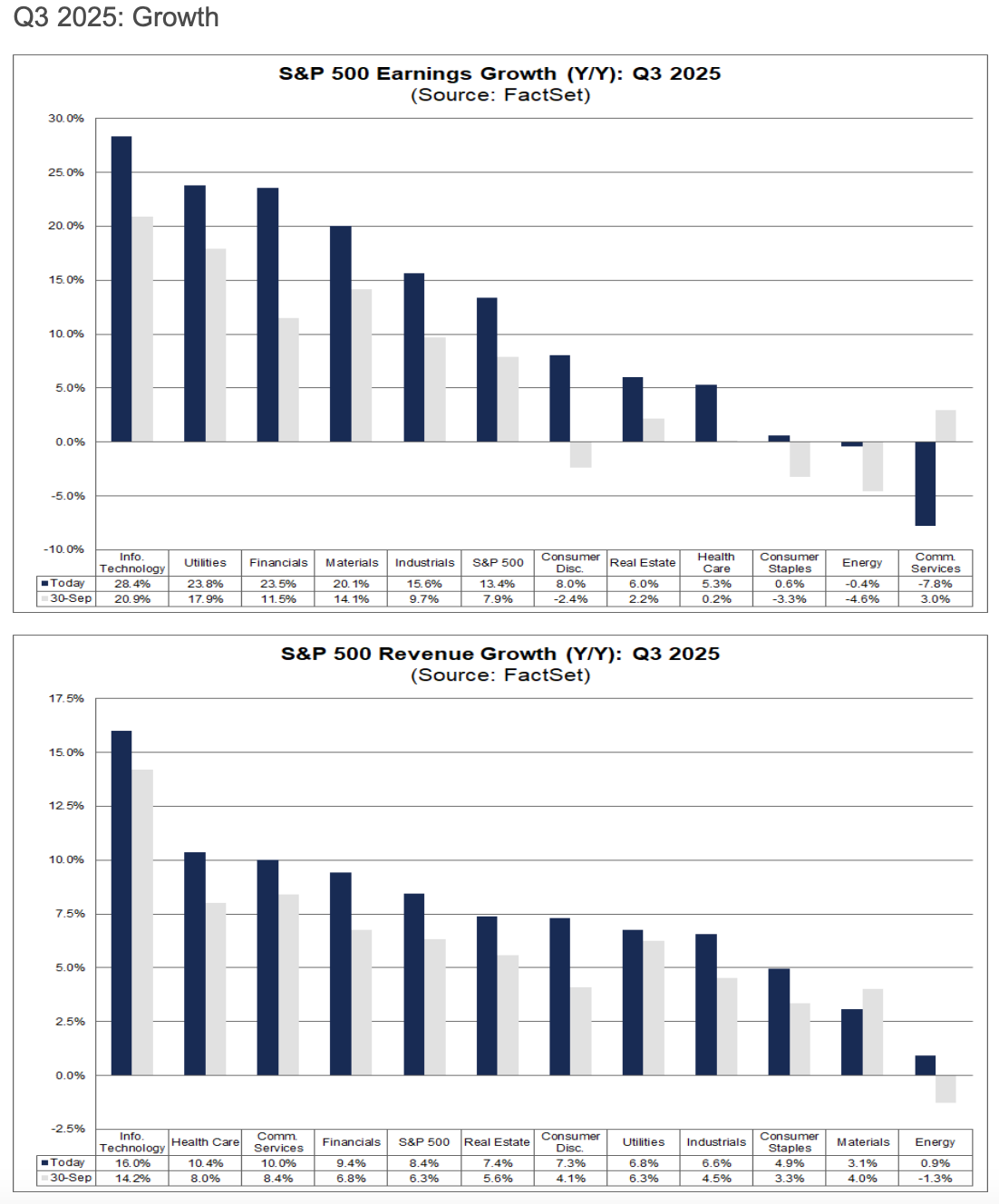

- Q3 earnings growth stands at 13.4% with 95% of S&P 500 firms reporting: 95% of S&P 500 companies have reported their Q3 earnings, with 83% and 76% respectively reporting positive earnings-per-share and revenue surprises, according to FactSet. In its second-to-last read for Q3, FactSet reported that the blended average growth rate for S&P 500 companies is 13.4%, nearly double the 7.9% estimates going into earnings season. The Info Tech, Utilities, Financial, Material, and Industrial industries outperformed other sectors, while Consumer Staples, Energy, and Communication Services lagged.

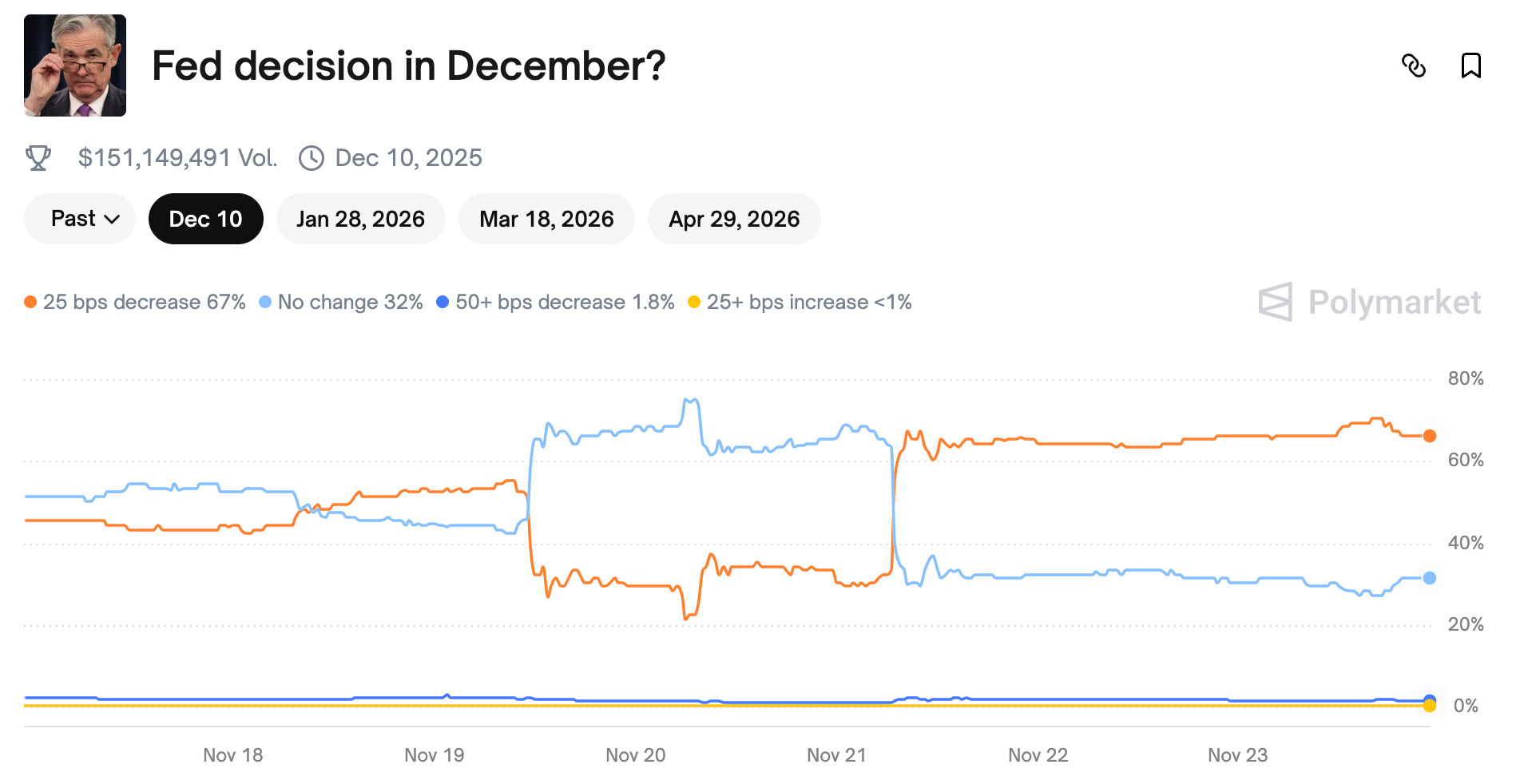

- Shaky markets scramble expectations for Dec Fed decision: Market expectations for the Fed’s rate decision in December seesawed last week, with forecasts oscillating day-by-day from forecasts for a hold, to a 0.25% cut, back to a hold, and back to a cut again. Currently, traders are pricing in a 70% chance of a 0.25% cut in December. Federal Reserve meeting minutes from the Central Bank’s October rate cut decision show that Federal Open Market Committee members are divided on what course to chart with December’s meeting.

- Job growth strong in September, while unemployment ticks up modestly: Government data is starting to roll in again after the end of the Government shutdown, and one of the first-released reports on the backlog gave investors a reason to smile – although not so wide that they could avoid last week’s market bleeding. The U.S. added 119,000 jobs in September, a significant rebound from the revised loss of 4,000 jobs in August. Unemployment did increase slightly to 4.4%, its highest read since October 2021. Hourly wages increased 0.2% MoM and 3.8% YoY, up 0.1% each from expectations.

- GDPNow model now reads a 4.2% bump to GDP in Q3: The Atlanta Fed’s GDPNow model currently forecasts 4.2% growth for GDP in Q3, up from prior revisions in October of 3.8% and 3.9%. The model shows a slight decrease of real personal consumption but a significant uptick in real gross private domestic investment (+4.9%). If the estimate holds or is close, indicating a resilient economy, it could impact the Fed’s rate easing decisions in the future.

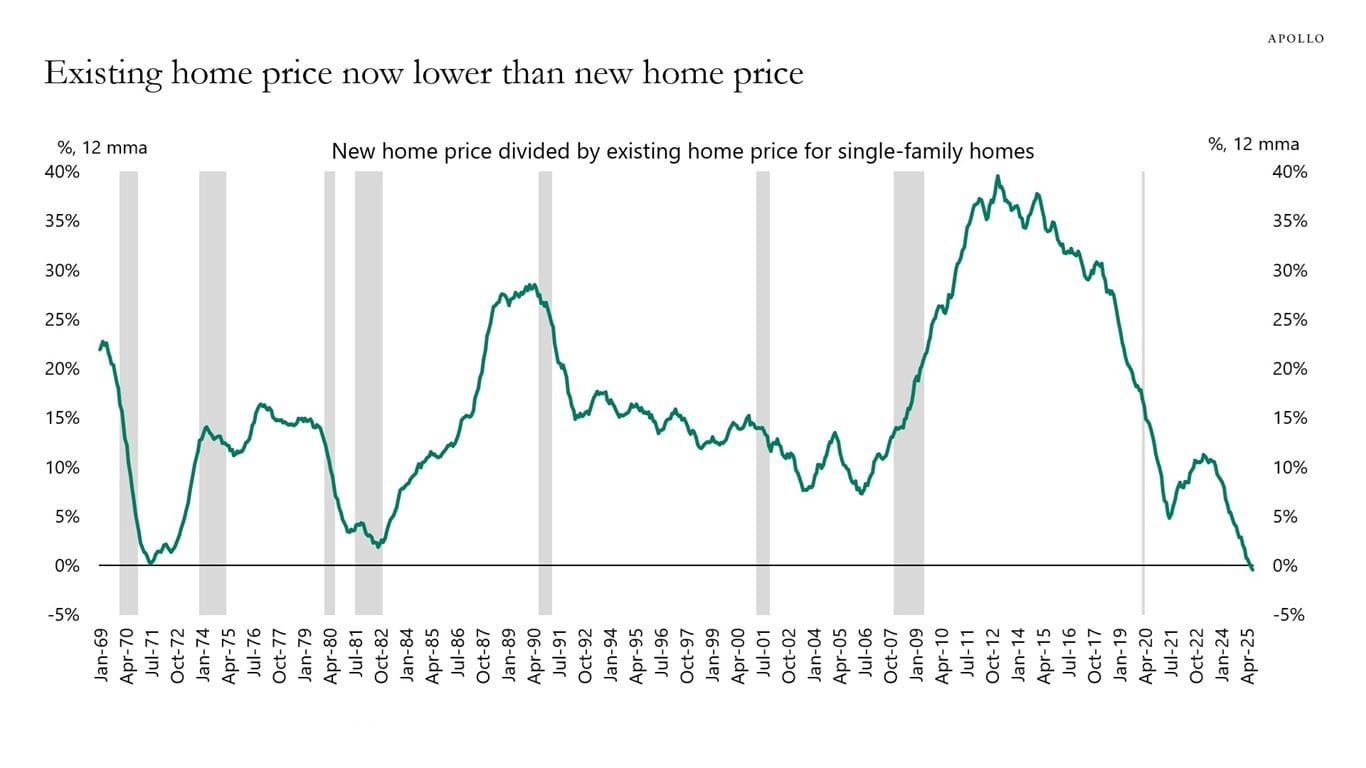

- Existing home sales increase as developers struggle to move new inventory: According to the National Association of Realtors, existing home sales in October 2025 were up 1.2% MoM and 1.7% YoY to a seasonally adjusted annual rate of 4.1 million, with the median sales price up 2.1% YoY to $415,200. Meanwhile, the National Association of Home Builders reported that 6-month sales expectations for new homes fell 3 points to 51 in November (50 being neutral, with any reading above positive and any below negative). 41% of builders reported cutting their prices in November, with the average price cut amounting to 6%. Another 65% said that they used buyers' incentives last month to clear supply. As developers struggle to move inventory, the average new home in the U.S. now costs less than the average existing home, per data from Apollo Global Management.

- Oil falls yet again: Oil prices are scraping the bottom of the barrel, as producers stare down price levels that challenge 2025's yearly low.

- WTI Crude: $57.98/barrel (-3.1%)

- Brent Crude: $61.30/barrel (-2.7%)

- Gold holds: Gold stood once again like a pillar against last week’s market volatility. At the time of writing gold is up 3% WoW to $4,160/oz.

The week ahead in data*:

- U.S. Census Bureau retail sales report (Tuesday)

- U.S. Census Bureau business inventories report (Tuesday)

- U.S. Bureau of Labor Statistics Producer Price Index (Tuesday)

- S&P Cotalility Case-Shiller 20-City Home Price Index (Tuesday)

- The Conference Board Consumer Confidence Index (Tuesday)

- National Association of Realtors pending home sales report (Tuesday)

- U.S. Census Bureau Durable Goods Orders report (Wednesday)

- U.S. Bureau of Labor Statistics jobs and unemployment for September (Wednesday)

*Government reports may be delayed in the aftermath of the shutdown

Thank you for reading, and please feel free to reach out with any questions.