CCM Blockchain Newsletter (November 4, 2025)

Bitcoin and gold sold off last week, while equities climbed to new highs.

Happy Tuesday everyone, and welcome back to this week’s market newsletter. Please see below this week’s market data.

Bitcoin Market Update and News

- Bitcoin slips to $101,000: Bitcoin was surging into last weekend, but the cryptocurrency sold off throughout the week to a local low of $107,000 before rallying to $110,000 into the weekend, only to sell off to start this week. At the time of publication, Bitcoin is down 10.2% WoW to $101,000.

- Core Scientific investors reject CoreWeave acquisition: Core Scientific (NASDAQ: CORZ) shareholders shot down CoreWeave’s (NASDAQ: CRWV) offer to acquire the bitcoin miner-turned AI infrastructure provider. CoreWeave offered to purchase Core Scientific, which is contracted to provide 590 MW of critical IT load to CoreWeave, in June in an all-stock offer that valued Core Scientific at $9 billion. In the ensuing summer, investors would grace AI-pivoting bitcoin miners with eye-popping valuations, leading many investors to feel the deal undervalued Core Scientific and eventually precipitating its failure.

Interesting Reads and Videos

- Everything you need to know about Bitcoin filter soft fork proposal

- Charting Bitcoin Miners’ $11 Billion – and Rising – Convertible Bond Boom

- Bitcoin & The Coming Liquidity Boom | Nik Bhatia

Bitcoin Treasury Company News and Updates

- S&P Global begins tracking Strategy, assigns B- credit rating: S&P Global has added strategy (NASDAQ: MSTR) to its credit ratings, scoring the Bitcoin treasury company with a B-. “Our ratings on Strategy incorporate our view of the company’s narrow business focus, high bitcoin concentration, low U.S. dollar liquidity, and very weak risk-adjusted capital offset, only partially, by Strategy’s strong access to capital markets and prudent management of its capital structure,” the firm said. The rating could open Strategy to doors to new capital markets that are seeking for high risk, high yield returns.

- Metaplanet authorizes share buybacks and preferred share issuance after briefly falling below 1x mNAV: Metaplanet (TYO: 3350; OTCQX: MTPLF) has issued capital allocation guidance, enumerating three policies that will guide its capital structure going forward:

- 1. Metaplanet will issue preferred shares for certain future Bitcoin purchases.

- 2. Metaplanet will halt common share issuance whenever its multiple of net asset value (mNAV) falls below 1x.

- 3. Metaplanet will buy back shares whenever mNAV dips below 1x in an attempt to correct the multiple.

- American Bitcoin adds 3,865 BTC to reserve: Hut 8 (NASDAQ: HUT) subsidiary and pure-play bitcoin miner American Bitcoin (NASDAQ: ABTC) has acquired 1,414 BTC from both open market purchases and its mining operations, upping its total Bitcoin treasury to 3,865 BTC worth over $4.25 billion at the time of writing.

Market Overview

- U.S. stocks climb to yet another record: Major U.S. indices cleared record highs once again last week. The Nasdaq led the charge for the big three on strong tech earnings, but mid and small caps largely sold off over the week.

- S&P 500: 6,840.20 (+0.7%)

- Nasdaq: 23,724.96 (+2.2%)

- Dow: 47,52.87 (+0.8%)

- Russell 2000: 2,479.38 (-1.4%)

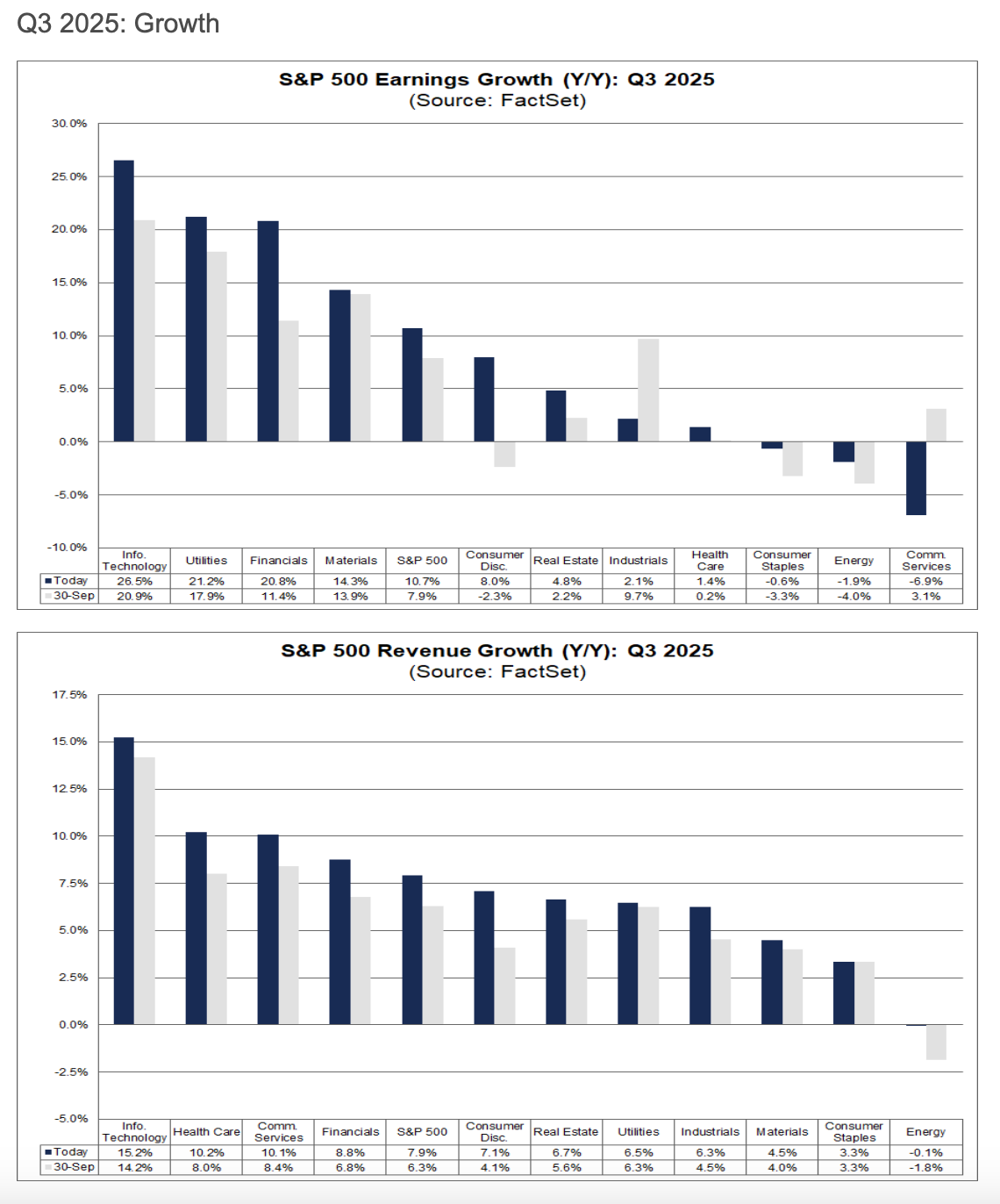

- S&P 500 earnings expectations rise: According to FactSet, 64% of S&P 500 companies have reported Q3 numbers, with 83% and 79% reporting positive earnings per share surprises and revenue surprises, respectively. The current growth rate for Q3 is 10.7%, which would mark the fourth consecutive quarter of double-digit growth, versus an expected 7.9% going into earnings season. S&P 500 company price-to-equity valuations are still above the 5-year (19.9) and 10-year (18.6) averages at 22.9. Information Technology, Utilities, and Financial services continue to outperform in earnings growth compared to other sectors, while Consumer Staples, Energy, and Commercial Services lag.

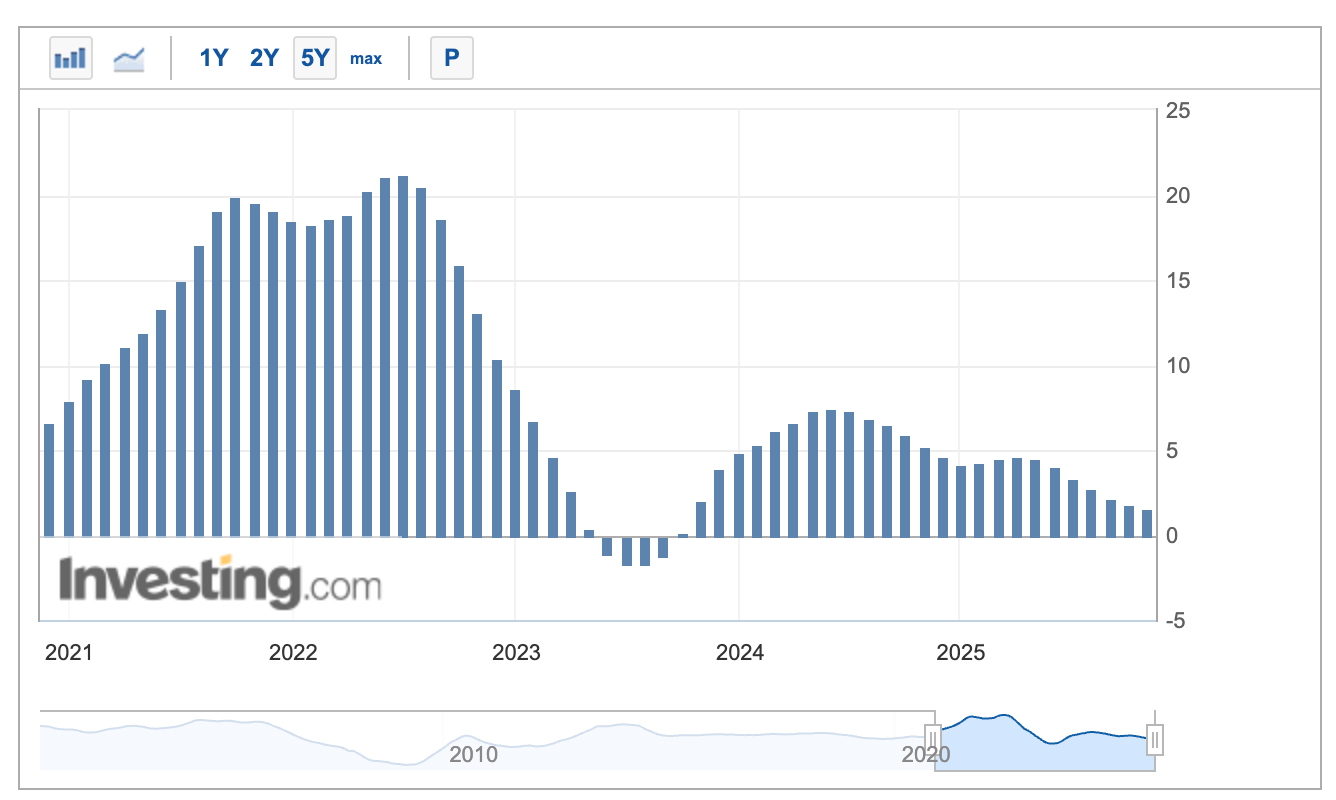

- Fed votes to lower rates by 25 bps: The Federal Reserve Open Market Committee (FOMC) voted to cut the federal funds target rate 25 basis points to 3.75-4%, the second reduction in a row and the second of the current cutting cycle that began in September. Powell emphasized that a cut during the next FOMC meeting in December is not guaranteed, stating that “a further reduction in the policy rate at the December meeting is not a foregone conclusion — far from it,” and that FOMC members hold “strongly differing views” about next steps. The probability for a 25 bps cut in December fell on the CME’s FedWatch tool to 69.8% following Powell’s address.

- Bond yields rally despite Fed cut: U.S. Treasury Bond yields rose following Jerome Powell’s Wednesday press conference as traders priced in Powell’s prevaricating remarks on a further cut in December. With no cut guaranteed next month, yields across all durations rose WoW:

- 30-Year: 4.66% (+11 bps)

- 10-Year: 4.08% (+10 bps)

- 5-Year: 3.69% (+8 bps)

- 2-Year: 3.58% (+9 bps)

- China and U.S. reach new trade deal: The United States and China have reached yet another trade, with China agreeing to purchase 25 million metric tons of U.S. soybeans over the next three years in exchange for a reduction of U.S. tariffs on Chinese imports from 57% to 47% on average. China also agreed to relax export controls on rare earth minerals that are critical for both tech manufacturing and weapons systems.

- Consumer confidence beats expectations in October: The Conference Board’s headline Consumer Confidence Index came in at 94.6 in October, versus expectations of 93.4 and a prior reading of 95.6. Consumer views of the “present situation” for labor and business conditions rose slightly, but forward-looking expectations for the next 6 months dipped and remained below 80, a bellwether for recession according to the Conference Board.

- 20-City Composite Home Price Index rises YoY in October, but growth pace slows: The S&P CoreLogic Case‑Shiller 20‑City Composite Home Price Index rose 1.6% YoY in October versus a 1.4% forecast. This is the slowest rate of growth since September 2023 as the housing market continues to cool, and the index actually fell MoM. Housing price growth is still skewed across the nation, with Sun Belt and West Coast cities stagnating or falling in price while markets in the Midwest rise.

- Pending home sales unchanged in September: According to the National Association of Realtors, pending home sales were the same in September as they were in August, with no meaningful change MoM. YoY, pending home sales were down 0.9% in September, and inventories are at a 5-year high. The West (-5.3%) and Midwest (-1.5%) saw pending home sales fall over the last year, while the South (0.9%) and Northeast (0.5%) rose.

- Oil extends sell-off: Oil prices fell slightly last week, with both WTI Crude and Brent Crude slipping.

- WTI Crude: $60.88/barrel (-/14%)

- Brent Crude: $64.77/barrel (-1.8%)

- Gold takes a breather Gold continues to cool off after a generational run, with the precious metal slipping 1.7% last week to just over $4,000/oz.

The week ahead in data*:

- Institute for Supply Management’s Manufacturing Index (Monday)

- ADP National Employment Report (Wednesday)

- National Association of Realtors Pending Home Sales report (Wednesday)

- Institute for Supply Management’s Non-manufacturing Index (Wednesday)

- University of Michigan Index of Consumer Sentiment, preliminary (Friday)

*Government releases omitted due to the government shutdown

Thank you for reading, and please feel free to reach out with any questions.