CCM Blockchain Newsletter (October 14, 2025)

Gold surged above $4,000/oz last week while bitcoin and equities tumbled.

Happy Tuesday everyone, and welcome back to this week’s market newsletter. Please see below this week’s market data.

Bitcoin Market Update and News

- Bitcoin craters on tariff-scare Black Friday: Bitcoin wasn’t spared in last Friday’s market crash sparked by a Trump tweet threatening more aggressive tariffs against China. At the time of publication, Bitcoin is down 7.3% WoW to $112,700.

- S&P Global to debut S&P Digital Markets 50 Index, merging crypto and equities: S&P Global has launched the world’s first mixed cryptocurrency and equity fund. The S&P Digital Markets 50 Index will provide investors with exposure to a basket of 15 cryptocurrencies plus 35 companies directly involved with or adjacent to crypto.

Interesting Reads and Videos

- Digital asset funds pull in $3.17 billion even as AUM dips 7% on tariff scare last week: CoinShares

- Two Seas Capital urges vote against Core Scientific’s sale to CoreWeave

- Miner Weekly: Bitcoin’s Shadow Hash in Xinjiang, China

Bitcoin Treasury Company News and Updates

- DDC Enterprise raises $124 million for Bitcoin treasury, with $3 million investment from CEO: DDC Enterprise (NYSEAMERICAN:DDC) has raised $124 million in an equity financing round to add to its bitcoin treasury. PAG Pegasus Fund, Mulana Investment Management, and OKG Financial Services led the round. The company holds 1,058 BTC and hopes to stack 10,000 BTC by year-end.

- Strategy raises $27.3 million and buys 220 Bitcoin for its first purchase in two weeks: Strategy (NASDAQ: MSTR) revealed it has purchased 220 BTC for $27.2 million, a purchase it made near Bitcoin’s all-time high to increase its treasury to 640,250 BTC. Strategy tapped an ATM to the tune of $27.3 million for the purchase.

- BitMine adds 200,000+ ETH to treasury: Former bitcoin miner turned-ETH treasury company, BitMine (NYSEAMERICAN: BMNR) added 203,037 ETH to its treasury recently last week.

Market Overview

- Stocks slip following record high week: U.S. equities were knocked from their record peaks last week following a tweet from President Trump for more stringent tariffs against China.

- S&P 500: 6,552.51 (-2.4%)

- Nasdaq: 22,204.43 (-2.5%)

- Dow: 45,479.60 (-2.7%)

- Russell 2000: 2,394.59 (-3.3%)

- Trump threatens to double Chinese tariffs over China rare earth policy: President Trump tweet that he may impose an additional 100% tariff on Chinese goods (effectively doubling the average current rate) and export controls on Chinese software in response to China’s new, aggressive rare earth trade policy. China recently expanded its own export controls that requires new licenses for exporting rare minerals, which extends the export control jurisdiction over not just raw materials, but also over manufactured tech products that utilized rare earth mineral components. In other words, if a company uses rare earths mined in China but refines them elsewhere and even manufacturers the final technology outside of China, these export controls may apply, raising concerns over jurisdictional overreach and China asserting an iron grip over a critical minerals sector that it already dominates.

- Fed meeting minutes confirm dovish forward stance despite standouts: The Federal Reserve released minutes from its latest policy meeting last week, and the transcript shows that, while some FOMC members disagree, the majority are on board for near-future cuts, with one member even calling for a larger, 50 bps cut. Powell attributed 0.3-0.4% of recent inflation to tariffs, adding that the Fed is in a pinch with elevated inflation and rising unemployment threatening stagflation as they ease into a rate cutting cycle: “It’s a very difficult policy environment when your two goals are telling you two different things — you’ve got to make a compromise,” he noted.

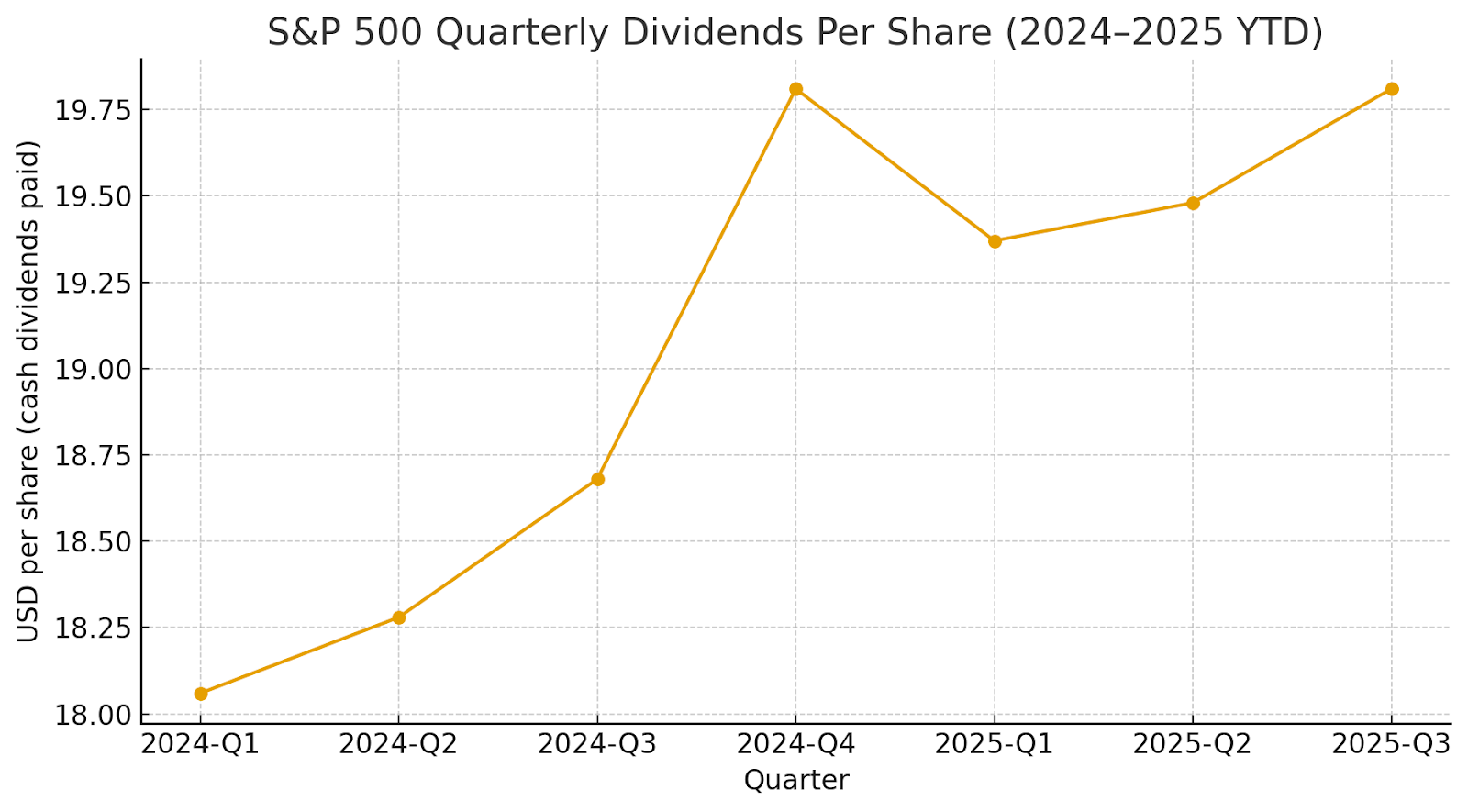

- Dividends increased in Q3: S&P 500 companies increased net dividends by $10.6 billion in Q3 2025, a sharp pickup from $7.4 billion in Q2 2025, signaling renewed confidence among large-cap firms. S&P Dow Jones Indices projects full-year 2025 dividend growth of nearly 6% over 2024, which would mark a new record annual payout. For context, the long-term average dividend growth rate for U.S. large caps is closer to ~4–5%, so 2025 is trending above the historic average.

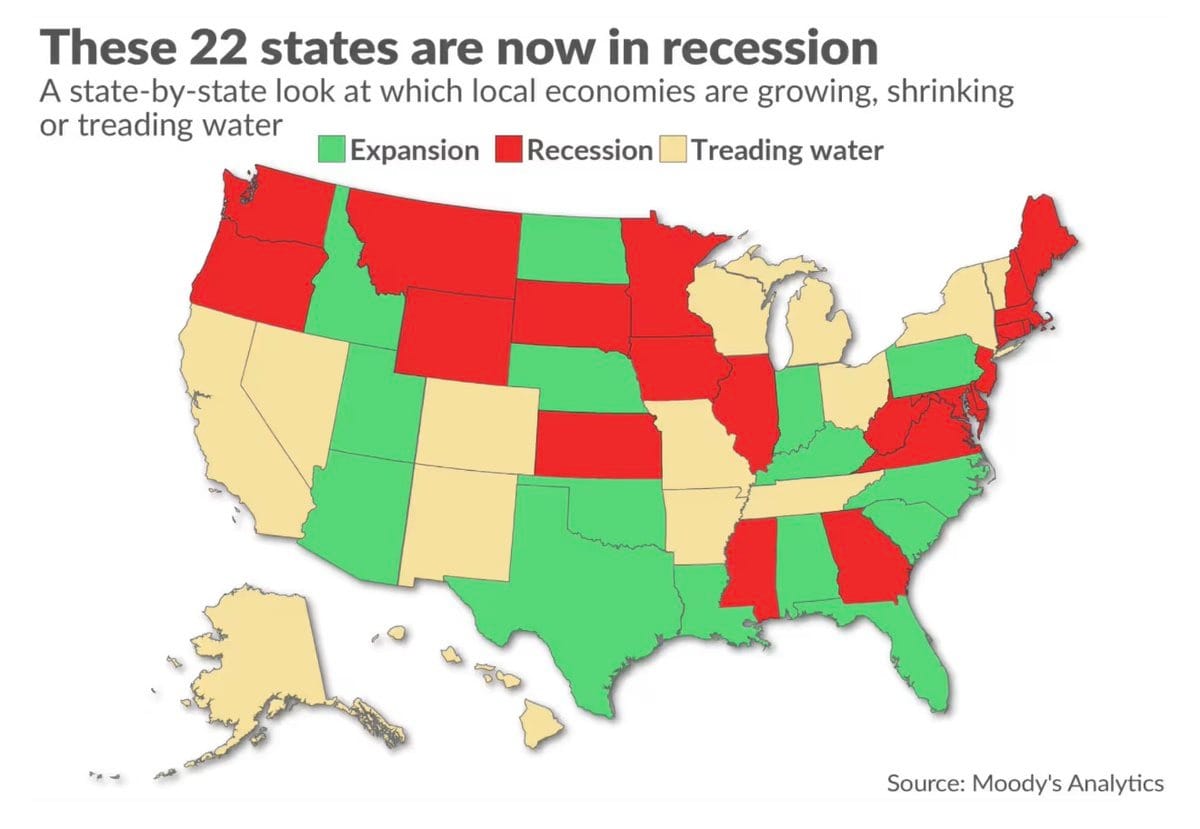

- Moody’s state-by-state GDP estimates reveal bifurcated national economy: The Atlanta Fed’s GDPNow estimate forecasts that the U.S.’s GDP will expand by 3.8% this year, but a look at state-by-state GDP estimates show that this growth is unevenly distributed. Moody’s estimates that 22 states are already in a recession, with economies in Northern and Western states slipping into contraction while Southern and Sun Belt states expand. Moody’s attributes manufacturing and housing slowdown in recession or near-recession states as primary drivers, adding that construction in Sun Belt states and a liquidity shot-in-the-arm from AI market speculation are keeping the national economy above water on paper.

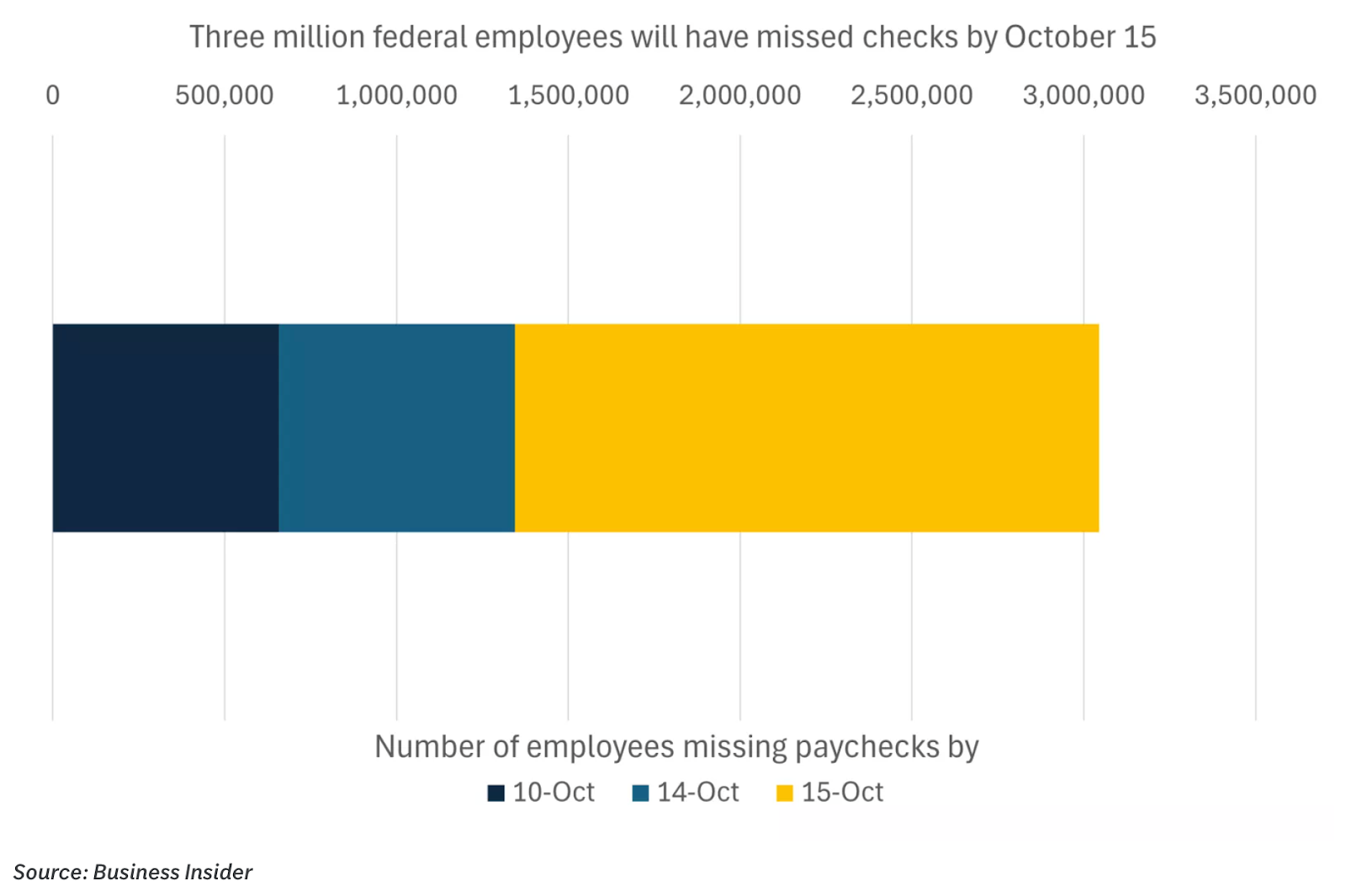

- Government shutdown enters week two: The Federal government’s shutdown enters its second week today, while the House is in recess and the Senate is adjourned until October 14 following 7 failed votes on a Federal budget. By October 15, over 3 million Federal employees will have missed paychecks on account of the shutdown.

- Oil tumbles on market selloff: Oil price fell once again last week, extending a multi-week selloff.

- WTI Crude: $58.90/bbl (-3.3% WoW)

- Brent Crude: $62.73/bbl (-2.8% WoW)

- Gold surges on market volatility: Gold crossed over $4,000/oz for the first time last week, and it climbed higher on Friday during the market meltdown. At the time of writing, gold is up 3.2% WoW to $4,120/oz and is up 11% MoM and 54.4% YTD.

The week ahead in data*:

- National Association of Home Builders Housing Market Index (Thursday)

*Government releases omitted due to the government shutdown

Thank you for reading, and please feel free to reach out with any questions.