CCM Blockchain Newsletter (October 20, 2025)

Bitcoin sold off last week, while equities rose and Treasury yields fell.

Happy Monday everyone, and welcome back to this week’s market newsletter. Please see below this week’s market data.

Bitcoin Market Update and News

- Bitcoin plummets to low $100,000s: It seemed like everything was green last week except Bitcoin. The cryptocurrency and its wider market took a beating, with Bitcoin touching $102,000. At the time of publication, Bitcoin is down 3% WoW and 4.1% MoM at $111,200.

- U.S. and UK authorities seize over $14+ billion in Bitcoin from Asian crime cell: Uncle Sam and John Bull teamed up to take down the Prince Group, a Cambodian crime syndicate that ran crypto pig butchering scams and forced-labor human trafficking operations. Authorities seized 127,271 BTC from the group, worth over $14 billion, and its ringleader, Chen Zhi, is facing a maximum sentence of 40 years.

Interesting Reads and Videos

- Big or Blip? Three Questions After the Flash Crash

- China is Accelerating the U.S. Debt Spiral

- Why Fiber Optic Is Too Slow for Trading Now

- Bitcoin Mining Debt Set for New Records — But This Time It’s Different

Bitcoin Treasury Company News and Updates

- Metaplanet issued new shares for warrant exercises, used proceeds to pay off bond: Metaplanet (OTC: MTPLF) announced last week that it, in June 2025, it issued 1.3 million new shares to the EVO FUND after the fund exercised its rights to 13,000 warrants priced at ¥637 ($4.22) per share. Metaplanet has used the proceeds to pay off a bond it issued to EVO FUND that matures in December 2025, of which the company currently has ¥3.75 billion ($24.9 million) outstanding out of the original ¥30 billion ($199 million) loan. As of October 10, there are still 284,000 warrant rights outstanding under Metaplanet and EVO FUND’s agreement, equal to ~28.44 million potential shares.

- BitMine purchases ~$1.5 billion Ethereum: Bitcoin mining firm-turned Ethereum treasury play, BitMine Immersion Technologies (NYSEAMERICAN: BMNR), purchased 379,271 ETH in a buying spree last week, splitting the nearly $1.5 billion purchase into three chunks. BitMine is the largest Ethereum treasury company on the map with over 3 million ETH (~2.5% of the supply) worth over $11.7 billion.

- ZOOZ increases BTC treasury to 942: Israeli Bitcoin treasury company, ZOOZ Power (NASDAQ: ZOOZ), announced last week that it has purchased 88.88 BTC for ~$10 million to increase its Bitcoin holdings to 942 BTC. The company has been accumulating Bitcoin since July 2025.

Market Overview

- Stocks recover following abrupt selloff: U.S. equities rose across the board last week following a selloff two weeks prior spurred by the threat of additional, 100% tariffs on China.

- S&P 500: 6,664.01 (+1.7%)

- Nasdaq: 22,679.97 (+2.2%)

- Dow: 46,190.61 (+1.6%)

- Russell 2000: 2,452.17 (+2.4%)

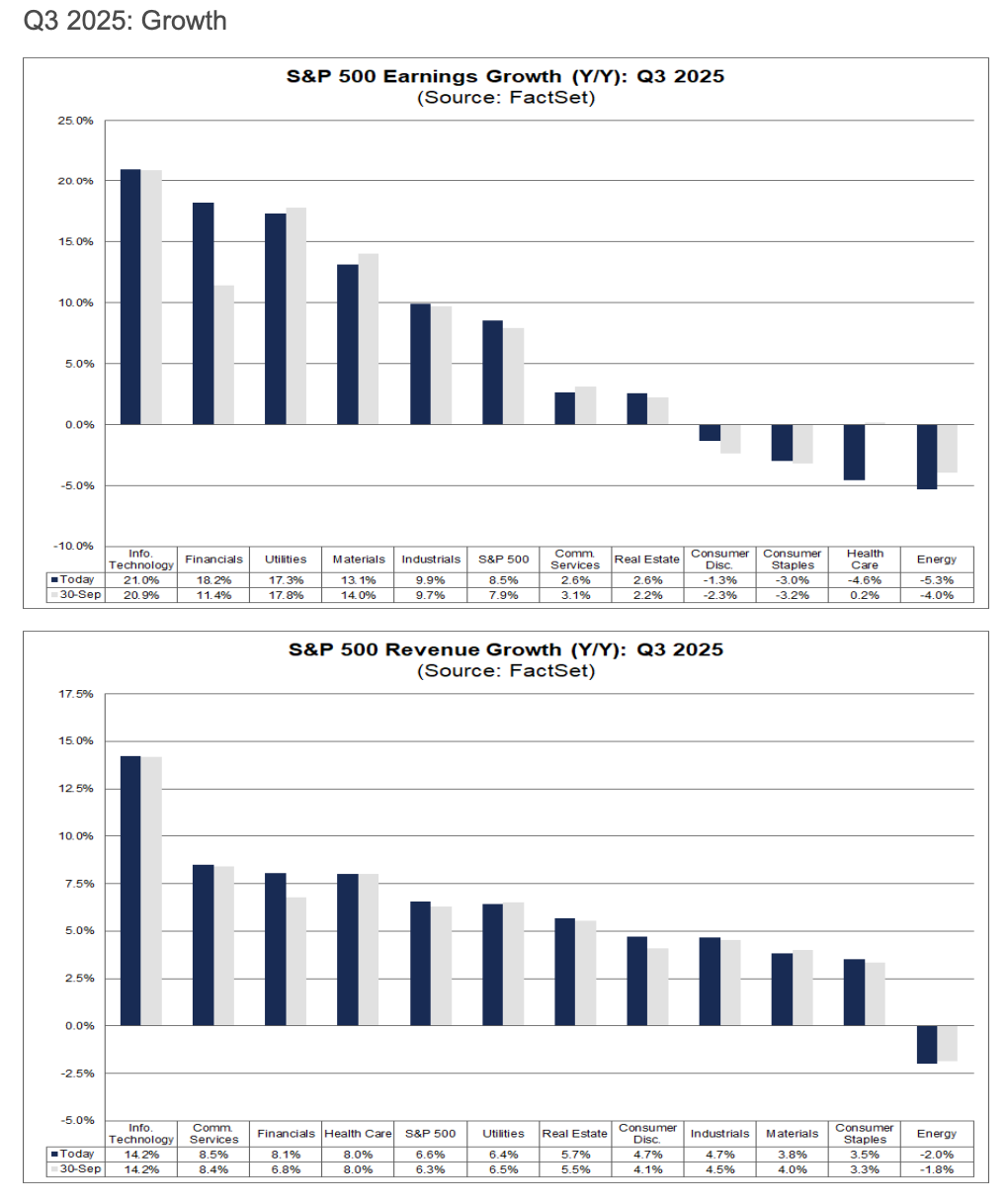

- Early earnings reporting signals strong growth for Q3: Per FactSet, 12% of S&P 500 companies have reported their Q3 financials, and 86% and 84% have respectively reported positive earnings per share surprises and positive revenue surprises. If the earnings hold, they will mark the ninth consecutive quarter of earnings growth for the S&P 500. FactSet estimates that S&P 500 companies averaged a year-over-year earnings growth rate of 7.9% in Q3 2025. The S&P 500’s average forward 12-month P/E ratio is currently 22.4, above both the 5-year (19.9) and 10-year (18.6) averages.

- Regional bank scare ripples through markets: Two regional banks, Zion Bancorp (NASDAQ: ZION) and Western Alliance Bancorp (NYSE: WAL) fell by double digits last week after they respectively revealed ~$50 and ~$100 million in sour loans. The news rippled through the banking and credit markets, leading to cascading stock prices among regional banks as investors were worried more bad loans were hiding under the surface. The KBW Regional Banking Index (NASDAQ: KRX) fell ~6.3% on one day — its biggest daily drop since April.

- U.S. Treasury yields fall on market volatility: U.S. Treasury Bonds of all durations fell last week as markets whipsawed from sell-off to recovery. The 10-Year dipped briefly below 4% before closing the week slightly above.

- 30-Year: 4.61 (-3bps)

- 10-Year: 4.01% (-4bps)

- 5-Year: 3.60% (-4bps)

- 2-Year: 3.47% (-3bps)

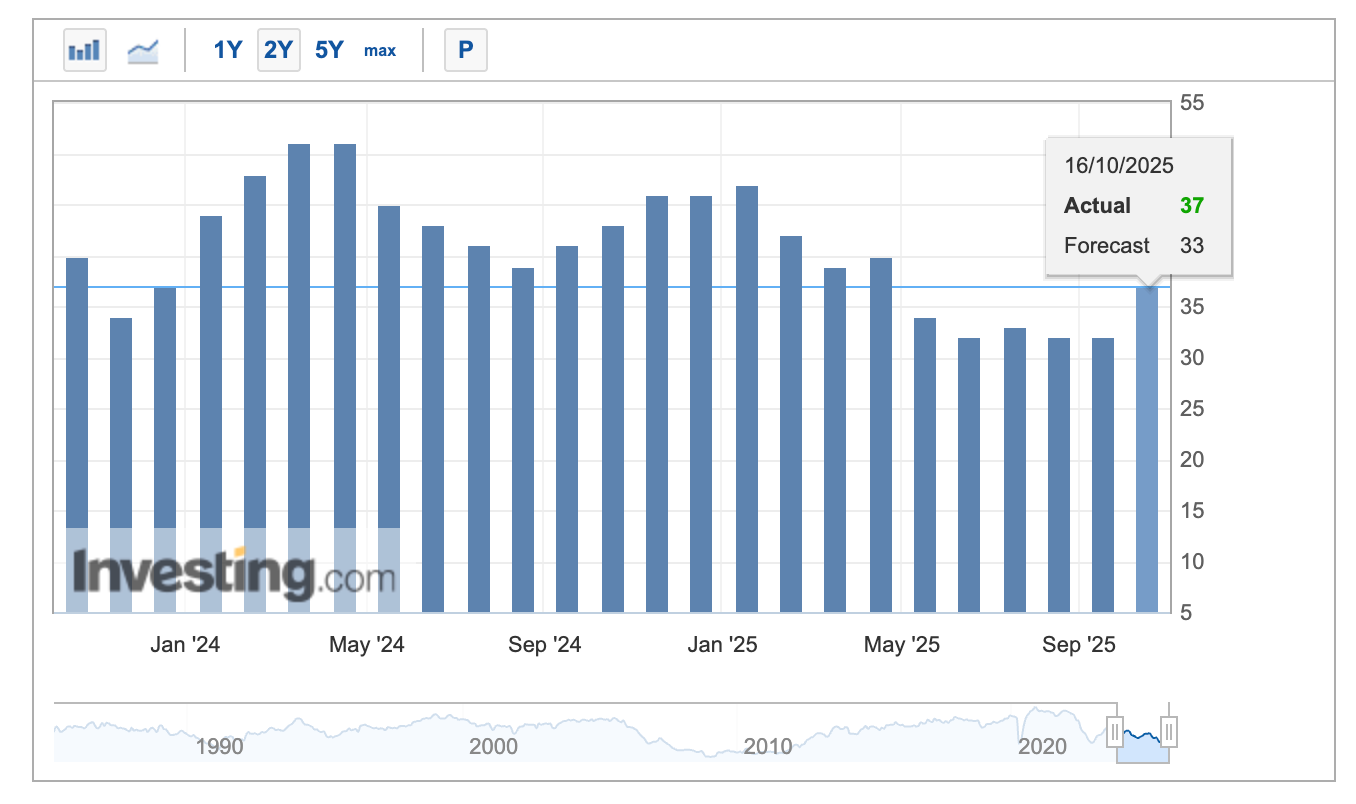

- NAHB Housing Market Index for October beats expectations but still in contraction: The preliminary reading of the National Association of Home Builders’ Housing Market Index for October indicates that the housing market improved from September and beat expectations, but it’s still weak. The index’s 37 reading beat expectations and marks a 6-month high, but it still falls well short of the 50 neutral level (a reading above 50 denotes real estate market expansion, and vice versa for a reading below 50). 38% of home builders reported slashing asking prices for homes in October, with the average home seeing a 6% decrease in price.

- VIX retreats from multi-month high: The Cboe Volatility Index (CBOE: VIX) rose a couple percentage points last week, but it sold off at the end of the week amid the stock market rally. The VIX hit a multi-month high of 24.94 last week, the highest since the index went parabolic during April's tariff-jittered market selloff. At the time of writing, the VIX is up 34.5% MoM.

- Oil extends sell-off: Oil prices slipped again last week, with WTI falling firmly below $60/barrel.

- WTI Crude: $56.93/barrel (-4%)

- Brent Crude: $61.06/barrel (-4%)

- Gold is up yet again: Gold continues to outshine other conventional investments, with the precious metal rising last week for the ninth week in a row to an all-time high just below $4,400/oz.

The week ahead in data*:

- The Conference Board Leading Economic Index (Monday)

- National Association of Realtors Existing Home Sales report (Tuesday)

- U.S. Bureau of Labor Statistics Consumer Price Index (Friday)

- University of Michigan Index of Consumer Sentiment (Friday)

*Most government releases omitted due to the government shutdown

Thank you for reading, and please feel free to reach out with any questions.