CCM Blockchain Newsletter (October 27, 2025)

Bitcoin and equities were up last week, while gold was down for the first time in over two months.

Happy Monday everyone, and welcome back to this week’s market newsletter. Please see below this week’s market data.

Bitcoin Market Update and News

- Bitcoin rebounds above $110,000: Following a brutal week that drove Bitcoin down to the low $100,000s, Bitcoin bounced back hard last week. Bitcoin is up 3.6% WoW at the time of writing to $115,000.

- JPMorgan to accept Bitcoin and Ethereum as collateral: Per Bloomberg, JPMorgan Chase will let institutional clients post Bitcoin and Ethereum as collateral for loans. JP Morgan plans to launch the offering by the end of the year, and it markets the first major integration of crypto into the credit structure of a top Wall Street firm.

Interesting Reads and Videos

- NYDIG Weekly Digest Oct. 24, 2025

- Bitcoin Mining Leaderboard Shakes up Ahead of Q3 Earnings

- For bitcoin mining to survive, we need to rethink L2s

Bitcoin Treasury Company News and Updates

- Strategy acquires 168 Bitcoin as it skips MSTR issuance for the third week in a row: Strategy (NASDAQ: MSTR) has added 168 BTC to its treasury, upping its trove to 640,418 BTC valued at over $73 billion at the time of writing. For the week of October 13, Strategy did not tap into the MSTR at-the market offering for the third week in a row.

- B. Riley initiatives coverage of NAKA, other crypto treasuries: B. Riley, which is advising equity offerings for a number a crypto treasury companies, has initiated coverage of Kindly MD/Nakamoto Holdings (NASDAQ: NAKA), as well as Sharplink Gaming (NASDAQ: SBET), Bitmine (NYSE: BMNR), and a handful of other crypto treasury plays. The investment bank has issued buy ratings for all of the treasury companies under its purview, including NAKA, which it says has a particular advantage given its partnership with other Bitcoin treasury and Bitcoin companies.

Market Overview

- Major indices see hat trick of record highs: U.S. equities roared to all-time highs last week, with the S&P 500, Dow Jones, and Nasdaq all setting record highs and the Russell 2000 closing just below its own all-time high.

- S&P 500: 6,791.69 (+1.9%)

- Nasdaq: 23,204.87 (+2.3%)

- Dow: 47,207.12 (+2.2%)

- Russell 2000: 2,513.47 (+1.7%)

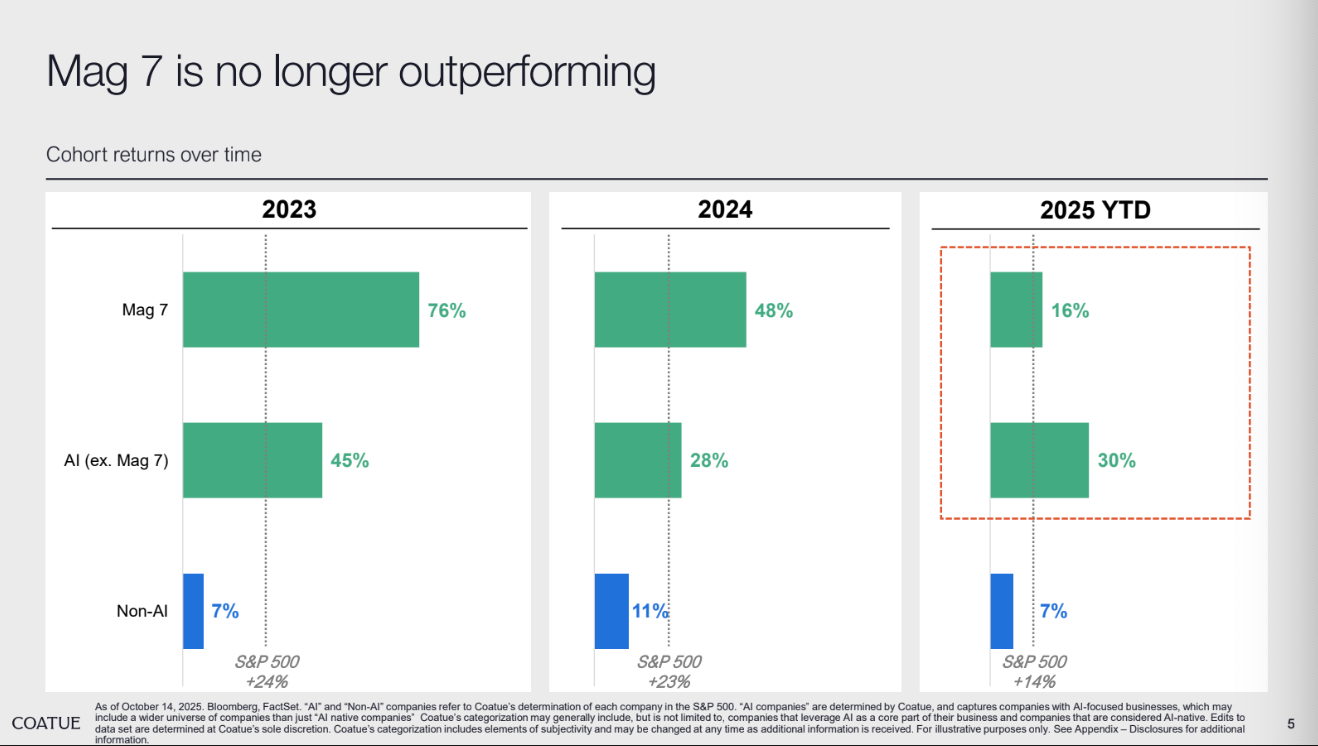

- Mag 7 is no longer outperforming AI growth stocks: Per research from Coatue as of October 2025, The Magnificent 7 (Nvidia, Microsoft, Alphabet (Google), Amazon, Tesla, Apple, and Meta) are no longer outperforming growth AI stocks. The Magnificent 7 was 16% YTD as of October 14, 2025, while a basket of AI stocks excluding the Magnificent 7 have surged 30%. The former cohort returned 48% to the latter’s 28% in 2024 and 76% to 45% in 2023.

- All eyes on Wednesday FOMC meeting: Markets are eagerly awaiting the results of October 29’s Federal Open Market Committee meeting, when the Federal Reserve board is expected to vote to lower the Federal Reserve’s target interest rate. The CME’s FedWatch tool currently shows a 96.7% probability of a 0.25% cut to 3.75-4.00% this week, followed by a 94.4% probability of another 0.25% cut to 3.50-3.75% in December.

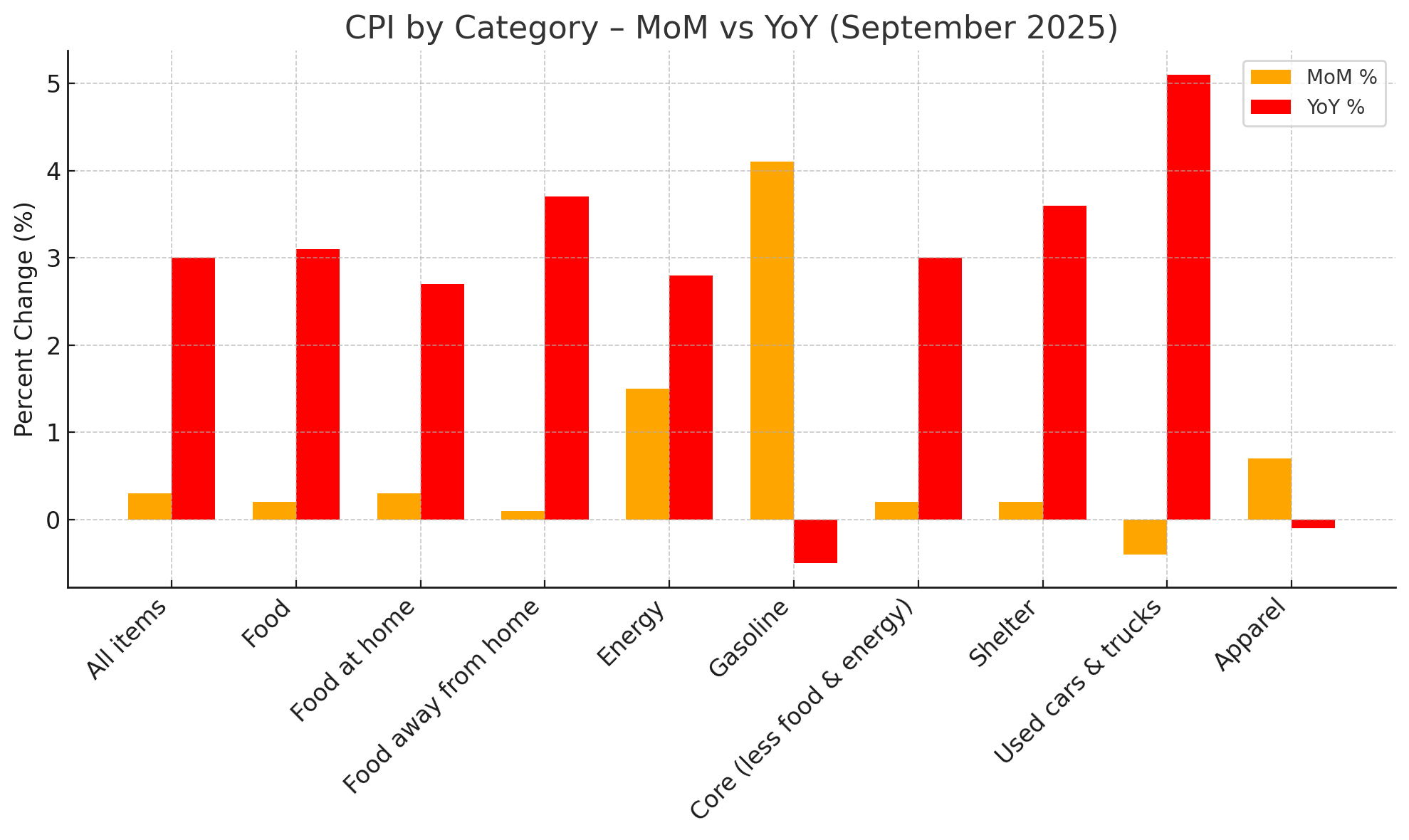

- Inflation still hot in September with CPI at 3% YoY: Despite the government shutdown, the U.S. Bureau of Labor Statistics released last month’s CPI data, and both core and headline came in at 3% YoY, with either measure respectively increasing 0.2% and 0.3% MoM. Energy, shelter, and food saw some of the largest YoY increases, with all energy rising 2.8%, shelter increasing 3.6%, grocery costs up 3.1%, and food away from home up 3.7%. Apparel and gasoline were the only categories that fell YoY, down 0.1% and 0.5%, although either was up 0.7% and 4.1% MoM.

Source: BLS | Generated by ChatGPT

- University of Consumer Sentiment slips in October: In the final read for its Index of Consumer Sentiment for the month, the University of Michigan reported that consumer sentiment is down again in October, falling to 53.6 from 55.1 in September for a 24% decline YoY. The index’s Current Economic Conditions sub-index fell to 58.6 (from 60.4), a 3.0% drop and about 9.7% lower than a year ago, while the Expectations sub-index dropped to 50.3, down 2.7% from September, and 32.1% below a year-ago. Year-ahead inflation expectations edged down to 4.6%, while long-run inflation fears ticked up to 3.9%.

- Existing home sales rise in September alongside asking prices: Per the National Association of Realtors, existing home sales rose 1.5% month-over-month in September to a seasonally adjusted annual rate of 4.06 million units — the highest level since February and a 4.1% increase YoY. Sales rose in every region except the Midwest, and the median national existing home price was $415,200 with the average 30-year mortgage rate dropping to 6.27%. For sale inventory increased by approximately 14% (to about 1.55 million units) for 4.6 months supply at the current sales pace.

- Oil extends sell-off: Oil prices bounced back last week after three weeks of selling as the United States slapped Russian oil companies with sanctions.

- WTI Crude: $61.79/barrel (+8.5%)

- Brent Crude: $65.99/barrel (+8.1%)

- Gold sees record selloff: Gold finally had a down week after a historic multi-month run, with the precious metal declining nearly 5% on Monday for a record selloff. Gold is currently down 3.5% WoW but still up 8.4% MoM and 54.6% YTD.

The week ahead in data*:

- The Conference Board Consumer Confidence Index (Tuesday)

- S&P Cotality Case-Shiller 20-City Composite Home Index (Tuesday)

- Fed Press Conference following FOMC meeting (Wednesday)

- National Association of Realtors Pending Home Sales report (Wednesday)

- U.S. Bureau of Economic Analysis Q3 GDP advance estimate (Thursday)

- U.S. Bureau of Economic Analysis PCE Price Index (Friday)

*Most government releases omitted due to the government shutdown

Thank you for reading, and please feel free to reach out with any questions.