CCM Blockchain Newsletter (October 6, 2025)

Bitcoin has surged to a new all-time high above $126,000.

Happy Monday everyone, and welcome back to this week’s market newsletter. Please see below this week’s market data.

Bitcoin Market Update and News

- Bitcoin breaches new all-time high: Bitcoin surged to a fresh record over the weekend, topping out just above $125,500 before setting yet another record high above $126,000 on Monday. At the time of publication, Bitcoin is up 9% WoW to $124,900.

- Core Scientific vote for CoreWeave acquisition set for October 30: One of the most anticipated bitcoin mining/HPC acquisitions of the year finally has a shareholder vote date, but one of the largest investors is urging others to vote no on the deal. Core Scientific (NASDAQ: CORZ) will hold a vote for CoreWeave’s (NASDAQ: CRWV) all-stock proposed merger on October 30. TwoSeas Capital, Core Scientific’s largest active shareholder at 6.2%, is pressing other investors to vote no on the proposal.

- BlackRock’s IBIT BTC ETF enters top 20 ETFs by AUM: Last week, BlackRock’s IBIT (NASDAQ: IBIT) BTC ETF entered the top 20 U.S. ETFs by assets under management after crossing $61.376 billion in BTC. BlackRock saw its largest daily inflow into its BTC ETF on September 10, bringing in $75.8 million.

Interesting Reads and Videos

- ICE raids bitcoin mine in Pyote, Texas

- Bullish launches Bitcoin options with top-tier crypto institutions

- Miner Weekly: Asia Investors the New Bagholders in Bitcoin Mining?

- The End of Fed Control? Bitcoin & Macro Outlook | Checkmate, Joe Carlasare, Matthew Pines

Bitcoin Treasury Company News and Updates

- Tether adds 8,888 Bitcoin to its treasury, now holds 86,335 BTC: Tether has added 8,888 BTC to its balance sheet, bringing its total BTC holdings to 86,335. This trove makes Tether’s treasury the second largest of known corporate treasuries behind Strategy's. The largest stablecoin issuer is currently raising $15-20 billion at a $500 billion valuation, a price tag that makes it one of the most valuable private companies next to OpenAI and SpaceX.

- Robinhood lists Strategy’s STRC, marking the broker’s first ever preferred stock listing: RobinHood (NASDAQ: HOOD) has launched trading for Strategy’s (NASDAQ: MSTR) STRC (NASDAQ: STRC) preferred stock, marking the investment platform’s first foray into preferred equities. Strategy recently raised the dividend on its STRC stock to 10.25%, and the company also revealed a 196 BTC purchase for $22 million last week.

- Metaplanet purchases $620 million in BTC: The Japanese Microstrategy, Metaplanet (OTC: MTPLF), recently made a mammoth 5,288 BTC buy for $616 million, a purchase that slingshot the company into the spot for the fourth largest corporate BTC treasury at 30,823 BTC.

Market Overview

- Stocks trudge upward: U.S. equities inched slightly higher last week, with the S&P 500 hitting a new all-time high.

- S&P 500: 6,715.79 (+1.1%)

- Nasdaq: 22,780.51 (+1.35%)

- Dow: 46,758.28 (+1.1%)

- Russell 2000: 2,476.18 (+1.4%)

- Disagreement over budget grinds government to a halt: The U.S. government shut down on October 1 after Congress couldn’t come to an agreement on the federal budget. Among other disagreements over cuts, Democrats have pushed back on proposed cuts to healthcare and Affordable Care Act subsidies and tax incentives. Some 803,000 government employees may be furloughed as a result of the shutdown, the first since December 2018.

- ADP September employment reveals job slide: With government economic data embargoed during the shutdown, the ADP’s report for September is the one of the few guidepost investors have right now for the job market’s health. ADP reports 32,000 job losses in September, versus a revision to 3,000 job losses in August from the originally reported 54,000 jobs added during the month. Wage growth for existing employees increased 4.5% YoY, while new job wage growth slowed to 6.6% YoY from 7.1% in August.

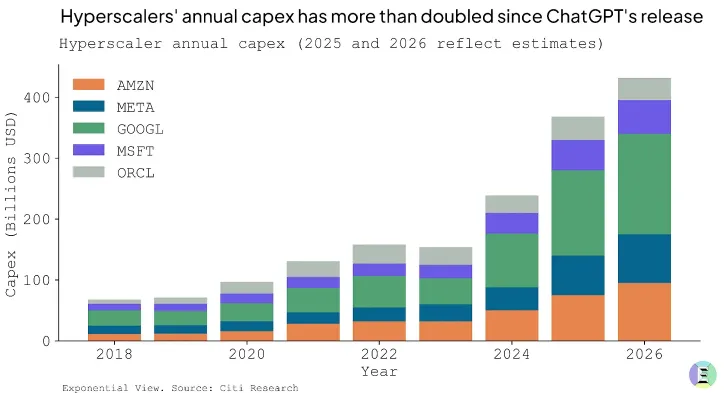

- Data center CAPEX spend from big 5 could top $400B in 2026: According to estimates from Citi Research, CAPEX datacenter spend from Amazon, META, Google, Microsoft, and Oracle alone could hit $320 billion in 2025 and $400 billion in 2026, up from $80 billion in 2018.

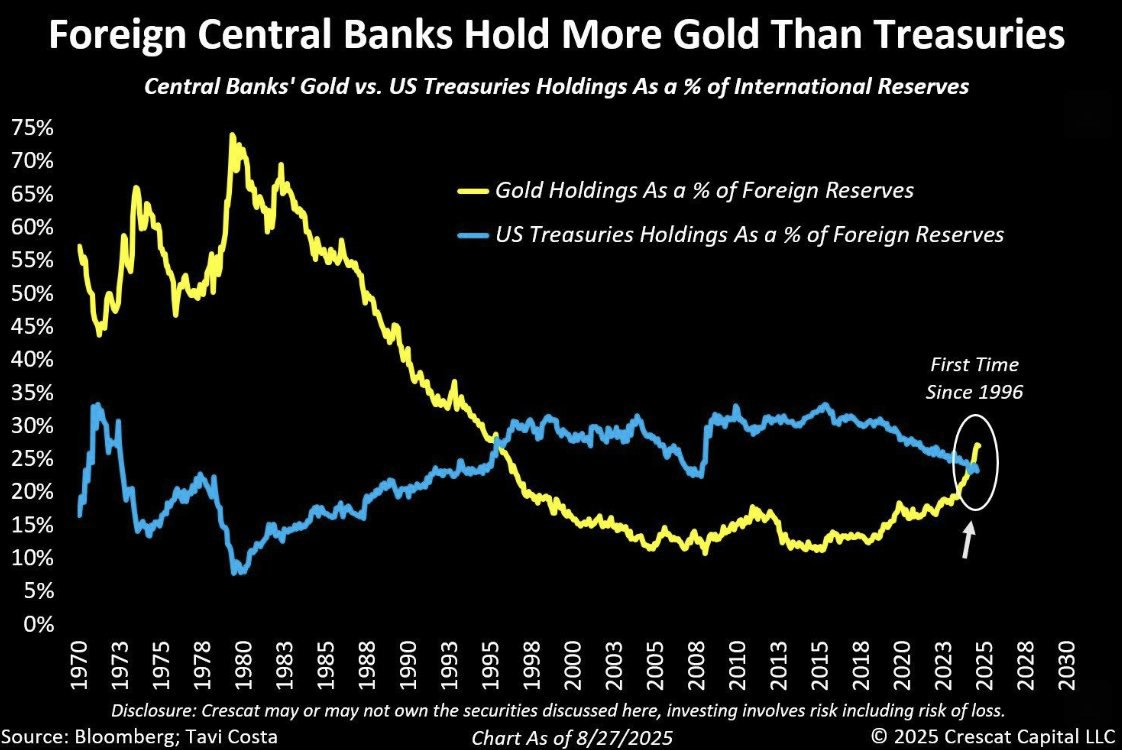

- Foreign banks hold more gold than treasuries for the first time since 1996: Central banks have been hoovering up gold at a record clip, and now foreign central banks hold more gold than U.S. Treasuries as a share of reserves for the first time since 1996. Gold holdings as a percentage of foreign reserves recently crossed 30%, leaping over U.S. treasuries as a percent of foreign reserves. With the U.S. government $35 trillion in debt, central banks have been tapering U.S. treasury holdings in recent years, particularly in response to sanctions freezing Russian-held U.S. Treasuries in 2022 after the outbreak of war in Ukraine.

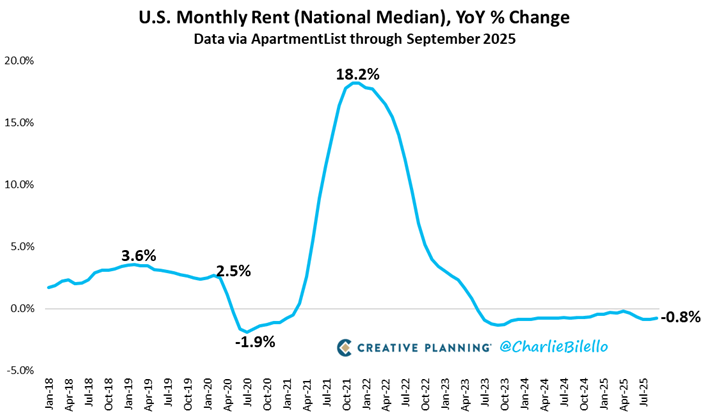

- Renting prices down for 28th consecutive YoY decline: Per ApartmentList data cited by Charlie Bilello, rental prices have fallen for 28 consecutive months in the U.S., with renting costs falling 0.8% YoY in September. Renting a home is currently cheaper than buying in all of the 50 largest metropolitan areas in the U.S. The national median rent is $2,050/month, versus ~$3,000/month for a median mortgage.

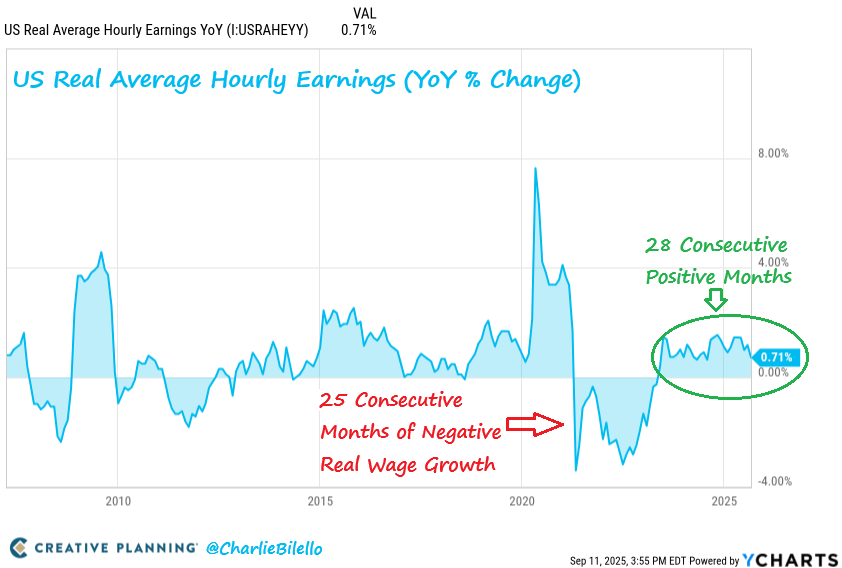

- Wage growth rises for 28th month in a row in September: In the hangover of COVID, the United States saw a record 25 straight months of negative real wage growth, but that trend has now flipped. Per Charlie Bilello, wage growth has outpaced inflation for 28 consecutive months as CPI moderates to 2.5-2.5% and wages grow 4-5% YoY.

- Oil slides: Oil price slipped last week following mostly positive price action in September.

- WTI Crude: $61.38/bbl (-5.1% WoW)

- Brent Crude: $65.42/bbl (-4.9% WoW)

- Gold jumps to another record high: Gold rose 3.2% last week, rising to as high as $3,945/oz. Gold has been on a tear this year as central banks hoard the precious metals and investors play the dollar debasement trade.

The week ahead in data*:

- University of Michigan Index of Consumer Sentiment (Friday)

*Government releases omitted due to the government shutdown.

Thank you for reading, and please feel free to reach out with any questions.