CCM Blockchain Newsletter (October 7, 2024)

Bitcoin ETFs have seen more than $35 billion in inflows in 2024.

Hi all – Please see this week’s market update attached at the bottom of this post.

Macro Market Update

Market Overview:

- Equity markets US markets last week traded mostly sideways until Friday where they posted a modest rally to end the week slightly in positive territory. The S&P 500 and the Dow ended the week modestly above record highs they set the previous week. The NASDAQ ended the week 2.7% below the record high it posted three months ago.

- Jobs: The jobs report came in at a surprise last week, generating 254k new jobs in September, above expectations of 140k jobs; it was the strongest result in six months. Yet again, July and August jobs were revised upward by a total of 72k jobs. The unemployment rate registered at 4.1% vs. 4.2% in August.

- Energy:

- Oil: Priced jumped 9% to end the week at ~$75 per barrel on Friday as geopolitical tensions increase in the Middle East. While prices have risen, we are still below the recent high of $83 in early July.

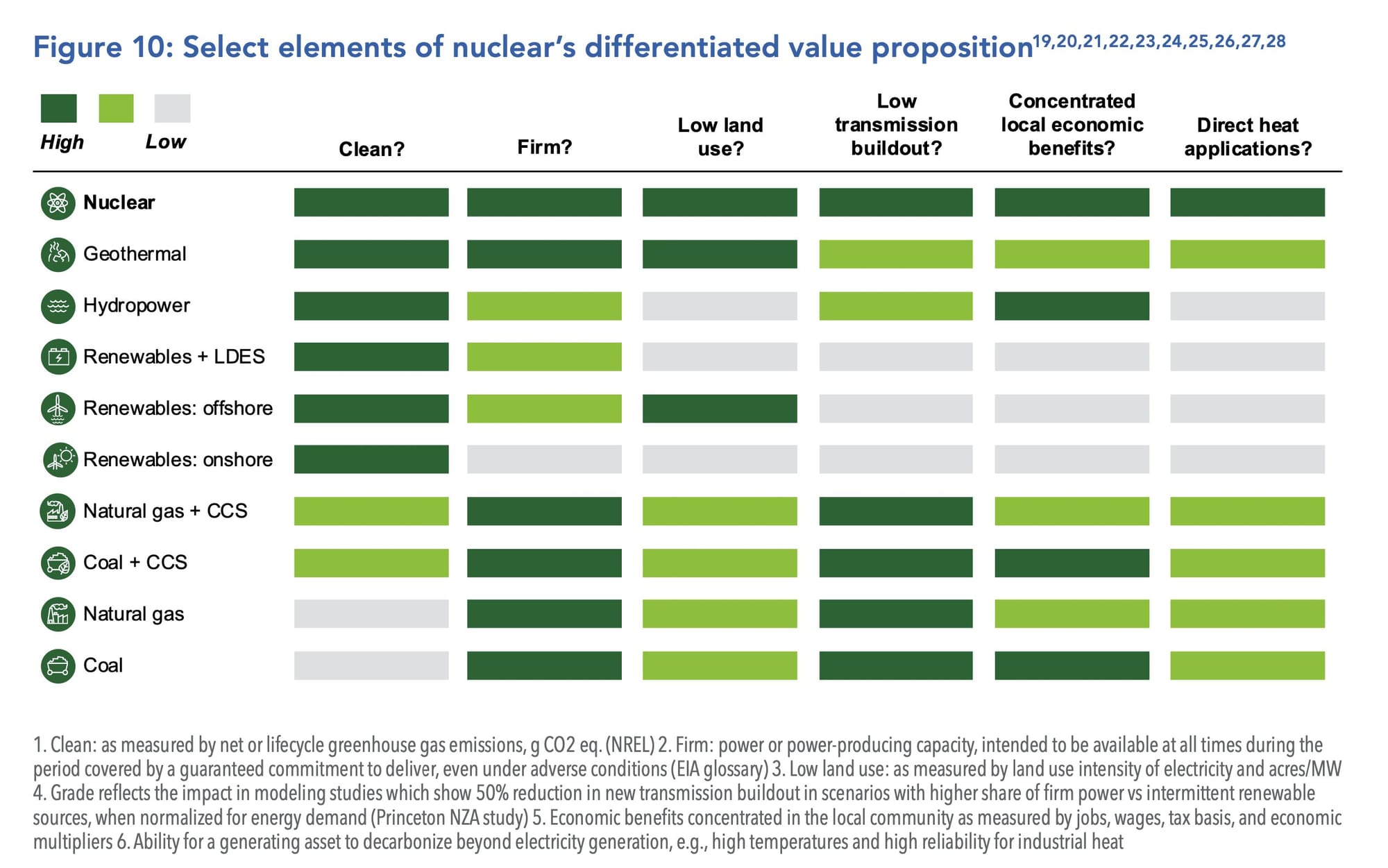

- Nuclear Having its Moment: It seems like everyday there’s a new headline of governments around the world exploring or investing in the rehabilitation of their nuclear power industries

- There’s an incredible surge in demand for clean, uninterruptable baseload energy to support the growth prospects for the unprecedented growth and forecasts for AI and HPC data centers

- The US department of energy is investing $3.4 billion into boosting domestic uranium mining, conversion and enrichment capability to support expansion of US nuclear fuel supply

- Microsoft and Constellation energy last month signed a deal to resurrect a unit of the Three Mile Island nuclear plant in Pennsylvania

What to Look Out for This Week

- CPI on Thursday

- Weekly Unemployment on Thursday

- PPI on Friday

Bitcoin Market Update

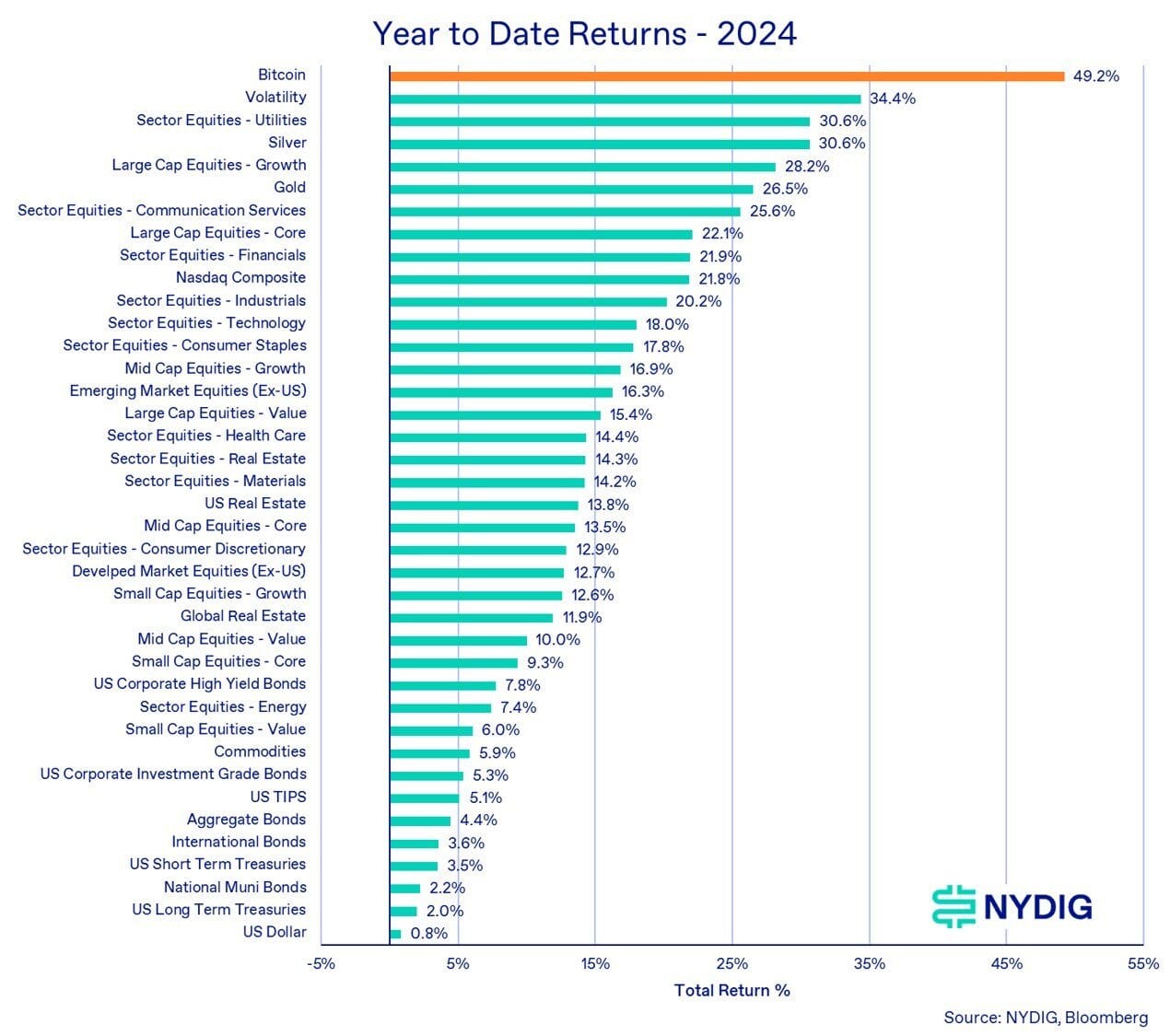

- We continue to pound the pavement that weak money environments drive investors to seek preservation of capital in more scarce asset classes

- 2024 has seen investors pile capital into hard commodities such as bitcoin, gold, and silver; and into sector themes such as energy and tech, driven by AI demand

- I predict that in the near future, you’ll begin to see nuclear / uranium equities show up on charts like the one below

- Of the 525 ETFs launched in 2024, 13 of the top 25 are crypto ETFs, most of the bitcoin ETFs