CCM Blockchain Newsletter (September 23, 2024)

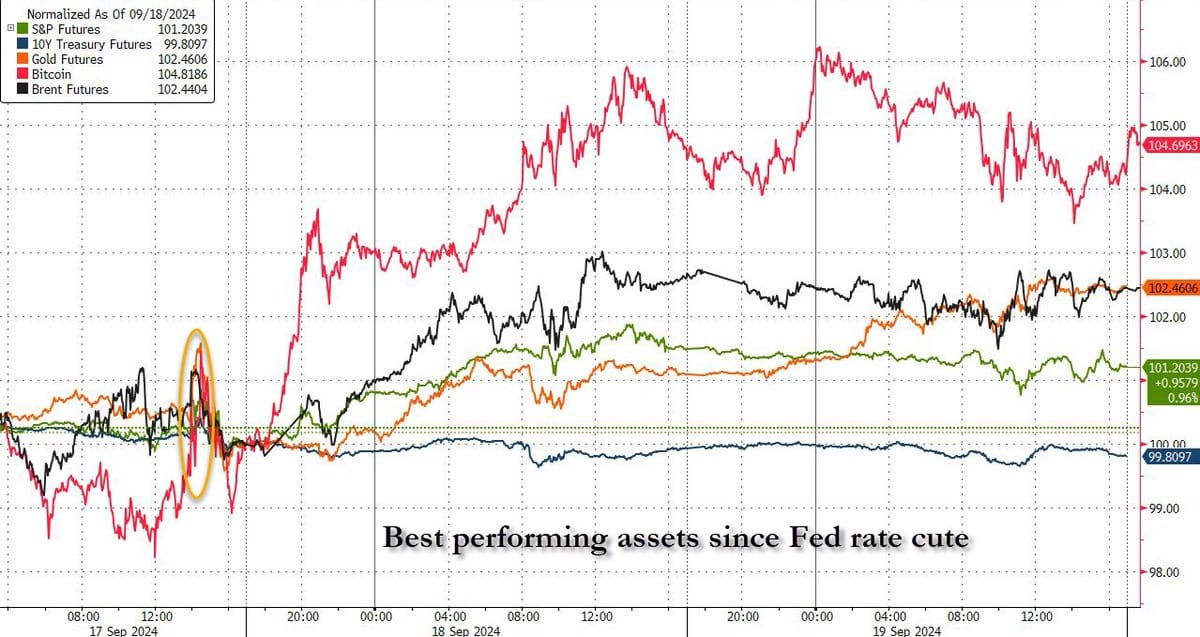

Bitcoin is the best performing asset since the Federal Reserve's September rate cut.

Hi all – Bitcoin has been the best performing asset since the Fed’s 50 bps rate cut decision, the first cut in four years. Whether the Fed can guide us towards a soft landing will be seen but we can be confident that a new cycle of monetary easing is upon us. Let’s dive into this week’s market update below.

Macro Market Update

Market Overview

- Equity markets While Bitcoin has been the best performer, each of the major indexes gained around 1.5% for the week, with the NASDAQ nearly 4% of it’s record peak

- Fed cut and impact: As expected, the Fed cut its rate although it went for 50 bps cut instead of the expected 25 bps as much of the market had predicted

- Unsurprisingly, the markets’ movement was most pronounced post rate-cut announcement

- Yield curve normalizing the yield curve is now showing a lower probability of an economic downturn – it has un-inverted, although as discussed last week, an un-inversion could actually lead to recession. We are seeing mixed data.

- PCE inflation this week: This Friday, the monthly PCE report will be released and will show whether slowing inflation extended into August. July’s report came in at 2.6%

What to Look Out for This Week

- Chase-Shiller Home Price Index

- New home sales

- PCE

Bitcoin Market Update

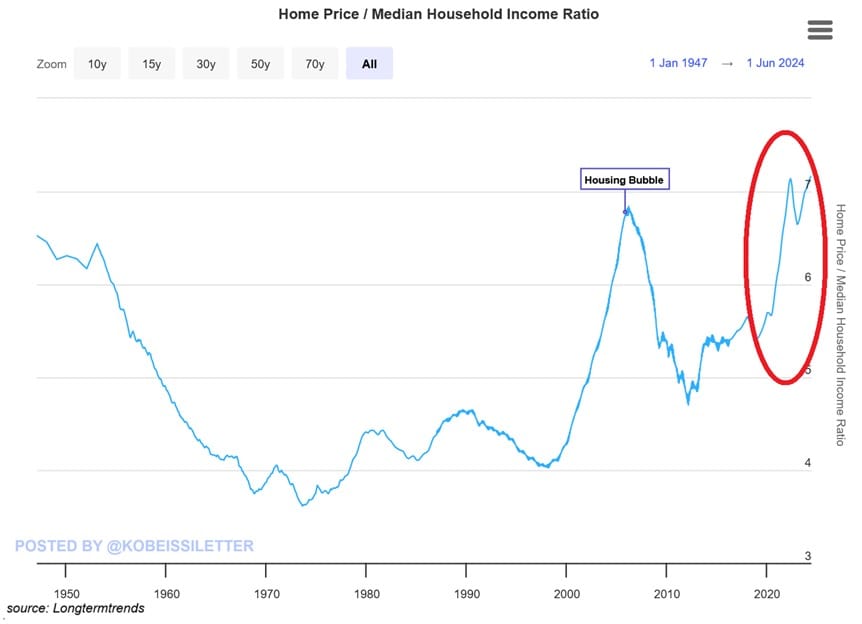

As a new cycle of monetary policy begins to set in, I started thinking about Chapter 17 in Lyn Alden’s, Broken Money regarding the financialization of everything, particularly real estate. Here is an abridged version:

- When money in a society maintains its value over time, there is an incentive to hold you wealth it in as savers will be more cautious with spending or investing

- On the other hand, when money in a society keeps losing its value (i.e., money printing / inflation), there is an incentive to hold other things that have greater scarcity thus creating a monetary premium to those things

- Weak money environments force investors into owning 2nd or 3rd homes, buy stocks, and own a large assortment of collectibles at inflated valuations

- In the absence of good money, everything else that has some degree of scarcity gets monetized instead

- This has caused home prices to income ratios to increase over time, going from 4x in 2000 to 7.2x today, a record high