CCM Blockchain Newsletter (September 23, 2025)

Bitcoin has slumped to start this week, while stocks surged to record highs last week.

Happy Tuesday everyone, and welcome back to this week’s market newsletter. We’ve made some changes to the weekly market data download that we think you’ll enjoy. You can download it below.

Bitcoin Market Update and News

- Bitcoin flat following mid-week rally: Bitcoin rose to as high as $117,000 over the week on guarantees of a Fed rate cut, but it sold off on the news and continued to fall at the beginning of this week. At the time of publication, Bitcoin is down 3.5% WoW at $113,000

- Bitcoin’s hashrate crosses 1 ZH/s: Per data from Luxor’s Hashrate Index, Bitcoin’s hashrate first crossed the 1 zettahash per second mark (ZH/s) on September 10 on the 7-day average. But last week, Bitcoin’s difficulty rose 4.63% to 142.34 trillion, crossing the 139.7 trillion difficulty threshold that officially reflects the Bitcoin network’s recognition that 1 ZH/s of Bitcoin mining hashrate is active on the network. (1 ZH/s is equal to 1,000 EH/s, which means Bitcoin miners globally produce 1 sextillion hashes per second to mine Bitcoin). At the time of writing, Bitcoin’s 7-day average hashrate is 1.08 ZH/s, just shy of the all-time high of 1.09 ZH/s the network set on September 20. As summer melts into autumn, U.S.-based Bitcoin miners are facing easier operating temperatures and are subject to less curtailment demands, so Bitcoin’s hashrate is surging accordingly. Bitcoin’s hashrate is up 15% MoM and 23% over the last three months.

- Tether to bring fully compliant stablecoin to U.S. market: At a private launch event in New York on September 12, stablecoin juggernaut Tether announced that it will launch USAT, a U.S.-only stablecoin, to bring a fully compliant stablecoin purpose built for the American market. President Trump’s former White House Crypto Council Executive Director Bo Hines will join Tether to lead USAT. With a $170.3 billion market cap, Tether’s flagship stablecoin, USDT, is the crypto market’s dominant stablecoin.

Interesting Reads and Videos

- What the oil industry’s vertical-integration, financialization can teach us about the future of hyperscalers

- Why Tether is launching USAT, its U.S.-only stablecoin

- Mike Alfred on IREN, Fintwit, and the Digital Infrastructure Thesis

- Zetahash & the Underdogs: August’s Bitcoin Mining Shakeup

Bitcoin Treasury Company News and Updates

- AgriForce Growing Systems to launch first NASDAQ-traded AVAX strategy with $550 million raise stratgey: AgriFORCE Growing Systems (NASDAQ: AGRI) is rebranding to AVAX One concurrently with ~$550 million raise to purchase Avalanche (AVAX) for an AVAX treasury strategy. The raise is comprised of a completed ~$300 million PIPE and a near term $250 million raise from equity linked instruments. AVAX One will be the first NASDAQ-listed company with a dedicated mission to provide pure-play exposure to the Avalanche ecosystem. Avalanche is a fast, institutional-grade blockchain enabling global firms like KKR and J.P. Morgan to build compliant networks for tokenizing real-world assets. Secured by $6.2B in staked assets, it serves as a foundational layer for the future of finance. The Company’s strategic advisory board will be led by Anthony Scaramucci, Founder of SkyBridge Capital, and Brett Tejpaul, Head of Coinbase Institutional, as well as other leaders in the finance industry that will be revealed shortly. The capital raise is led by Hivemind Capital, with participation from over 50 institutional and crypto-native investors including ParaFi, Galaxy Digital, Digital Currency Group, Kraken, Cypher Capital, FalconX and others. Cohen & Company Capital Markets, a division of Cohen & Company Securities, LLC, served as exclusive financial advisor to Hivemind Capital and exclusive placement agent to the Company.

- Metaplanet launches U.S. subsidiary, seeks $1.4 billion raise: Metaplanet (TYO: 3350; OTCQX: MTPLF) has created Metaplanet Income Corp. to establish a presence in the U.S. The subsidiary will be based in Miami and will focus on derivatives-trading income strategy for Metaplanet with an initial $15 million earmarked. Metaplanet also recently upsized an international equity offering to ¥212.9 billion ($1.44 billion).

- Strategy hit pause on its MSTR ATM: Strategy (NASDAQ: MSTR), the OG Bitcoin treasury company originally known as Microstrategy, paused its $21 billion at-the-market offering on the trading week of September 8-12, reporting no sales for the period. As of the pause, Strategy had sold $16.11 billion of the outstanding offering.

- Strategy purchases 525 BTC: Strategy also purchased 525 BTC last week for roughly $60 million, bringing its total Bitcoin treasury to 638,985 BTC (~$73.67 billion).

- Cathie Wood, UAE investors pour $300 million into Football club crypto treasury play: Ark Invest’s Cathie Wood and a group of investors from the United Arab Emirates (UAE) have poured $300 million into Brera Holdings (NASDAQ: BREA), an Irish European football club operator that owns stakes in clubs in Italy, Mongolia, Mozambique, and North Macedonia. The company said last week that it plans to build a Solana (SOL) treasury. As of the weekend, Brera was up 158% over the last month but fell 33% after a post-news surge.

- Ether Machines raises $654 million ahead of Nasdaq listing: Ethereum treasury company Ether Machine raised $654 million in private financing, which included a 150,000 ETH investment, ahead of its planned NASDAQ debut via the SPAC Dynamix Corporation (NASDAQ: DYNX). The company holds ~495,362 ETH and $367.1M in cash, earmarked for future ETH buys.

- Corporations scoop up 47,718 BTC in August, down from July by half: Per CoinDesk, in August, known companies purchased 47,718 BTC for $5.2 billion. The haul is roughly half what these corporations accumulated in July. At the end of August, public companies, known private companies, governments, and ETFs held 3.68 million BTC worth ~$423 billion, with public companies alone holding just over 1 million BTC.

Market Overview

- Stocks continue to climb as high and small caps hit record highs: U.S. equities rose across the board last week, with all of the major indices, including the small cap Russell 2000, setting all-time highs.

- S&P 500: 6,664.36 (+1.2%)

- Nasdaq: 22,631.48 (+2.2%)

- Dow: 46,315.27 (+1.0%)

- Russell 2000: 2,448.77 (+2.2%)

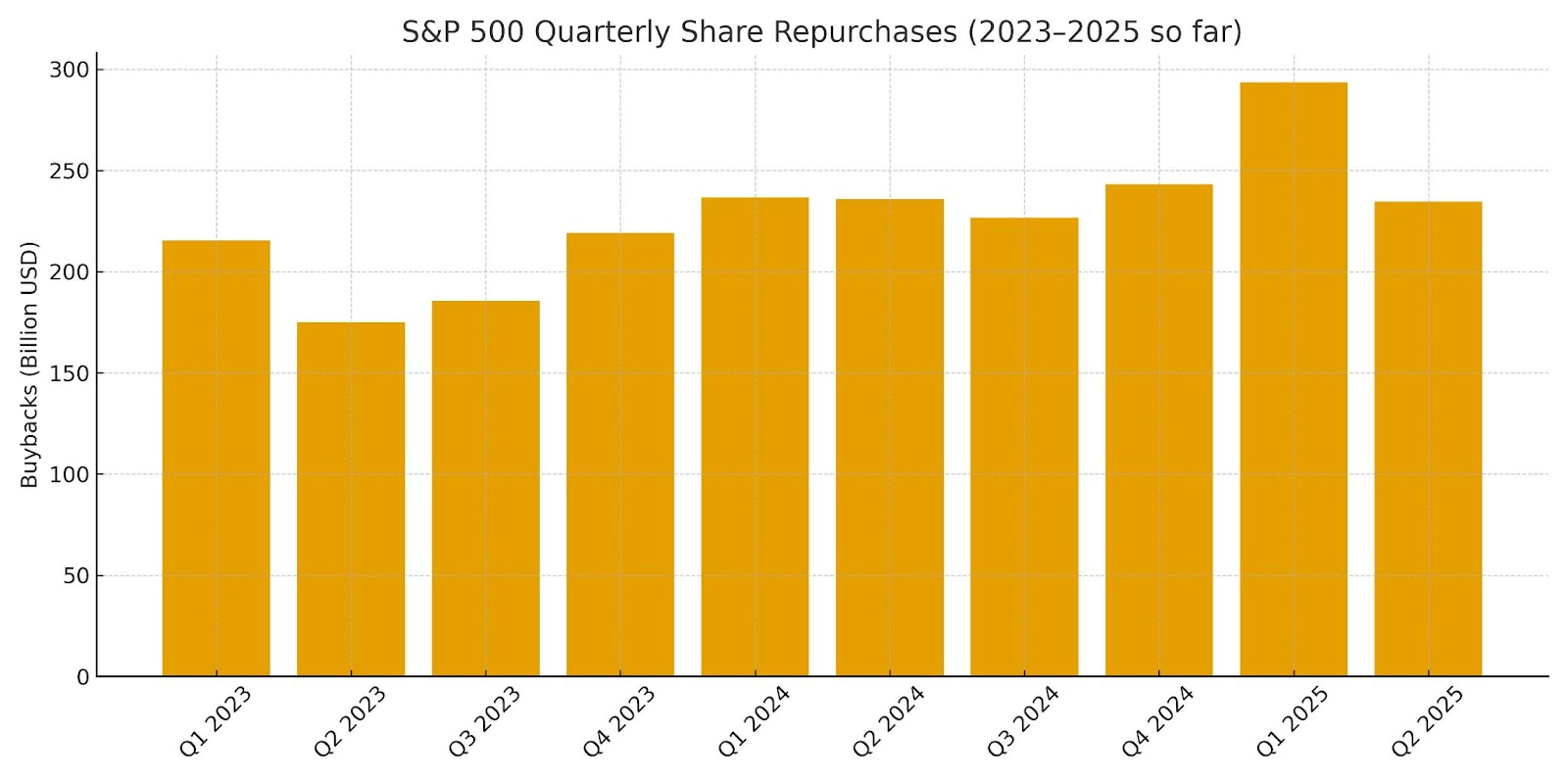

- Stock buybacks slowed in Q2: S&P 500 companies spent substantially less on stock repurchases in Q2 than in Q1. Companies bought $234.6 billion of their own shares in Q2, a 20% haircut from Q1 and a fractional decrease from Q2-2024. That said, the 12-month rolling total for stock buybacks ($997.8 billion) is still up over the prior 12-month period. As the data suggests, companies are tightening up their cash positions, with leadership citing tariff and economic uncertainty and cash flow concerns among others for the slowdown in share repurchases last quarter.

- Federal Reserve votes 11-1 to cut rates by 25 bps: The Federal Reserve met for its September 17 policy meeting last week, with 11 out of 12 FOMC members voting to lower the federal funds rate by 0.25% to 4.00-4.25%, the first rate cut since December 2024. The CME’s FedWatch tool has the market pricing in a 91.9% probability of another 25 bps cut in October and a 80.5% probability of yet another 25 bps reduction in December.

- Housing starts down in August: The U.S. Census Bureau reported that housing starts were down 8.5% MoM in August to 1,307,000 units, a 6% decrease YoY. Both single family and multi-family dwelling starts decreased last month, and building permits decreased 3.7% MoM and 11% YoY to 1,312,000.

- Housing Market Index’s September read unchanged from August: The National Association of Home Builders released September’s housing market sentiment index last week. The 32 reading (with anything above 50 signaling strength and anything under 50 weakness) for September is steady from last month, but the weak number reflects waning builder confidence. The index placed current sales conditions at 34 and sales expectations for the next six months at 45, a 2 point increase for the highest reading since March. Meanwhile, builders' expectations for prospective buyers fell by one point to 21, and 39% reported cutting prices in September to spur demand, up from 37% in August and the highest since in the post-COVID era. The national average home price reduction in August came in at 5%, in line with recent months in 2025. The Northeast and Midwest, while still weak relative to the index’s 50 benchmark, currently have stronger markets than the South and West:

- Northeast: 44 (0%)

- Midwest: 42 (+1%)

- South: 29 (0%)

- West: 26 (+1%)

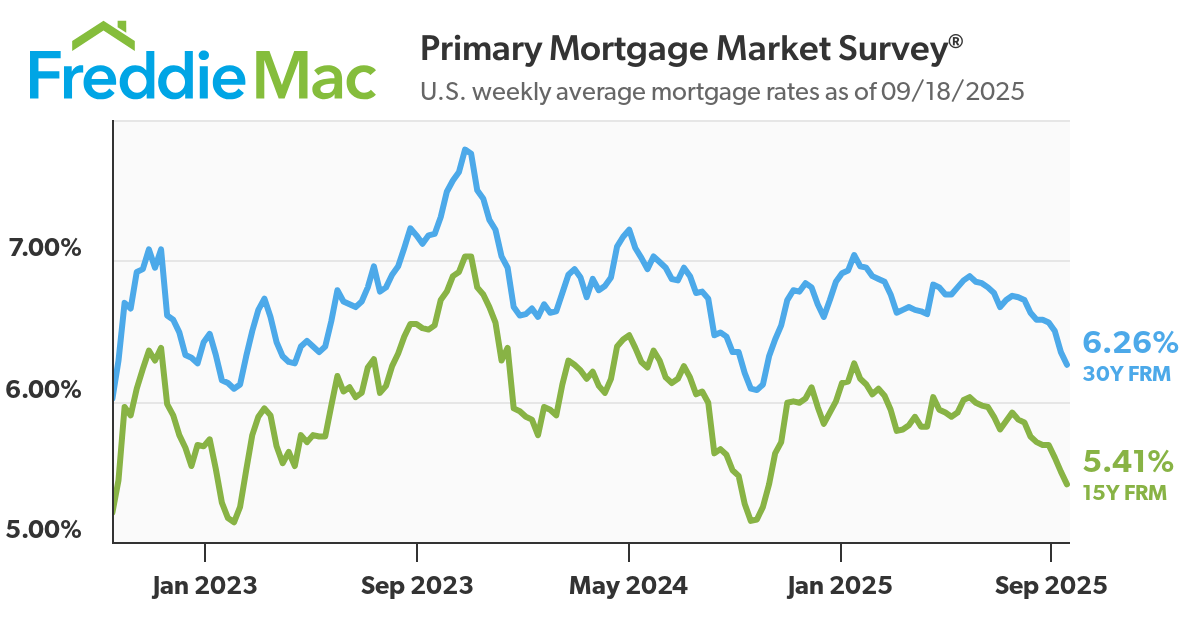

- Interest rates slip lower on easing Fed policy: 30-year and 15-year mortgage rates in the U.S. dropped last week after the Fed slashed rates. The average 30-year rate fell 9 bps last week to 6.26%, according to Freddie Mac, with 15-year rates falling 9 bps as well to 5.41%. In January of this year, 30-year and 15-year mortgages were 7.04% and 6.27% on average, and in October of 2023 they were as elevated as 7.79% and 7.03%, the highest rates in over two decades.

- Full imports rise modestly in August, remain flat YoY: The U.S. Bureau of Labor Statistics reported that import prices rose a modest 0.3% MoM in August following an even more modest 0.2% bump in July, but prices were essentially flat YoY. Fuel imports fell 0.8% on weak oil and gas demand, while non-fuel imports rose 0.4% after being flat in July, the largest increase since April 2024. Consumer goods excluding auto, capital goods, and nonfuel industrial supplies / materials all increased notably, while food, feed, and drink declined 2.1%. Meanwhile, export prices rose 0.3% to match imports, the same level as July, and YoY export prices were up 3.4% in August, the strongest showing since December 2022. Nonagricultural exports such as consumer and capital goods drove the increase as agricultural exports were flat last month.

- Industrial production inches upward in August: Per the Federal Reserve, the U.S.’s total industrial production capacity rose modestly by 0.1% in August, up 0.9% YoY. Mining output led the increase with a steep 0.9% rise last month that reversed July’s contraction, while utilities dropped 2% and electric utilities fell 2.3%, offset somewhat by a small gain in natural gas utilities. Capacity utilization ticked up 0.1% to 76.8%, mining utilization increased to 90.6%, and utilities utilization fell to 68.6%.

- Total retail sales increases in August: According to the U.S. Census Bureau, total retail and food services sales in July were $732 billion, up 0.6% from July and 5% YoY, and the 3-month trend for sales was up by 4.5%, as well. Non-food retail trade increased 0.6% MoM and 4.8% YoY; non-store, largely ecommerce sales exploded upward by 10.1% YoY; and food services saw a 6.5% bump in sales YoY. Some sectors, like furniture and home, were flat or down on the month while auto and gasoline sales are still volatile.

- Oil prices mostly flat: Oil prices rebounded two weeks ago and mostly maintained this price level last week. The prior week’s price rise followed Ukrainian drone attacks that disrupted oil shipments out of Primorsk, Russia’s largest port, and a smaller than expected rise in output from OPEC+ to 137,000 barrels/day starting in October.

- WTI Crude: $62.68/bbl (-0.02% WoW)

- Brent Crude: $66.68/bbl (-0.5% WoW)

- Gold surges to yet another high: Gold just won’t quit. The precious metal blew higher last week to a record just above $3,735/oz. Gold is up 1% WoW and 40% YTD.

The week ahead in data:

- U.S. Census Bureau New Home Sales report (Wednesday)

- U.S. Bureau of Economic Analysis Q2 GDP third estimate (Thursday)

- U.S. Census Bureau Durable Goods Orders report (Thursday)

- National Association of Realtors Existing Homes Sales report (Thursday)

- U.S. Department of Labor weekly unemployment claims (Thursday)

- U.S. Bureau of Economic Analysis Personal Consumption Expenditures Price Index (Friday)

- University of Michigan Index of Consumer Sentiment (Friday)

Thank you for reading, and please feel free to reach out with any questions.