CCM Blockchain Newsletter (September 29, 2025)

Equities and bitcoin sold off last week while gold surged to a new record high.

Happy Monday everyone, and welcome back to this week’s market newsletter. Please see below this week’s market data.

Bitcoin Market Update and News

- Bitcoin falls amid dip in equities: Bitcoin wasn’t saved from a broader market sell off last week, falling from $114,00 to as low as $108,000 before recovering over the weekend. At the time of writing, bitcoin is up 1.4% WoW to $114,000.

- Morgan Stanley to launch crypto allocation strategy: Morgan Stanley will soon offer cryptocurrency investing for its clients, recommending a few percentage point allocation depending on the portfolio. Morgan Stanley plans to launch crypto trading on E*Trade in partnership with rehash starting in the first half of 2026.

- FTX Trust sues one of the largest private bitcoin miners in the world over Alameda investment: The FTX Recovery Trust is suing Genesis Digital Assets (GDA), one of the largest private miners in the world and in which FTX’s sister company, Alameda Research, invested. The trust is seeking to claw back some $1.15 billion in investments Sam Bank-Fried’s Alameda made in GDA, saying that the funds were mingled from the FTX exchange. “If the spiking cost of energy, crippling regulations, and lack of interest from other investors were not enough, the diligence process again raised a number of red flags, all of which Bankman-Fried did not take into account when he purchased GDA shares at an even more excessive overvaluation,” court documents read. “Worse still, over half of the funds invested went directly to Makhat and Krohn personally, allowing them to cash out of the failing company and conveying no benefit to GDA itself.”

Interesting Reads and Videos

- Edward Dowd on the housing market

- AI’s cash burn problem

- Is Luke Dashjr planning a Bitcoin hard fork?

- Miner Weekly: Bitcoin Mining Profitability Hits Chill Zone as Hashprice Set for Five-Month Low

Bitcoin Treasury Company News and Updates

- Strive to acquire Semler Scientific at 210% premium, adds 5,816 Bitcoin: Strive Asset Management (NASDAQ: ASST) has entered into an agreement to acquire Semler Scientific (NASDAQ: SMLR) in an all-stock deal valued at $675 million. The deal priced in a 210% premium for Semler’s stock at the time of announcement. Strive also announced that it purchased 5,816 BTC (~$652 million) last week for its treasury.

- Strategy logs its 80th Bitcoin purchase, adds 850 BTC after tapping STRF and MSTR ATM: Strategy (NASDAQ: MSTR) broadcasted its 80th Bitcoin buy last Monday, a 850 BTC purchase for nearly $100 million that raises its total bitcoin treasury to 639,835 BTC valued at over $71.7 billion. The week before last, Strategy raised $100 million from ATMs for its STRF preferred and MSTR common stocks.

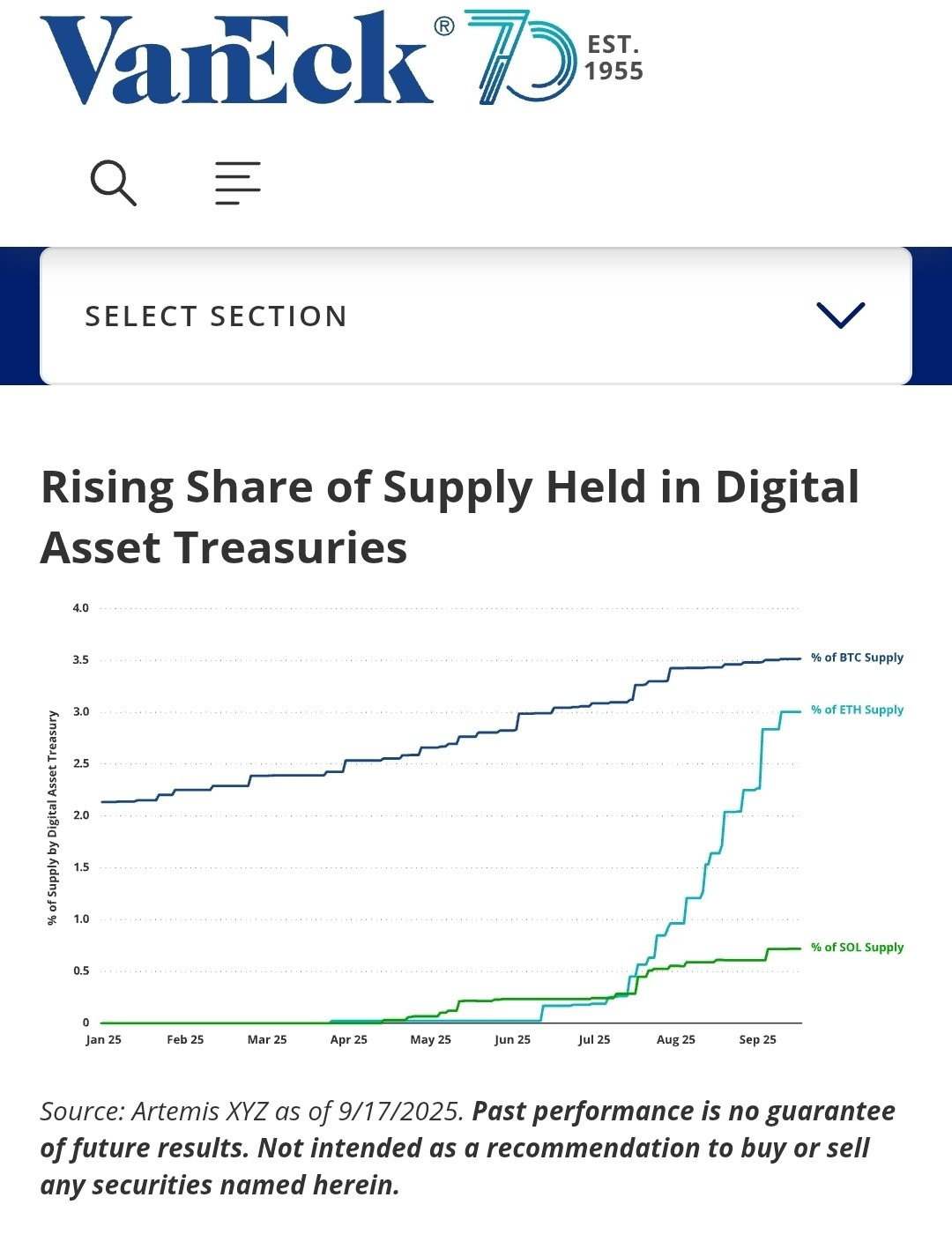

- ETH treasury companies are catching up to Bitcoin: Crypto’s number 2 asset, Ethereum, is starting to catch up to King Bitcoin in the crypto treasury race. According to VanEck, known corporate treasuries hold nearly 3.5% of Bitcoin’s total supply, versus 3% for Ethereum. In June, the amount of Ethereum’s total supply held in corporate treasuries was ~0.1%.

Market Overview

- Stocks slip following record high week: U.S. equities fell slightly last week after multiple indices set all-time highs in the prior period.

- S&P 500: 6,643.70 (-0.3%)

- Nasdaq: 22,484.07 (-0.7%)

- Dow: 46,247.29 (-0.1%)

- Russell 2000: 2,434.32 (-0.6%)

- Q2 2025 GDP up on 3rd estimate as imports decrease: On its third read, the U.S. Bureau of Economic Analysis’ revised its Q2 2025 GDP estimate up by 0.5% to 3.8%, with GDP positive in 48 out of 50 states save Arkansas and North Dakota. Consumer spending largely created the GDP bump (retail sales increased by 1% to 2.9% from the last read), as did a reduction in imports. The private-goods producing industry grew by 10.2% in Q2 versus 3.5% for the private services-producing industry, while the government sector declined by 3.2%.

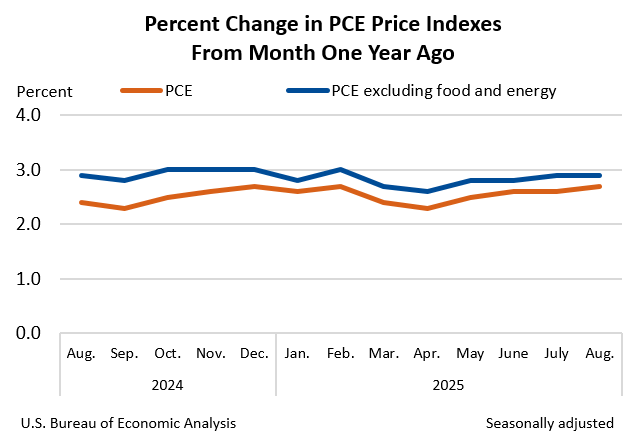

- PCE up again in August: The Federal Reserve's favorite inflation gauge ticked higher in August. The Bureau of Economic Analysis' Core Personal Consumption (PCE) Index rose a slight 0.2% in August and 2.9% YoY, while headline PCE rose 2.7% YoY. Personal income rose 0.4% in August, as did disposable personal income.

- New home sales surprise in August for hottest month in recent memory: New residential home sales popped in August, with ~800,000 sold for a 20.5% increase from July and 15.4% increase YoY. Housing inventory slid 1.4% to 490,000 with 7.4 months supply, a 17.8% decline from July’s 9 month supply and below August 2024’s 8.2 months supply. The median sales price in July was $413,500 (4.7% MoM and 1.9% YoY).

- Existing home sales down fractionally in August: Conversely to new home sales, existing residential sales fell 0.2% in August from July to 4 million, which is still up 1.8% YoY. August’s inventory for existing homes also came in -1.3% from July, a 4.6 months supply that is unchanged from July and up from 4.2 a year ago. Single family homes fell 0.3% MoM (+1.9% YoY) with a median price of $427,800 (+1.9% YoY). The northeast region was hit the hardest, down 4% MoM and 2% YoY with a median home price of $534,000 (+6.2% YoY); in the South, sales fell 1.1% MoM but were up 3.4% YoY with a median price of $364,100. The Midwest and the West fared better, with the Midwest seeing a 2.1% bump in sales MoM and 3.2% YoY with houses priced at $330,500, and the West saw a 1.4% MoM rise in sales (down 1.4% YoY) with the media price at $624,300.

- Value of U.S. housing market tops $55 trillion: Per Zillow, the total value of all homes in the U.S. is roughly $55.1 trillion, up $20 trillion since 2020 (with new construction accounting for $2.5 trillion) and $862 billion YoY. The total value of real estate in California (+$3.4 trillion), Florida (+$1.6 trillion), New York (+$1.5 trillion), and Texas (+$1.2 trillion) are all up since 2020, while Florida (−$109 billion), California (−$106 billion), and Texas (−$32 billion) have all also lost the most in home values over the last year. Zillow says that 9 metro areas account for 31.9% of the nation’s total housing wealth: New York ($4.6 trillion), Los Angeles ($3.9 trillion), San Francisco ($1.9 trillion), Boston ($1.3 trillion), Washington, D.C. ($1.3 trillion), Miami ($1.2 trillion), Chicago ($1.2 trillion), Seattle ($1.1 trillion), and San Diego ($1.0 trillion).

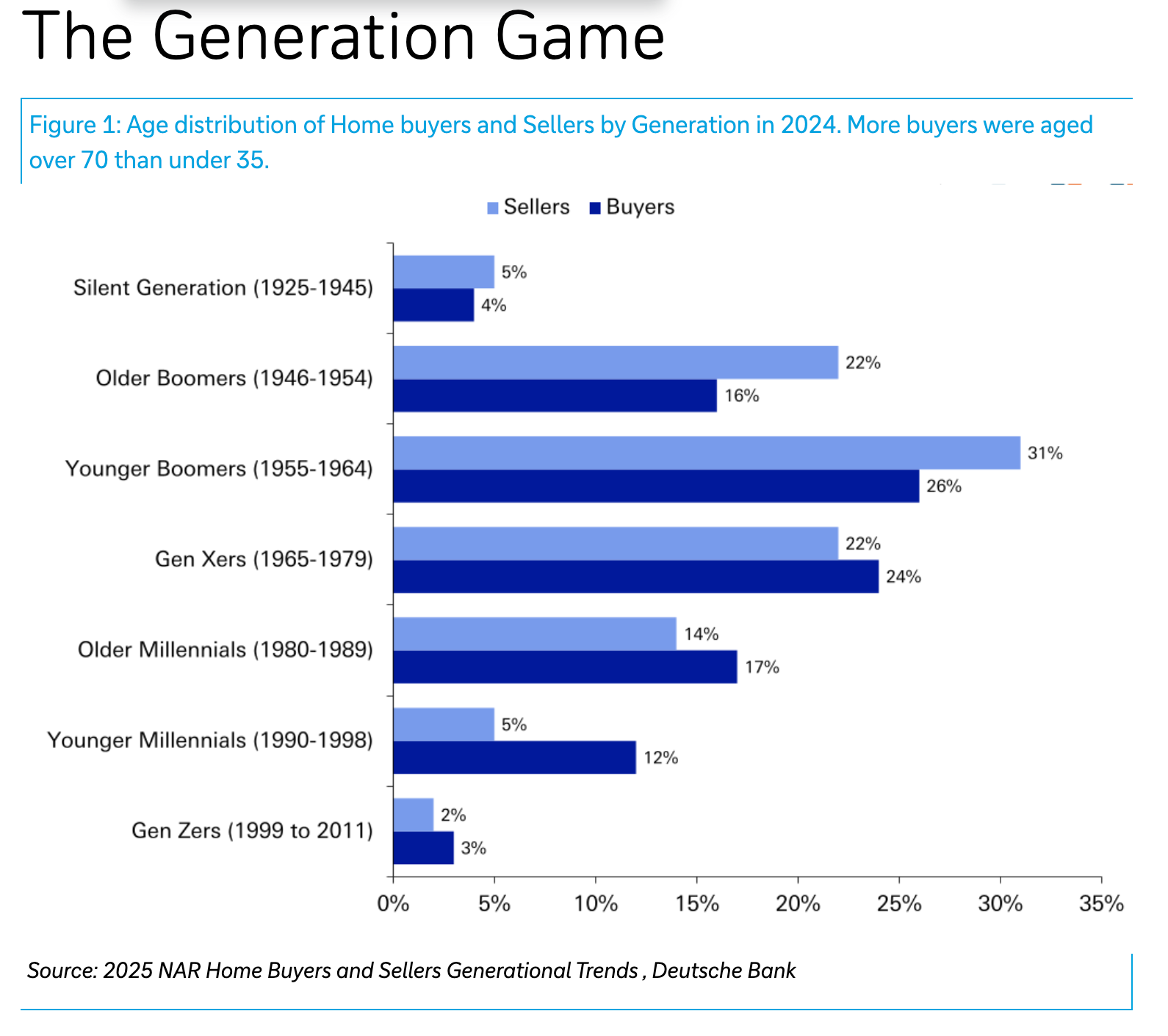

- 46% of home sales in 2024 to buyers aged 60+: Deutsche Bank: According to a research note from Deutsche Bank, 46% of home buyers in the U.S. were 60 years or older last year, while 22% of buyers buyers were 70 and older and only 15% buyers were 35 and younger. “Over the long run, property is an asset that ultimately gets redistributed from one generation to the next. Right now, that handoff is being stalled by high interest rates and elevated home prices. At some point, either—or both—will have to adjust, or real wages for younger people will need to rise sharply. Eventually, the younger generation will own the homes currently held by the older generation. We just don’t yet know what the price will be,” the note reads.

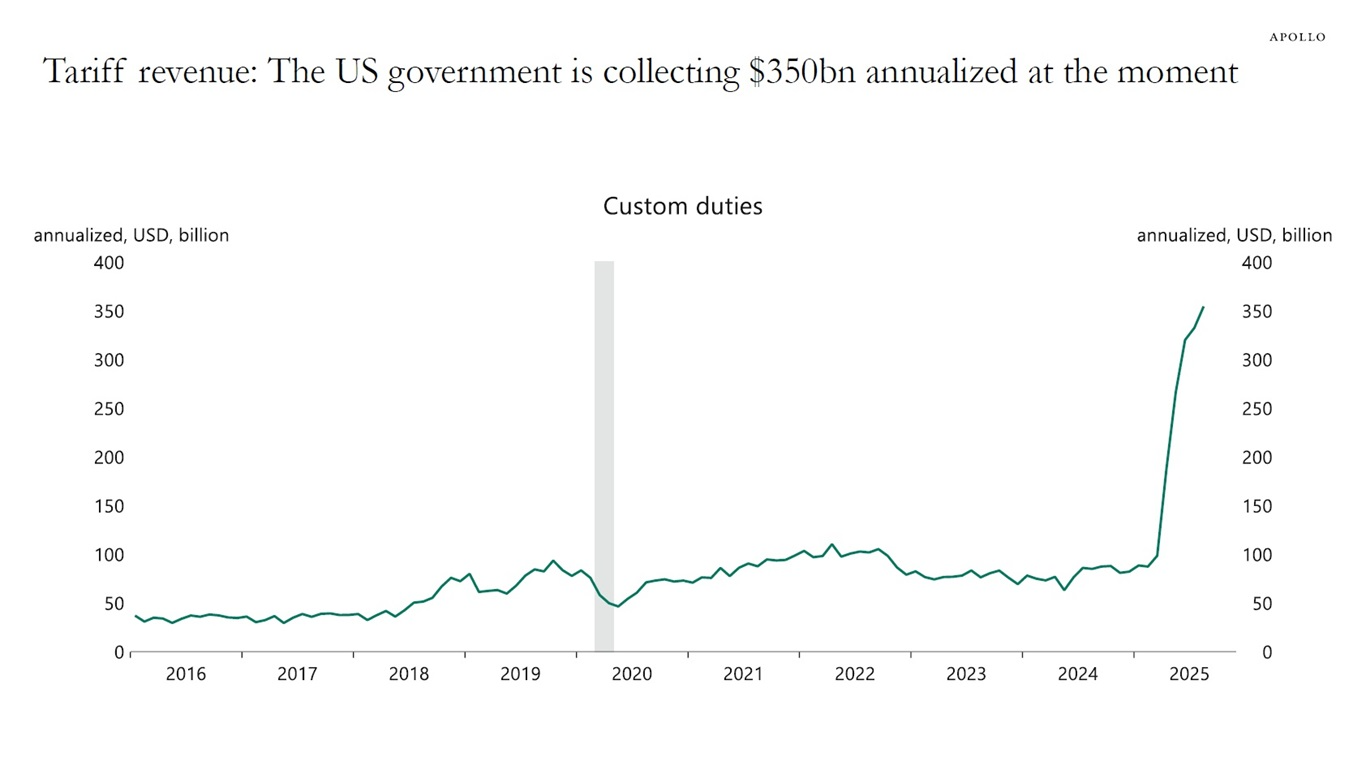

- U.S. tariff income hits $350 billion ARR: According to research from Apollo Sløk, the United States government is on track to haul in $350 billion in revenue for the year from tariffs. If it holds, this would represent roughly 18% of annual household income tax payments.

- Consumer Sentiment droops yet again in September: The University of Michigan’s Index of Consumer Sentiment fell to 55.1 in September, down from 58.2 in August and a drop of ~5.3% month-over-month. The current economic condition subinex also fell 2.% to 60.4 , while the subindex for consumer expectations fell a steeper 7.5% to 51.7. The respondents’ near-ahead inflation expectations sat at ~ 4.7% (slightly down from 4.8% last month), while long-term inflation expectations rose to 3.7% for the second month in a row.

- Gold is knocking on the door of $4,000: Gold surged to yet another record high above $3,800 last week, making gold up 10% on the month and 43% YTD / YoY.

The week ahead in data:

- National Association of Realtors Pending Home Sales report (Monday)

- U.S. Bureau of Labor Statistics Job Openings and Labor Turnover Survey (Tuesday)

- S&P Cotality Case-Shiller 20-City Composite Home Price Index (Tuesday)

- The Conference Board Consumer Confidence Index (Tuesday)

- ADP National Employment Report (Wednesday)

- U.S. Census Bureau construction spending report (Wednesday)

- Institute for Supply Management manufacturer’s index (Wednesday)

- U.S. Census Bureau Factory Orders report (Thursday)

- U.S. Department of Labor weekly unemployment claims (Thursday)

- U.S. Bureau of Labor Statistics jobs and employment report (Friday)

- Institute for Supply Management manufacturing index (Friday)

Thank you for reading, and please feel free to reach out with any questions.