CCM Blockchain Newsletter (September 2, 2025)

Equities sold off last week after the S&P 500 crossed 6,500 for the first time.

Happy Tuesday everyone, and welcome back to this week’s market newsletter. Hope everyone had a restful Labor Day weekend. Please see below this week’s market data.

Bitcoin Market Update and News

- Bitcoin extends losses following Jackson Hole selloff: Bitcoin continued to decline last week, starting at ~$112,000 and falling below $110,000 to finish and dipping as low as $107,300 over the long weekend. At the time of writing, Bitcoin is down -1% WoW to $110,900.

- US Senate eyes end of September for crypto market structure bill markup: According to Blockworks, the U.S. Senate will have a markup hearing for the Responsible Financial Innovations Act of 2025 in late September. The legislation will be some combination of a bill of the same name drafted by Tim Scott, Cynthia Lummis, Bill Hagerty, and Bernie Moreno and the CLARITY Act that passed in the U.S. House in July. At 35 pages, the current draft of The Responsible Financial Innovations Act is much slimmer than the CLARITY's 250. It particularly takes a look at how the SEC distinguishes investment contracts from everything else and presents a 5-part question alternative to the Howey Test’s 4-parts.

Interesting Reads and Videos

- Bitcoin transaction fees are in free fall. This report explains why

- Driving US Treasury Demand Through Pro-Bitcoin Policy

- U.S. Government Starts Pushing Economic Data Onto Blockchains as 'Proof of Concept'

- Businesses Are Absorbing Bitcoin at 4x the Rate It Is Mined, According to River’s Research

Bitcoin Treasury Company News and Updates

- Strategy purchases 3,000 BTC for $356.9 million: Strategy (NASDAQ: MSTR) announced that it has added 3,081 BTC to its treasury on Monday. The OG bitcoin treasury company now holds 632,457 BTC (~$68.5 billion).

- ETHZilla opens $250 million stock buy back: Previously known as 180 Life Sciences, ETHZilla (NASDAQ: ETHZ) announced a $250 million stock buy back last Monday. The company holds 102,237 ETH ($441 million) purchased for an average price of $3,948.

- Metaplanet buys $11.7 million in bitcoin: Japanese hotel company Metaplanet (OTC: MTPLF) has purchased 103 BTC for $11.7 million. The company now holds 18,991 BTC (~$2.1 billion).

- Nakamoto (KindlyMD) opens $5 billion ATM: KindlyMD (NASDAQ: NAKA), also known as Nakamoto Holding, has filed to issue up to $5 billion in equity under an at-the-market (ATM) offering. The company said it plans to use the capital to purchase Bitcoin and for “working capital, funding of acquisitions of businesses, assets or technologies, capital expenditures, and/or investing in existing and future projects.”

Market Overview

- Stocks slip after S&P 500 hits all-time high: Stocks rose in the middle of the week, with the S&P 500 breaching 6,500 for the first time, only to sell off by Friday to end the week marginally lower.

- S&P 500: 6,460.26 (-0.1%)

- Nasdaq: 21,455.55 (-0.2%)

- Dow: 45,544.88 (-0.2%)

- Russell 2000: 2,366.42 (+0.2%)

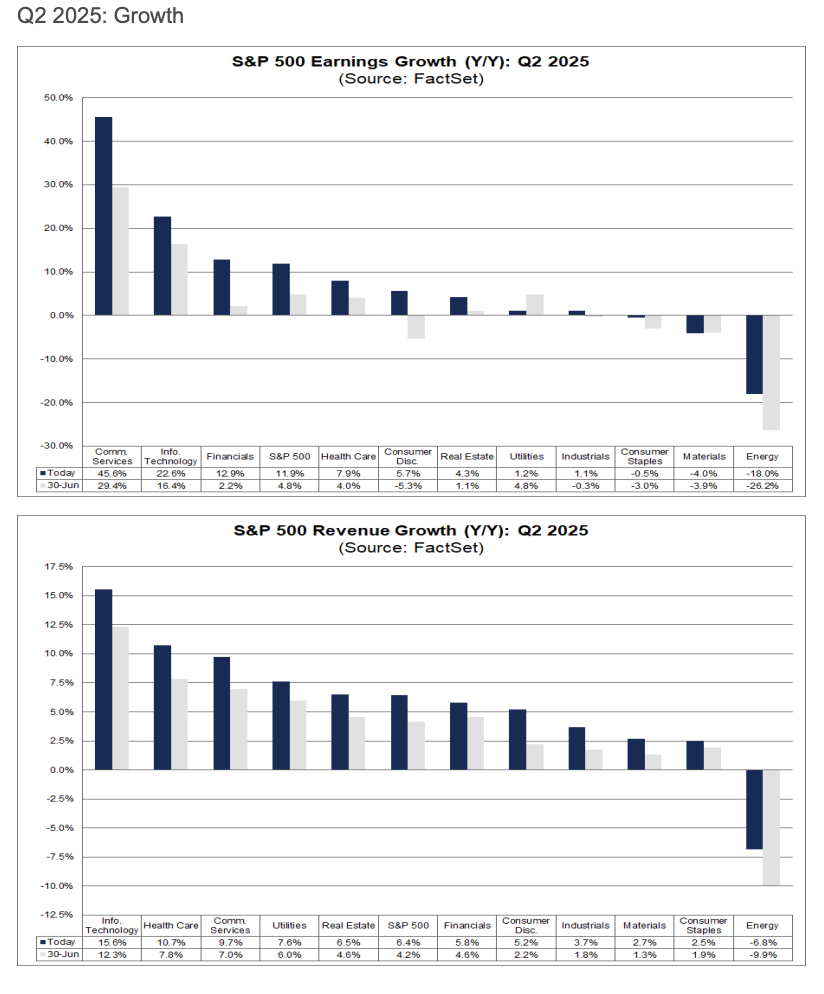

- Earnings surge in Q2 with better-than-expected revenue above multi-year averages: 98% of S&P 500 companies have reported their Q2 financials, and according to FactSet, the blended average earnings growth rate for Q2 was 11.9%, marking the third consecutive quarter of double-digit growth. 81% of companies beat revenue forecasts, a sight above the 5-year (70%) and 10-year (64%) averages. The Communications, Information Technology, and Financial sectors led last quarter’s earnings growth, while Energy, Materials, and Utilities lagged.

Source: FactSet

- Fed’s favored inflation gauge rises again in July: The Personal Consumption Expenditures Index (PCE) rose in July, with Core PCE rising 2.9% YoY for the fourth straight month and Headline PCE increasing 2.6%. MoM, Core and Headline PCE increased by 0.3% and 0.2% respectively. Financial Services and Insurance (+1.2%) saw the largest increase MoM, while Recreation Goods and Vehicles (-0.9%) and Gasoline and Other Energy Goods (-1.7%) decreased the most.

- Home sales plummet year-over-year in July: A number of real estate reports last week point toward a slackening housing market. According to the U.S. Census Bureau, new single-family home sales fell in July by 0.6% MoM and 8.2% YoY. The median price for a new home stood at $403,800 in July, a 0.8% decrease from June and 5.9% from last year. Per the National Association of Realtors, pending home sales dipped 0.4% MoM in July but increased 0.7% YoY. The West (+3%) saw the most activity, while the Northeast (-0.6%) and Midwest (-4%) saw the least and the South was essentially flat.

- S&P CoreLogic Case-Shiller 20-City housing index declines in June: The S&P CoreLogic Case-Shiller 20-City Composite Home Price Index reported that housing prices fell 0.3% MoM in June for 20 major U.S. cities, but prices were still up 2.1% YoY versus’ May’s 2.8%. The Northeast and Midwest regions saw the strongest demand, with prices rising in New York (+7%), Chicago (+6.1%), and Cleveland (+4.5%) the most. The Sunbelt and West took the largest hits, with prices down the most in Tampa (-2.4%) and San Francisco (-2%).

- Q2 U.S. GDP revised upward on latest read: According to the U.S. Bureau of Economic Analysis, the agency has changed its Q2 GDP growth estimate from 3% to 3.3%, driven by boosts to consumer spending and private investment; a decrease in imports (~-30%), which contributed to roughly 5% of Q2 growth; and strong corporate income gains, up $65.5 billion. If it holds, the read indicates a strong reversal from Q1’s -0.5% GDP.

- Durable goods orders contract in July: Per the U.S. Census Bureau’s Durable Goods Orders report for July, total new orders for durable goods fell 2.8%, a reversal from June’s -9.4% and better than the expected -3.8%. Transportation took a particular hit, with commercial aircraft orders declining 9.7% to $101.7 billion. Excluding transportation, new orders actually rose by 1.1%, outperforming the 0.1% forecast. Similarly, core capital goods orders (non-defense equipment excluding aircraft) also increased 1.1%, a turn around from June’s decline.

- Oil rises slightly: Oil prices rose again last week as they continue to recover from the summer’s selloff.

- WTI Crude: $64.01/bbl (+0.8%)

- Brent Crude: $68.12/bbl (+6%)

- Gold hits record high above $3,500/oz: Gold surged last week by ~3% to just over $3,500/oz. Year-to-date, gold is up 32% and 40% YoY.

The week ahead in data:

- Institute for Supply Management Manufacturing Index (Tuesday)

- U.S. Census Bureau construction spending report (Tuesday)

- ADP National Employment Report (Wednesday)

- Institute for Supply Management Non-Manufactoring Index (Wednesday)

- U.S. Bureau of Labor Statistics productivity and labor costs report (Wednesday)

- U.S. Census Bureau trade balance report (Wednesday)

- U.S. Department of Labor weekly unemployment claims (Thursday)

- U.S. Bureau of Labor Statistics August jobs and unemployment (Friday)

Thank you for reading, and please feel free to reach out with any questions.