CCM Blockchain Newsletter (September 30, 2024)

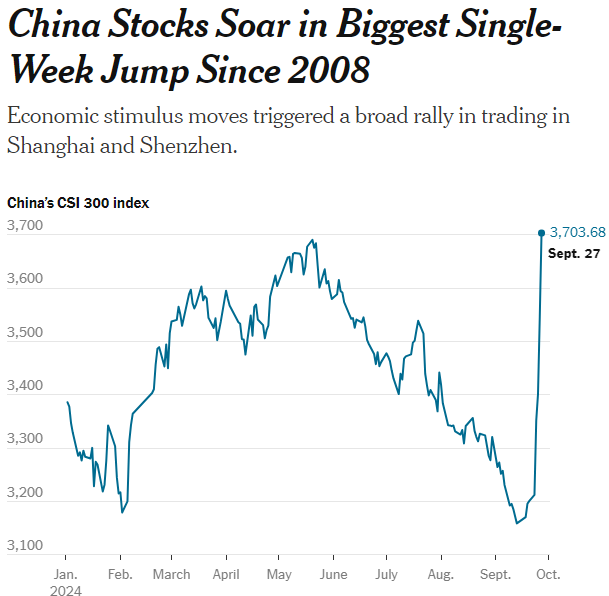

China's CSI 300 Index jumped to 3,704 on September 27 in the biggest move since 2008.

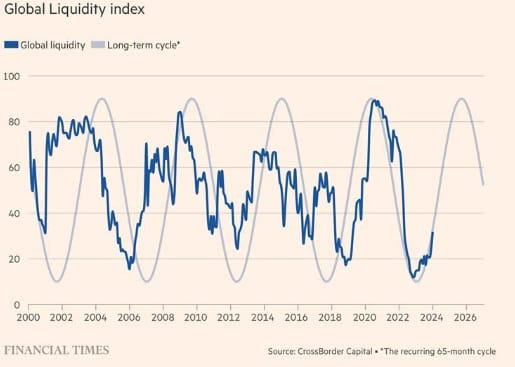

Hi all – the Personal Consumption Expenditures Index (PCE) for August, a key Federal Reserve inflation gauge, came in below expectations last week and China just injected their economy with a serious stimulus package. This may set the stage for additional rate cuts in the US and a new cycle of global liquidity. What happens to asset prices as a new global liquidity cycle sets in?

Macro Market Update

Market Overview

- Equity markets US markets rose for the third week in a row, extending their recovery from a sharp weekly decline in early September

- Inflation Cools: One of the Fed’s key inflation gauges, PCE, showed continued easing of price increases. The index rose at an annualized rate of 2.2% in August, slightly below consensus. Excluding energy and food prices, core PCE rose at 2.7%, matching expectations.

- China Stimulus Chinese stocks performed well last week as the country’s central bank, The People’s Bank of China announced plans to lower borrowing costs, inject more funds into the economy, and ease households’ mortgage repayment terms. China’s market posted its bigg3est jump since 2008.

- Oil Slide: The price of U.S. crude oil dropped nearly 4% for the week to less than $69 per barrel on Friday on news that Saudi Arabia, the world’s top crude exporter, is preparing to abandon its official price target of $100/barrel and increase output. That price is down from a recent high of nearly $84 per barrel in early July and is little changed year to date.

What to Look Out for This Week

- Construction spending

- ADP National Employment Report

- Jobs and unemployment, US Bureau of Labor Statistics

Bitcoin Market Update

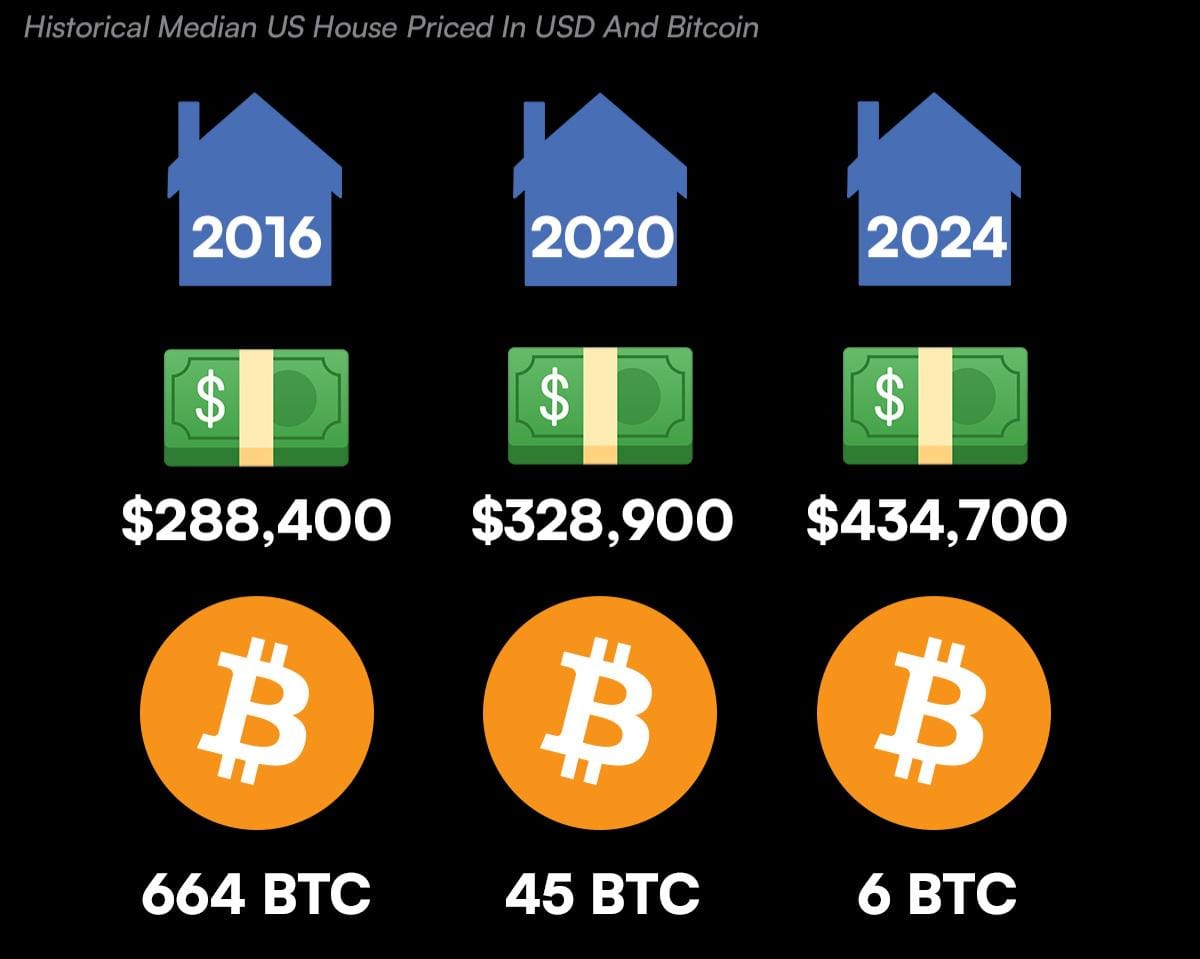

Following-up on last week’s note regarding the unfortunate increase in home price to income ratio over the last few decades got me thinking about Bitcoin as digital property. Michael Saylor’s take on Bitcoin as digital property is compelling:

- In the absence of sound money, then rational actors will tend to take their weakening currency and invest it in a stronger asset that will be a store of value

- There was a time when you could actually take your cash and put it in a bank account and generate 5% but eventually that disappeared as yields on credit went towards zero and below the inflation rate

- Investors moved their capital from low yielding credit to other assets such as market indexes, real estate, and venture capital and using these as a store of value or purchasing power

- This is called monetization of assets; using different assets as a store of value

- As central banks have flooded their economies with excess currency, that currency is trying to find a tangible asset that will hold its value

- Bitcoin is emerging as the apex property asset or monetizing asset

- Real estate has a utility value and anything above that is it’s monetary premium; over the last few decades that monetary premium has inflated because investors continue piling money into the asset class

- But real estate is not the perfect monetary asset: it can be destroyed, it erodes, there are maintenance requirements, it continues to consume your time, there are property taxes, it can’t be easily traded, etc.

- Real estate will be demonized against bitcoin as more investors realize its properties as a monetary asset.

- Bitcoin is indestructible digital property.