CCM Blockchain Newsletter (September 9, 2024)

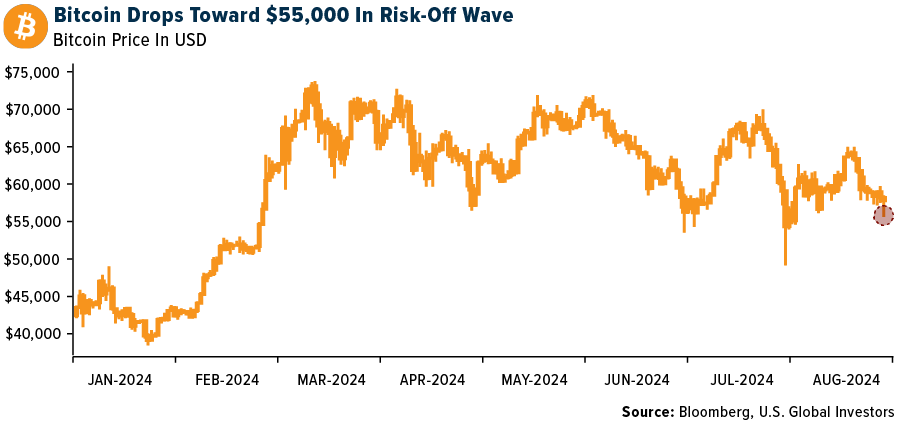

Following the broader risk asset markets, bitcoin is in a risk-off state.

Hi all – Great start to the morning watching Michael Saylor on CNBC’s Squawk Box predict BTC price of $13m.

Please find this week’s market update below.

Macro Market Update

Market Overview

- Equity markets posted some of the steepest weekly declines in over a year with NASDAQ down almost 6% and S&P 500 falling more than 4% as of Friday’s close

- Mixed jobs data: ahead of the Fed meeting in mid-September, it was reported that the US added 142,000 jobs in August, below consensus estimates of 160,000

- Estimates for June and July were revised downward by ~86,000 combined

- Treasury yields fell amid expectations of an interest-rate cut by the Fed at its two-day meeting that concludes on 9/18, ending the week at 3.72%, which is their lowest point since June 2023

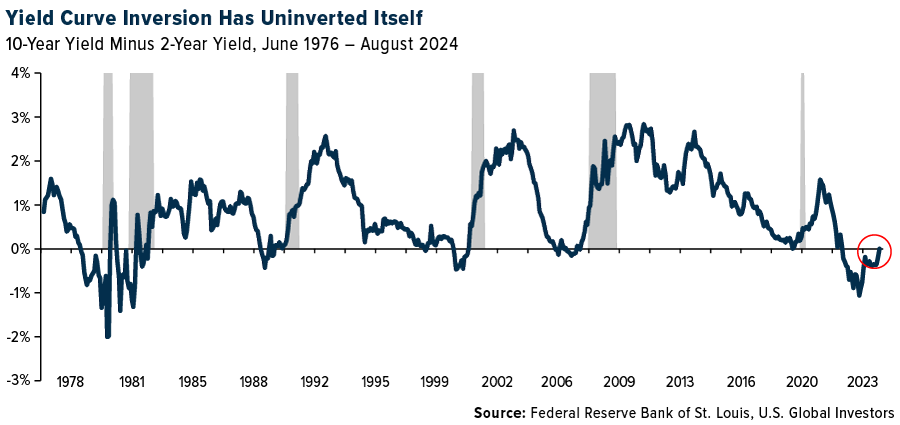

- Notably, the yield curve has un-inverted (more on that below)

- Oil prices fell nearly 8% last week, pointing to yet another indicator that we are headed towards a recession, as concerns grow over slowing demand in the US and China

- Volatility is back: Expectations of short-term volatility jumped ~49% for the week, closing at a reading of ~22

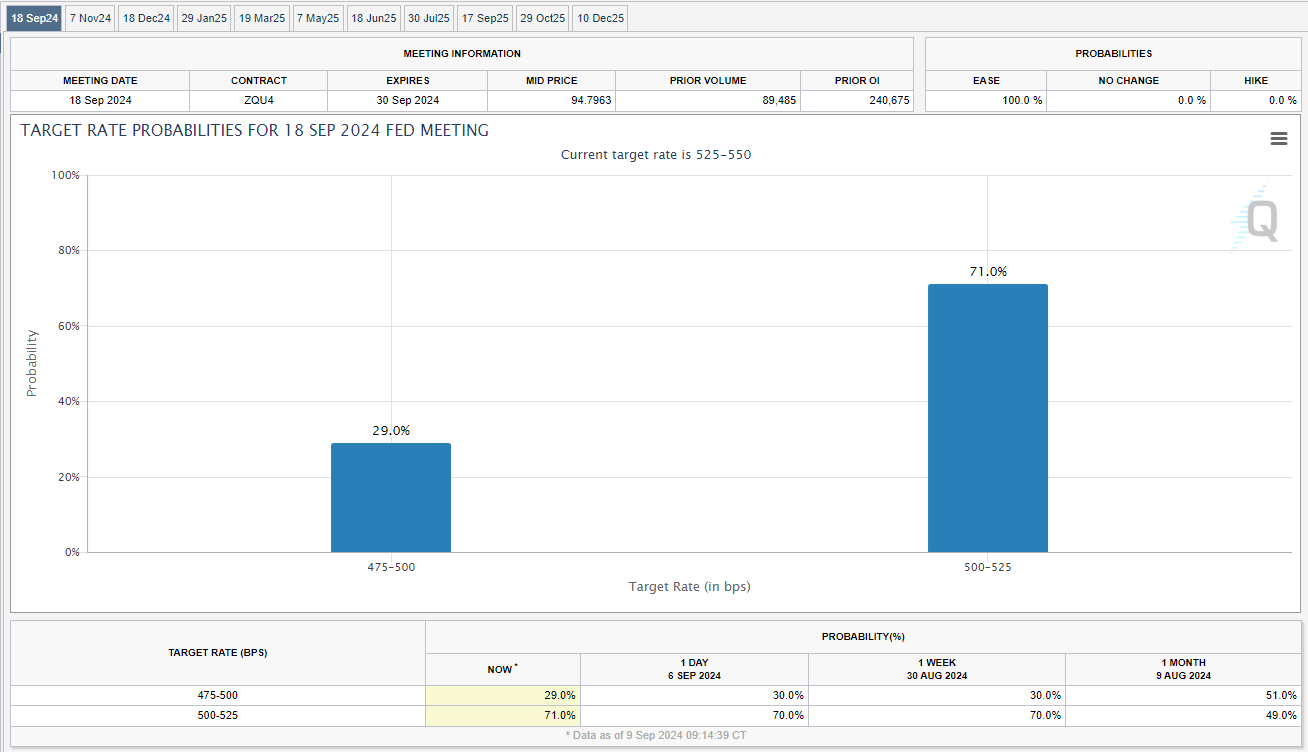

- Honing in on rates: The next CPI report is scheduled for release this Wednesday, providing one of the last data points for the Fed as it considers cutting rates by 25bps or 50 bps at this month’s meeting (9/18)

- The last CPI report in August came in at 2.9%, the first reading below 3.0% since early 2021

- According to CME FedWatch, traders are pricing in a 71% probability of a 25-point cut and a 29% probability of a 50-point cut

The yield curve briefly un-inverted – is a recession looming?

- One of the most reliable recession indicators has been the yield curve and last week it turned positive for the first time in over two years, the longest periods of inversion in U.S. history (783 consecutive days)

- An inverted yield curve (where long-term rates are lower than short-term rates), has preceded every US recession since the 1970s

- Historically, there has been a 12-month lag between the first inversion and a recession

- In August, the yield curve briefly un-inverted; this same thing happened in May 2007 (a few months before the financial crisis) and November 2000 (a few months before the 2001 recession)

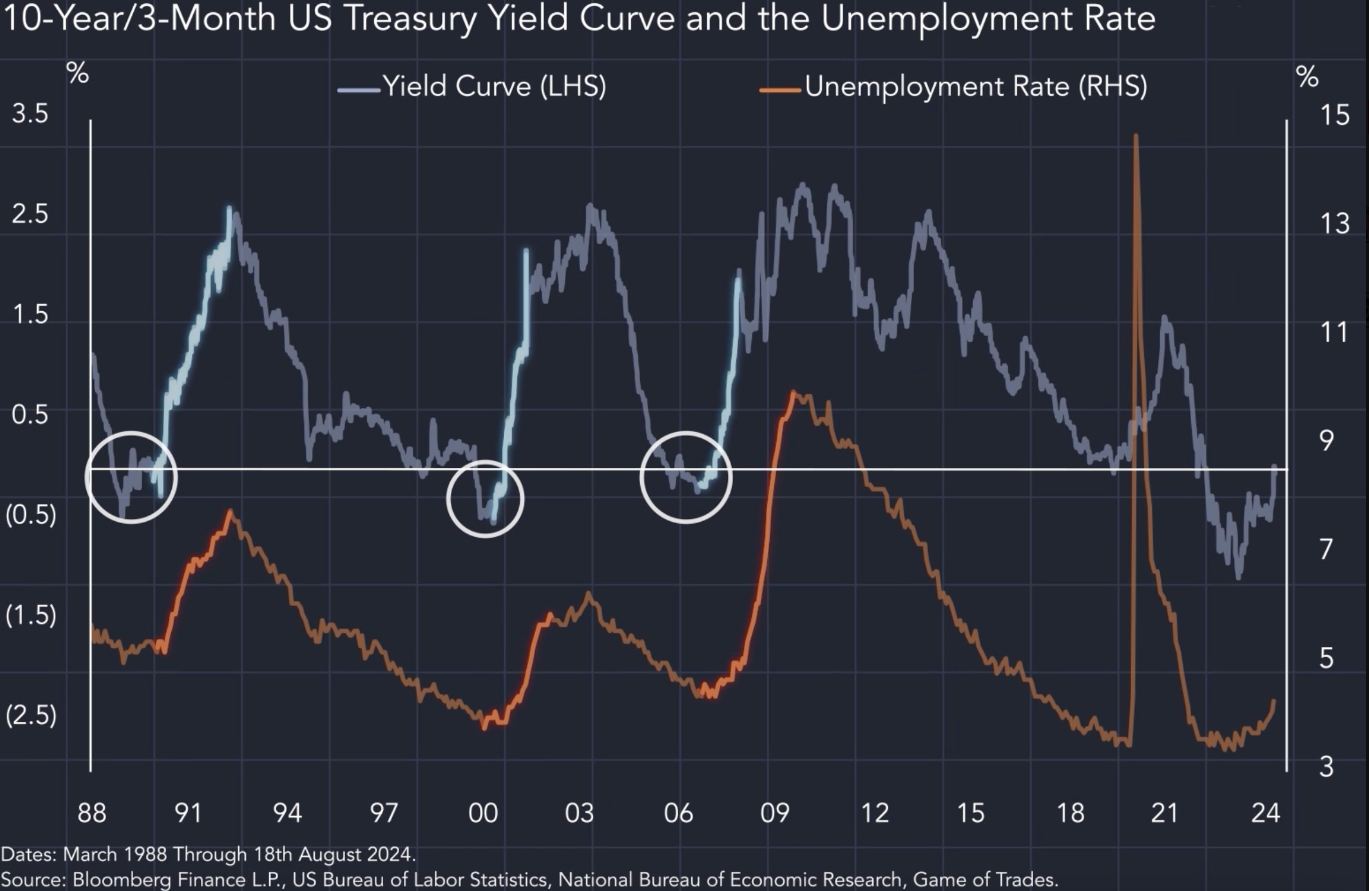

- An inverted yield curve suggests a tight labor market, which typically aligns with rising interest rates as the Fed aims to cool an overheating economy

- As the curve un-inverts and steepens, it signals the Fed is easing monetary policy because of a looser labor market and rising unemployment

What to Look Out for This Week

- CPI

- PPI

- Consumer sentiment index

Bitcoin Market Update

Bitcoin Price Action

Following the broader risk asset markets, bitcoin is in a risk-off state.

Hashprice: With hashprice sitting just below $40 / PHs / ay, Miners who have aging fleets feeling the pain and are looking forward to racking new generation fleets

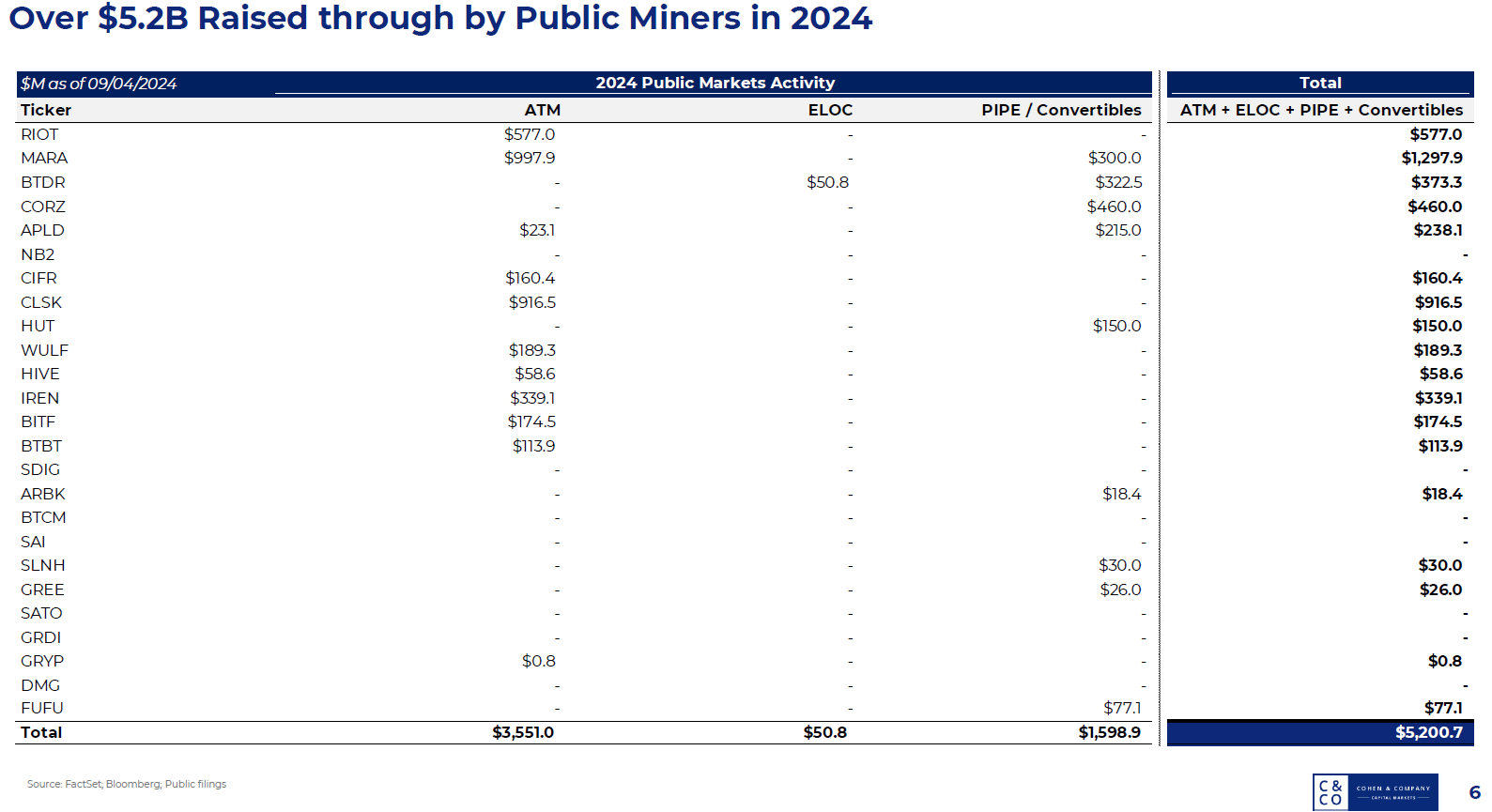

Bitcoin miners have raised over $5.2 billion in 2024: Despite increasingly tightening margins, the capital markets have been open to bitcoin miners in 2024. More recently, there has been a slew of converts with use of proceeds more focused on HPC / AI than mining. We expect that miners with access to infrastructure will continue exploring the opportunity to arbitrage their access to power to higher margin revenue lines.